Billionaire Warren Buffett Dumps Two Key US Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Warren Buffett Dumps Two Key US Stocks: What Does It Mean for Investors?

Oracle of Omaha's recent moves have sent ripples through the investment world. Warren Buffett's Berkshire Hathaway has significantly reduced its holdings in two major US companies, leaving many investors wondering about the implications. This unexpected shift in the legendary investor's portfolio is sparking considerable debate and analysis. Let's delve into the details and explore what this could mean for you.

Berkshire Hathaway Sheds Bank of America and Activision Blizzard Shares

The news broke recently that Berkshire Hathaway has drastically lowered its stake in Bank of America (BAC) and Activision Blizzard (ATVI). While the exact reasons remain officially unstated, analysts are offering various interpretations. The reduction in Bank of America shares represents a significant decrease in Berkshire's overall banking sector exposure. Similarly, the offloading of Activision Blizzard shares follows a period of uncertainty surrounding the Microsoft acquisition.

Why the Shift? Analyzing Potential Factors

Several factors could be contributing to Buffett's decisions. These include:

-

Economic Uncertainty: The current economic climate is marked by rising interest rates and inflation. These macroeconomic factors could be influencing Buffett's risk assessment, prompting a shift towards more conservative investments.

-

Sectoral Rotation: Buffett is known for his long-term investment strategy, but he also adjusts his portfolio based on market trends and perceived opportunities. A shift away from the financial and gaming sectors might signal a reallocation of resources to other areas considered more promising.

-

Microsoft Acquisition Uncertainty (Activision Blizzard): The ongoing regulatory scrutiny of Microsoft's acquisition of Activision Blizzard could have played a role in Berkshire's decision to reduce its stake. Any delays or potential failure of the acquisition would likely impact the value of Activision Blizzard shares.

-

Profit-Taking: Another possibility is that Berkshire Hathaway simply took profits on its substantial holdings in these two companies. This is a standard practice for long-term investors to secure gains and re-allocate capital.

What This Means for Investors

Buffett's moves are significant, but they don't necessarily predict a market crash or widespread downturn. However, they do underscore the importance of:

-

Diversification: Holding a diversified portfolio across different sectors and asset classes is crucial to mitigate risk. This is a lesson consistently reinforced by Buffett himself.

-

Long-Term Perspective: Successful investing requires a long-term outlook. Short-term market fluctuations should not dictate major investment decisions.

-

Due Diligence: Before making any investment decisions, it's vital to conduct thorough research and consider your own risk tolerance.

Looking Ahead: Analyzing Berkshire's Future Portfolio Moves

The market will be closely watching Berkshire Hathaway's future moves. Where will Buffett invest next? What sectors will he favor? These are critical questions that will shape investor sentiment in the coming months. Stay tuned for further updates as the investment landscape continues to evolve.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Warren Buffett Dumps Two Key US Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

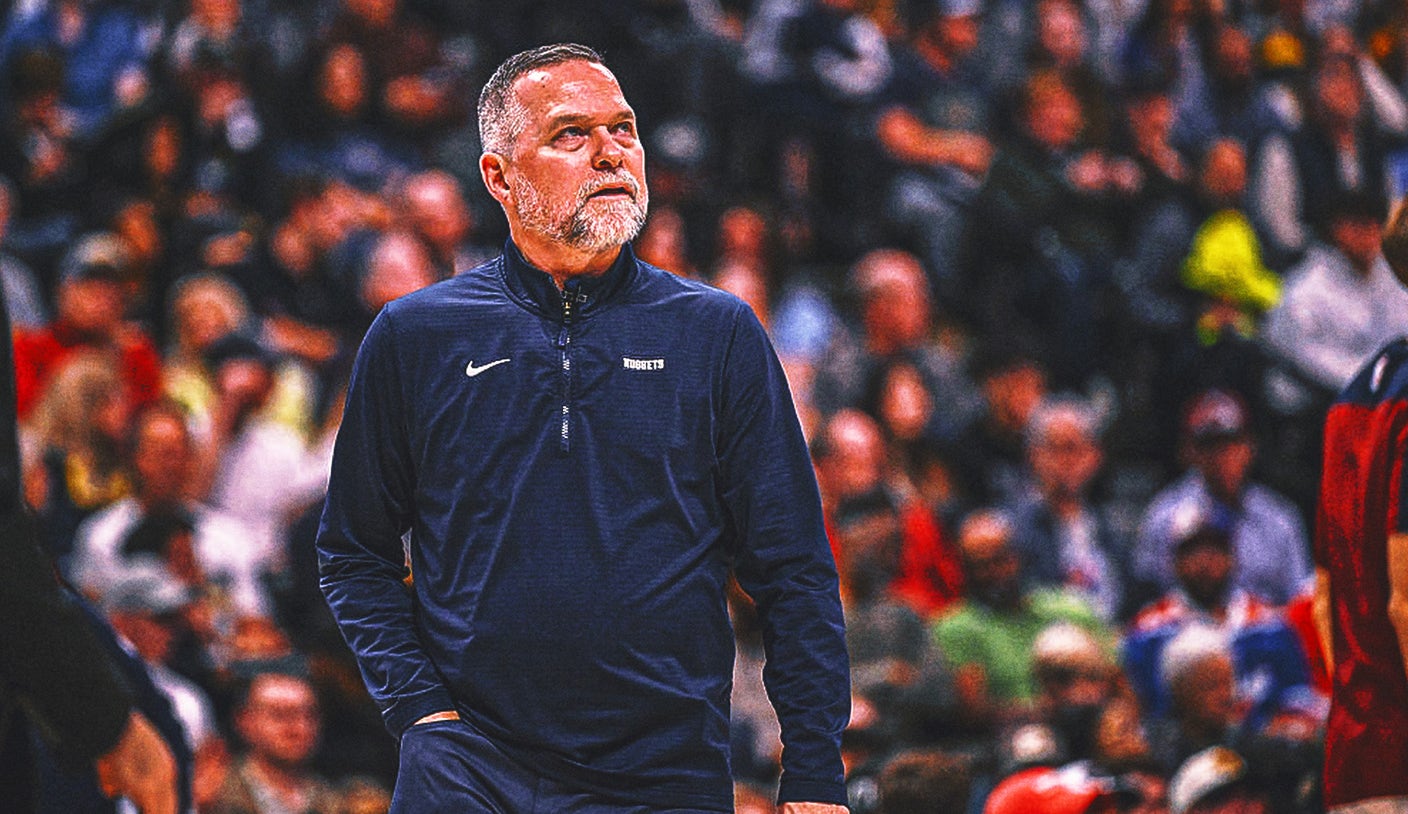

New York Knicks Head Coach Odds A Deep Dive Into The Potential Replacements

Jun 05, 2025

New York Knicks Head Coach Odds A Deep Dive Into The Potential Replacements

Jun 05, 2025 -

French Open 2024 Sabalenka Beats Zheng Qinwen Reaches Semifinals

Jun 05, 2025

French Open 2024 Sabalenka Beats Zheng Qinwen Reaches Semifinals

Jun 05, 2025 -

Caddie Split Doesnt Slow Max Homa Down At U S Open Qualifier

Jun 05, 2025

Caddie Split Doesnt Slow Max Homa Down At U S Open Qualifier

Jun 05, 2025 -

Espns Top 2025 Prospect Examining Trade Scenarios For Cooper Flagg

Jun 05, 2025

Espns Top 2025 Prospect Examining Trade Scenarios For Cooper Flagg

Jun 05, 2025 -

Hear The Unheard Grace Potter Opens Her Musical Archives

Jun 05, 2025

Hear The Unheard Grace Potter Opens Her Musical Archives

Jun 05, 2025