Billionaire Warren Buffett Shifts Investment Strategy: From Bank Of America To A Booming Consumer Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Warren Buffett Shifts Investment Strategy: From Bank of America to a Booming Consumer Brand

Oracle of Omaha Makes a Bold Move, Signaling a Shift in Market Sentiment

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has sent shockwaves through the financial world with a significant shift in his investment strategy. Recent filings reveal a reduction in Berkshire's stake in Bank of America, a long-time portfolio stalwart, and a simultaneous significant increase in its holdings of a rapidly growing consumer brand: [Insert Name of Consumer Brand Here – e.g., "On! Running Shoes"]. This unexpected move has sparked intense speculation about the future direction of the market and Buffett's evolving investment philosophy.

The news comes as a surprise to many analysts who have long viewed Bank of America as a core holding reflecting Buffett's preference for established financial institutions. The reduction in Berkshire's stake, while not a complete divestment, signifies a notable departure from this traditional strategy. This decision, coupled with the substantial investment in [Insert Name of Consumer Brand Here], suggests a growing confidence in the resilience and future growth potential of the consumer sector, even amidst current economic uncertainties.

What Drove the Shift? Analyzing Buffett's Investment Choices

Several factors may have contributed to this strategic realignment. While Buffett himself hasn't publicly commented on the specific reasons, experts suggest a few key possibilities:

-

Changing Economic Landscape: The current economic climate, marked by rising interest rates and inflation, may have prompted Buffett to reassess his holdings. While Bank of America remains a strong player, the potential for reduced profitability in a tighter monetary policy environment may have influenced his decision. Conversely, the consumer brand's robust performance in a challenging market suggests resilience and strong future potential.

-

Growth Potential: [Insert Name of Consumer Brand Here] has experienced phenomenal growth in recent years, [mention specific figures or achievements, e.g., "posting triple-digit revenue growth in Q2 2024" or "capturing a significant market share in the athletic footwear segment"]. This impressive trajectory likely attracted Buffett's attention, aligning with his long-term investment philosophy of identifying companies with sustainable competitive advantages.

-

Diversification Strategy: Diversifying Berkshire's portfolio into sectors beyond traditional finance might reflect a proactive approach to mitigating risk and capitalizing on emerging growth opportunities. The consumer goods sector, with its potential for consistent demand, presents a compelling alternative.

[Insert Name of Consumer Brand Here]: A Closer Look at the Investment

[Insert Name of Consumer Brand Here] [briefly describe the company, its products, and its unique selling points. E.g., "is a Swiss-based manufacturer of high-performance running shoes known for its innovative design and commitment to sustainability."] The company's success can be attributed to [mention key factors contributing to its success, e.g., "strong brand loyalty, effective marketing campaigns, and a commitment to environmentally friendly production methods"].

This investment signals a potential trend: a shift in investor sentiment towards robust consumer brands that demonstrate resilience and growth potential, even in the face of economic headwinds.

Implications for the Market and Future Investment Strategies

Buffett's move underscores the dynamic nature of the investment landscape and the importance of adapting to evolving market conditions. It suggests a potential paradigm shift, where consumer brands with strong fundamentals are becoming increasingly attractive to even the most seasoned investors. This shift could influence other investors to reassess their portfolios and explore similar opportunities in the growing consumer sector.

This bold move by the "Oracle of Omaha" will undoubtedly be closely watched by investors worldwide, as it offers valuable insights into the future direction of the market and the potential for significant returns in the ever-evolving consumer landscape. This strategic pivot highlights the importance of staying informed about market trends and adapting investment strategies accordingly.

Call to Action (subtle): Stay tuned for further updates on Warren Buffett's investment activities and market analysis on [your website/news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Warren Buffett Shifts Investment Strategy: From Bank Of America To A Booming Consumer Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Applied Digital Rides Core Weave Ai Deal To 48 Share Price Jump

Jun 05, 2025

Applied Digital Rides Core Weave Ai Deal To 48 Share Price Jump

Jun 05, 2025 -

Unexpected Turn In Karen Read Retrial Judges Decision On Testimony Explained

Jun 05, 2025

Unexpected Turn In Karen Read Retrial Judges Decision On Testimony Explained

Jun 05, 2025 -

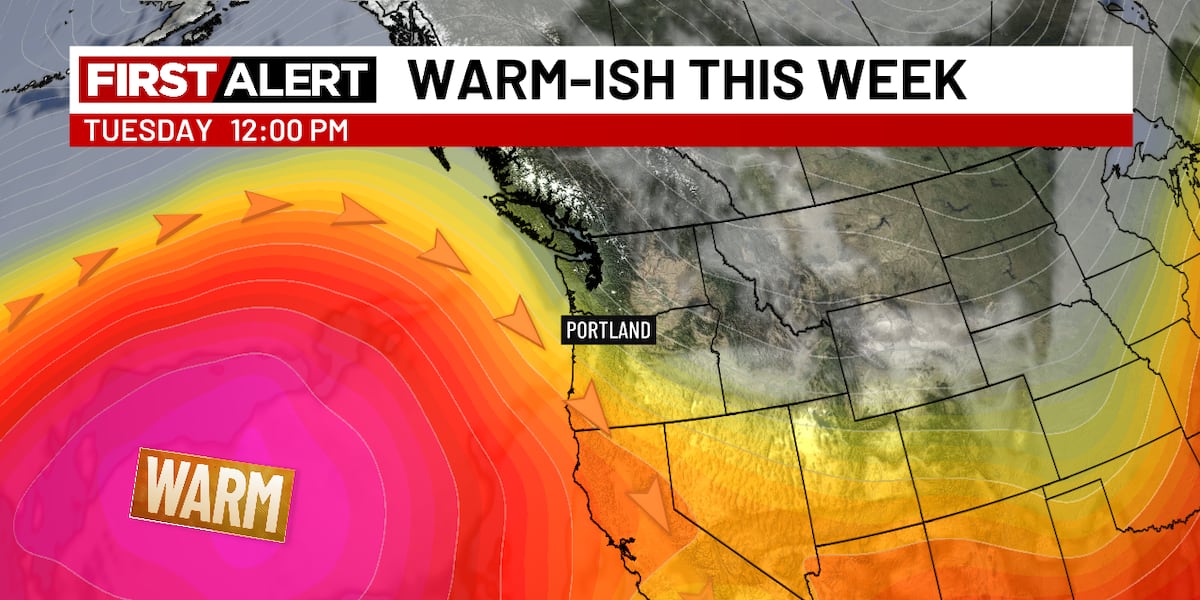

Fair Weather Ahead Warm Sunny And Dry June Outlook

Jun 05, 2025

Fair Weather Ahead Warm Sunny And Dry June Outlook

Jun 05, 2025 -

Video Controversy Wont Cut Diggs Patriots Roster Spot

Jun 05, 2025

Video Controversy Wont Cut Diggs Patriots Roster Spot

Jun 05, 2025 -

Longtime Patriot David Andrews Retires His New England Legacy

Jun 05, 2025

Longtime Patriot David Andrews Retires His New England Legacy

Jun 05, 2025