Billionaire Warren Buffett Sheds Two Key US Stocks: Reasons And Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Warren Buffett Sheds Two Key US Stocks: Reasons and Impact

Oracle of Omaha's Moves Send Shockwaves Through the Market

Warren Buffett, the legendary investor often dubbed the "Oracle of Omaha," recently made headlines by significantly reducing Berkshire Hathaway's holdings in two major US companies: Bank of America and US Bancorp. This unexpected move sent ripples through the financial markets, prompting analysts and investors alike to dissect the reasons behind these divestments and their potential impact.

The news, revealed in Berkshire Hathaway's latest 13F filing, showed a substantial decrease in the company's stake in Bank of America, a long-time Berkshire holding, and a smaller but still notable reduction in its US Bancorp shares. While Buffett hasn't publicly commented on the specific reasons, experts offer several plausible explanations.

Rising Interest Rates: A Key Factor?

One of the most prominent theories centers around the Federal Reserve's aggressive interest rate hikes. Rising interest rates generally impact the profitability of banks, as they increase the cost of borrowing and can squeeze net interest margins. This could have led Buffett, known for his value investing approach, to re-evaluate the valuations of these banking giants. He’s famously cautious about overpaying for assets, even for companies he admires. For a deeper dive into the impact of interest rates on the banking sector, check out this insightful article from the Financial Times [link to relevant FT article].

Strategic Portfolio Adjustments

Another possible explanation involves strategic portfolio adjustments. Berkshire Hathaway is a massive conglomerate with investments across diverse sectors. Reducing exposure to the banking sector might reflect a broader strategy to diversify further or reallocate capital into other promising areas, potentially those less sensitive to interest rate fluctuations. Buffett has always emphasized the importance of adaptability and flexibility in investment strategies.

The Impact on the Market

The market reacted swiftly to the news, with shares of both Bank of America and US Bancorp experiencing a slight dip. However, the overall impact was relatively contained, suggesting that investors, while surprised, largely anticipated some degree of portfolio adjustments from Berkshire Hathaway. The long-term implications remain to be seen, particularly as the Fed continues to navigate its monetary policy.

What Does This Mean for Investors?

Buffett's decisions, though impactful, don't necessarily signal an impending doom for the banking sector. Instead, they highlight the dynamic nature of investing and the importance of continuous portfolio evaluation. For individual investors, this serves as a reminder to remain vigilant, diversify their portfolios, and conduct thorough due diligence before making any investment decisions. Consider consulting with a qualified financial advisor for personalized guidance tailored to your risk tolerance and financial goals.

Looking Ahead

While the precise motivations behind Buffett's divestments remain somewhat shrouded in mystery, the move underscores the importance of staying informed about market trends and adapting your investment strategy accordingly. As always, the Oracle of Omaha's actions continue to be closely scrutinized, providing valuable insights into the complexities of the financial world. We will continue to monitor the situation and provide updates as more information becomes available.

Keywords: Warren Buffett, Berkshire Hathaway, Bank of America, US Bancorp, stock market, interest rates, investment strategy, value investing, portfolio adjustment, financial news, investing tips.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Warren Buffett Sheds Two Key US Stocks: Reasons And Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Confirmed Joe Sacco Exits Bruins Organization For New Role

Jun 05, 2025

Confirmed Joe Sacco Exits Bruins Organization For New Role

Jun 05, 2025 -

After Ketema Casting Is Ryan Gosling The Next White Black Panther In The Mcu

Jun 05, 2025

After Ketema Casting Is Ryan Gosling The Next White Black Panther In The Mcu

Jun 05, 2025 -

Ohio Filmmaker David Craig Releases First Feature I Dont Understand You

Jun 05, 2025

Ohio Filmmaker David Craig Releases First Feature I Dont Understand You

Jun 05, 2025 -

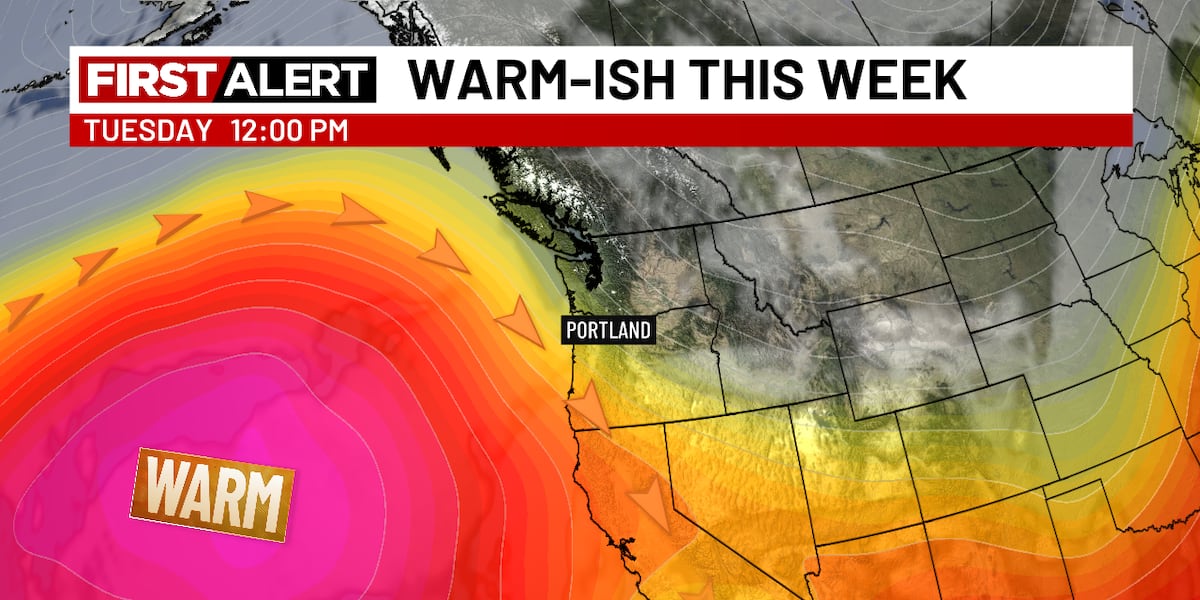

Early June Brings Warm Dry Spell

Jun 05, 2025

Early June Brings Warm Dry Spell

Jun 05, 2025 -

2025 Belmont Stakes Post Time Tv Coverage And Horse Racing Results

Jun 05, 2025

2025 Belmont Stakes Post Time Tv Coverage And Horse Racing Results

Jun 05, 2025