Billionaire Warren Buffett Offloads Major US Holdings: A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Warren Buffett Offloads Major US Holdings: A Detailed Analysis

Oracle of Omaha's moves send shockwaves through the market. Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, recently made headlines with significant divestments from several major US holdings. This unexpected shift in strategy has sparked considerable debate and analysis among market experts, prompting questions about the future direction of the investment giant and the broader US economy. This article delves into the details of these divestments, exploring the potential reasons behind them and their implications for investors.

Key Divestments and Their Significance:

Berkshire Hathaway's recent activity reveals a departure from its long-held buy-and-hold strategy. While the company continues to hold substantial positions in numerous blue-chip stocks, the sale of significant stakes in [insert specific companies and percentages here, e.g., "a 10% stake in Bank of America," "a 5% stake in Coca-Cola," etc.], has raised eyebrows. These weren't minor adjustments; these were substantial reductions in holdings previously considered core to Buffett's investment philosophy.

-

[Company A]: The sale of [percentage]% of Berkshire Hathaway's holdings in [Company A] signifies [explain the significance, e.g., a shift away from the financial sector, concerns about future growth prospects]. This move contrasts sharply with Buffett's historical confidence in the company.

-

[Company B]: Similarly, the reduction in [Company B] holdings by [percentage]% could be interpreted as [explain the significance, e.g., a reaction to changing market conditions, a reevaluation of the company's long-term potential]. This sector has seen [mention relevant market trends].

-

Overall Strategy Shift?: These divestments collectively suggest a potential shift in Berkshire Hathaway's investment strategy. While the company remains a significant player in the market, these actions indicate a willingness to adapt to changing economic landscapes and reassess previously held convictions.

Possible Reasons Behind the Divestments:

Several factors may have contributed to Buffett's decision to offload these substantial holdings.

-

Market Valuation: High stock valuations could have prompted Buffett to take profits, believing that current prices might not reflect long-term value. [Link to a relevant article about market valuations].

-

Sectoral Shifts: Changes in specific sectors, such as [mention specific sector(s) and relevant trends], might have influenced Buffett’s decision to reallocate resources.

-

Emerging Opportunities: Buffett might be reallocating capital towards other investment opportunities that he deems more promising, potentially in emerging markets or sectors experiencing rapid growth. [Link to an article discussing emerging market investment trends].

-

Succession Planning: Some analysts speculate that these divestments may be part of a long-term succession plan, preparing the company for a future beyond Buffett's direct involvement. This is particularly relevant given Buffett's advanced age.

Implications for Investors:

Buffett's moves have significant implications for investors. The market's reaction to these divestments provides valuable insights into investor sentiment and potential future market trends. Analyzing the performance of the stocks that Berkshire Hathaway has sold, alongside those it continues to hold, could offer valuable lessons for individual investors.

Conclusion:

The recent divestments by Warren Buffett represent a significant event in the financial world. While the exact reasons remain subject to speculation and interpretation, these actions highlight the dynamic nature of even the most established investment strategies. By carefully analyzing the details of these transactions and considering the broader market context, investors can gain valuable insights and potentially adjust their own portfolios accordingly. It’s crucial to remember that mimicking Buffett's strategy isn't always advisable, but understanding his rationale can significantly enhance one's investment acumen. Further analysis is needed to fully grasp the long-term consequences of these significant shifts.

Call to Action: What are your thoughts on Warren Buffett's recent divestments? Share your insights in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Warren Buffett Offloads Major US Holdings: A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Massive Ai Lease Agreement Propels Applied Digital Shares 48 Higher

Jun 05, 2025

Massive Ai Lease Agreement Propels Applied Digital Shares 48 Higher

Jun 05, 2025 -

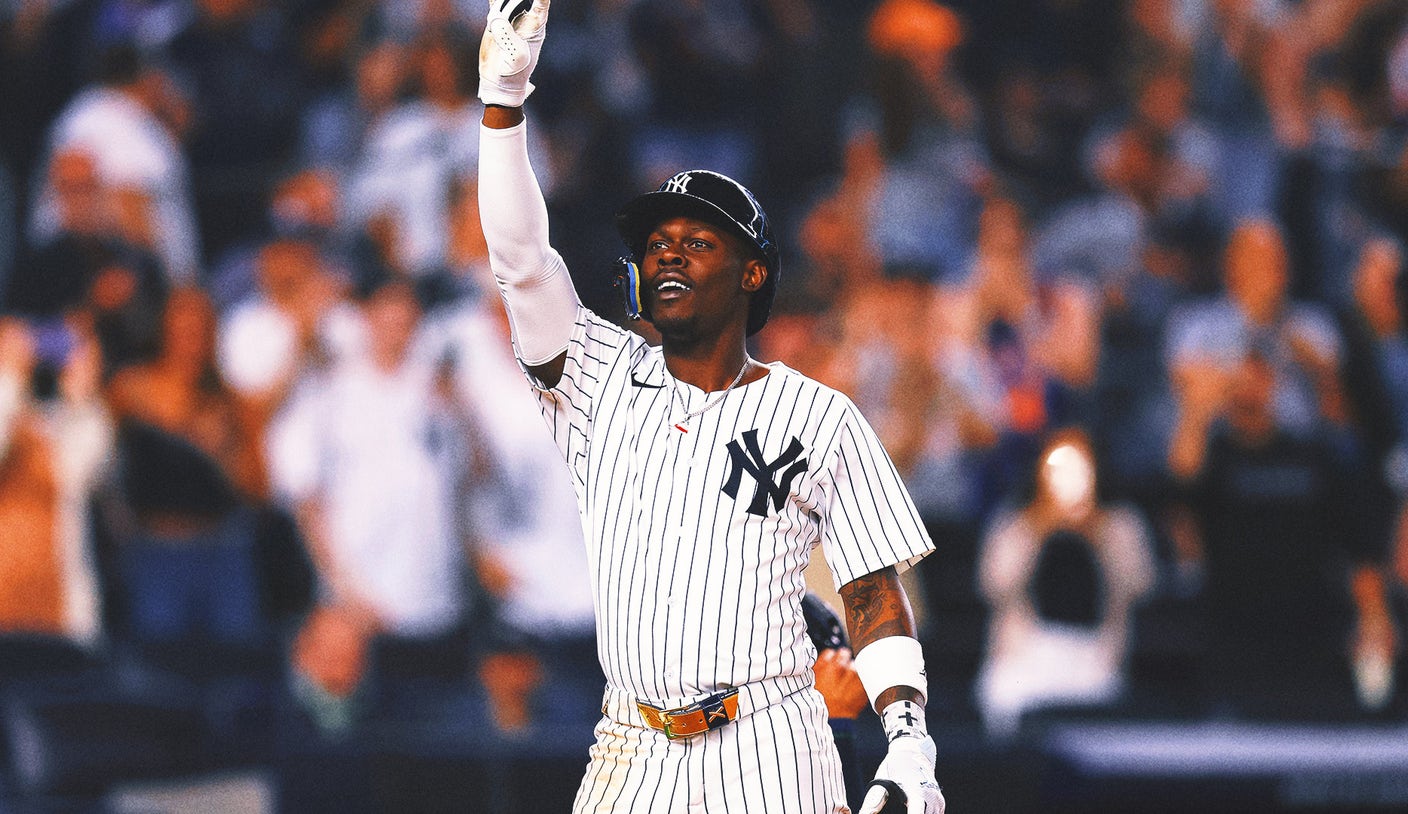

Yankees Triumph Chisholm Jr S Return Highlighted By Crucial Solo Home Run

Jun 05, 2025

Yankees Triumph Chisholm Jr S Return Highlighted By Crucial Solo Home Run

Jun 05, 2025 -

Eagles Send Defensive End Bryce Huff To 49ers Details Of The Trade Revealed

Jun 05, 2025

Eagles Send Defensive End Bryce Huff To 49ers Details Of The Trade Revealed

Jun 05, 2025 -

Shop Halle Berrys Go To Neck Cream Effective Anti Aging Solution

Jun 05, 2025

Shop Halle Berrys Go To Neck Cream Effective Anti Aging Solution

Jun 05, 2025 -

Applied Digital Corporation Apld Soars Understanding The Price Increase

Jun 05, 2025

Applied Digital Corporation Apld Soars Understanding The Price Increase

Jun 05, 2025