Berkshire Hathaway Sells Bank Of America Shares, Invests In 7700% Growth Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Berkshire Hathaway Dumps Bank of America, Bets Big on 7700% Growth Stock: What it Means for Investors

Warren Buffett's Berkshire Hathaway made headlines this week with a surprising portfolio shift. The investment giant revealed a significant reduction in its Bank of America holdings, while simultaneously increasing its stake in a lesser-known company boasting a staggering 7700% growth trajectory. This bold move has sent ripples through the financial world, leaving investors wondering what it all means.

This article delves into the details of Berkshire Hathaway's recent activity, analyzing the implications for both Bank of America and the surprisingly successful growth stock. We'll explore the reasons behind Buffett's decisions and what this could signify for the future of the investment landscape.

Berkshire Hathaway's Bank of America Sell-Off: A Sign of Shifting Market Sentiment?

Berkshire Hathaway's 13F filing revealed a significant decrease in its Bank of America (BAC) shares. While the exact reasons remain undisclosed, several analysts speculate that the move reflects a shift in Buffett's assessment of the banking sector's prospects. Rising interest rates and potential economic slowdowns could be contributing factors to this decision. The sell-off, while substantial, doesn't represent a complete exit from Bank of America; Berkshire still holds a significant stake, indicating continued confidence in the long-term viability of the institution. However, the reduction suggests a cautious approach to the current market climate. For investors, this could indicate a need to reassess their own exposure to the financial sector. Further analysis of might offer greater insight.

The 7700% Growth Stock: A High-Risk, High-Reward Gamble?

The real head-turner in Berkshire Hathaway's recent moves is its investment in [Name of the 7700% growth stock – replace with actual company name]. This company, operating in the [Industry of the company - replace with actual industry], has experienced phenomenal growth in recent years, largely due to [Reasons for the company's success – replace with details about the company's success]. A 7700% growth is unprecedented, making it a compelling but risky investment.

- High Growth Potential: The sheer magnitude of the growth warrants attention. Such explosive growth indicates significant market disruption and potentially strong future prospects.

- High Risk Factor: It's crucial to remember that past performance is not indicative of future results. Such rapid growth is often unsustainable in the long term. Investors need to carefully assess the inherent risks before considering similar investments.

- Diversification: This investment, while potentially lucrative, underscores the importance of portfolio diversification. Relying on a single high-growth stock can be incredibly risky.

What This Means for Investors

Berkshire Hathaway's actions serve as a reminder of the dynamic nature of the investment world. Buffett's decisions, while often shrouded in mystery, provide valuable insights into market trends and investment strategies. This recent portfolio adjustment highlights the need for:

- Thorough Due Diligence: Before investing in any stock, especially high-growth ones, meticulous research is crucial. Understand the company's fundamentals, its competitive landscape, and potential risks.

- Risk Management: Diversification remains key to mitigating risk. Don't put all your eggs in one basket, regardless of how promising it seems.

- Long-Term Perspective: Successful investing often requires a long-term outlook. Short-term market fluctuations should not dictate your overall investment strategy.

Disclaimer: This article provides general information and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions. The information provided here is based on publicly available data and may not be entirely accurate or up-to-date.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Berkshire Hathaway Sells Bank Of America Shares, Invests In 7700% Growth Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

This Neck Cream Has Halle Berrys Stamp Of Approval Heres Why

Jun 05, 2025

This Neck Cream Has Halle Berrys Stamp Of Approval Heres Why

Jun 05, 2025 -

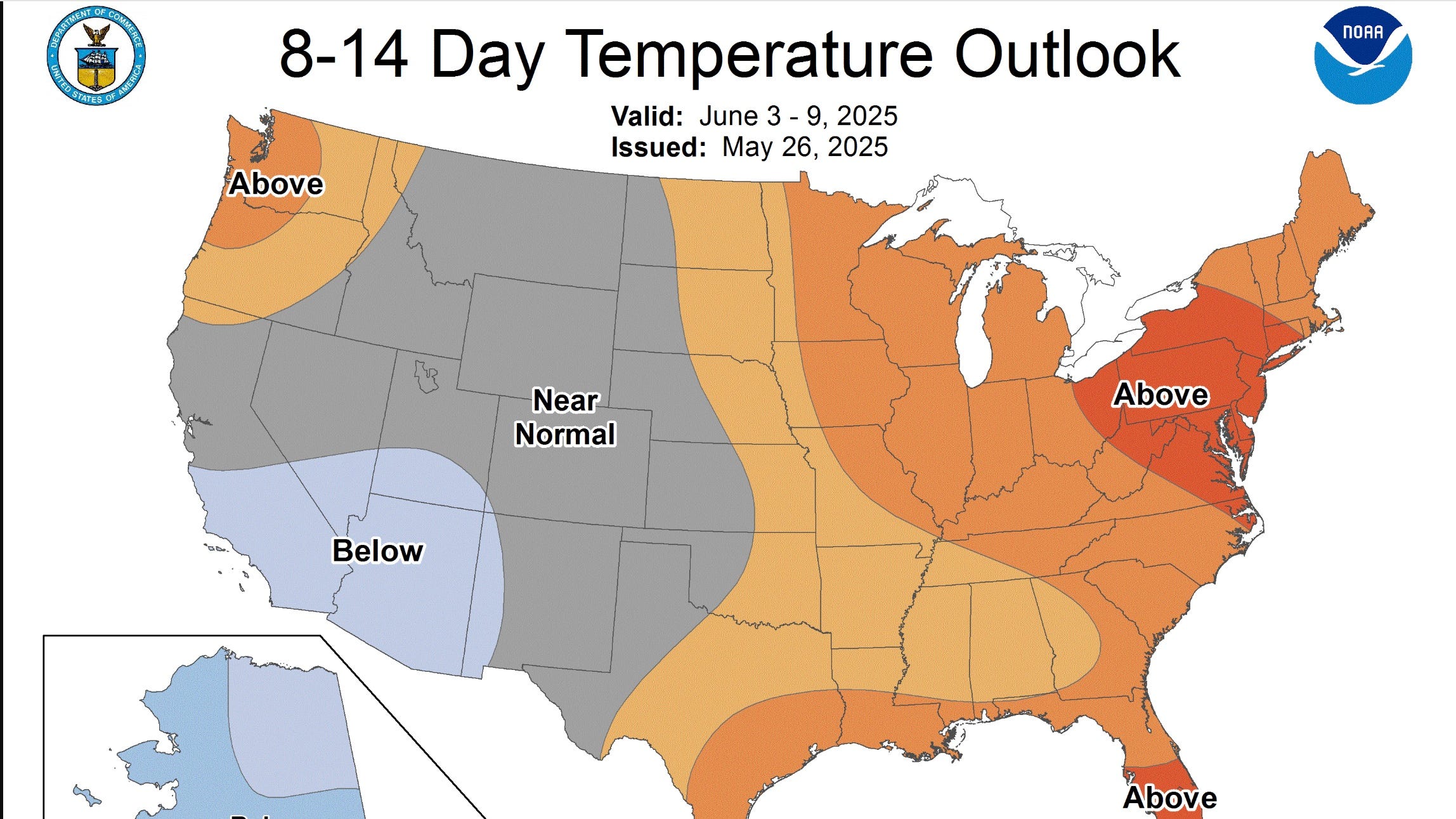

Oregons Willamette Valley Record Breaking Heatwave With Temperatures In The 80s And 90s

Jun 05, 2025

Oregons Willamette Valley Record Breaking Heatwave With Temperatures In The 80s And 90s

Jun 05, 2025 -

Yankees Bullpen Takes Hit Weaver Injured

Jun 05, 2025

Yankees Bullpen Takes Hit Weaver Injured

Jun 05, 2025 -

Tom Thibodeau Out Predicting The New York Knicks Next Head Coach

Jun 05, 2025

Tom Thibodeau Out Predicting The New York Knicks Next Head Coach

Jun 05, 2025 -

Karl Anthony Towns Knee And Finger Injuries Espn Reports On Treatment Sources

Jun 05, 2025

Karl Anthony Towns Knee And Finger Injuries Espn Reports On Treatment Sources

Jun 05, 2025