Berkshire Hathaway Sells Bank Of America Shares, Invests In 7,700% Growth Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Berkshire Hathaway Offloads Bank of America, Bets Big on Unexpected 7,700% Growth Stock

Warren Buffett's Berkshire Hathaway has made headlines again, this time for a surprising double move: selling off a significant portion of its Bank of America holdings while simultaneously investing in a company that has seen a staggering 7,700% growth. This bold strategic shift has sent ripples through the financial world, leaving analysts scrambling to understand the Oracle of Omaha's latest gambit.

The sale of Bank of America shares, a long-held Berkshire Hathaway position, signals a potential shift in the company's investment strategy. While the exact amount sold remains undisclosed, SEC filings reveal a noticeable decrease in Berkshire's stake. This move comes amidst rising interest rates and concerns about the overall health of the banking sector, prompting speculation about Buffett's assessment of future bank profitability. Experts are divided, with some suggesting it's a strategic repositioning for anticipated market volatility, while others point to potential internal portfolio adjustments. Further analysis of Berkshire Hathaway's quarterly reports will be crucial to fully understanding the reasoning behind this decision. For more detailed information on the regulatory filings, you can visit the .

However, the real surprise lies in Berkshire Hathaway's simultaneous investment in a lesser-known company experiencing phenomenal growth. While the specific company remains unnamed at this time (due to ongoing regulatory requirements surrounding public disclosures), the 7,700% growth figure alone is unprecedented. This level of growth suggests a disruptive technology or a significant market shift. Analysts are speculating about potential sectors like renewable energy, artificial intelligence, or biotechnology – all areas known for their rapid growth potential.

<h3>Decoding Buffett's Move: What Does it Mean?</h3>

This dual action – divesting from a seemingly stable blue-chip stock while investing heavily in a high-growth, high-risk venture – speaks volumes about Berkshire Hathaway's evolving approach to investment. It suggests a willingness to embrace higher risk for potentially higher returns, a departure from the traditionally conservative strategy the company has maintained for decades.

Several factors could explain this strategy:

- Market Diversification: Reducing reliance on the banking sector and diversifying into rapidly expanding sectors could be a key element of this strategy.

- Long-Term Vision: Buffett is known for his long-term investment horizon. He might be betting on the long-term potential of this high-growth company, despite the inherent risks.

- Responding to Market Shifts: The current macroeconomic climate, characterized by inflation and interest rate hikes, could be prompting Buffett to seek out faster-growing sectors to offset potential losses elsewhere.

<h3>The Mystery Company: Speculation and Analysis</h3>

The identity of the company experiencing the 7,700% growth remains a closely guarded secret, fueling widespread speculation. Social media is abuzz with theories, ranging from breakthrough medical technologies to innovative software solutions. Further updates are expected as soon as official disclosures are made, making this a story to follow closely.

<h3>What's Next for Berkshire Hathaway?</h3>

This unexpected move leaves investors and analysts alike eager to see Berkshire Hathaway's next steps. Will this be a one-off strategy or the beginning of a new era for the investment giant? Only time will tell. However, one thing is certain: this bold move highlights the enduring power and influence of Warren Buffett and Berkshire Hathaway in shaping the global financial landscape. Stay tuned for further updates as this story develops.

Call to Action: What are your thoughts on Berkshire Hathaway's recent investment decisions? Share your predictions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Berkshire Hathaway Sells Bank Of America Shares, Invests In 7,700% Growth Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can The Cowboys Make The Playoffs In 2025 A Game By Game Analysis

Jun 05, 2025

Can The Cowboys Make The Playoffs In 2025 A Game By Game Analysis

Jun 05, 2025 -

2025 Nfl Season Predicting The Kansas City Chiefs Game Outcomes

Jun 05, 2025

2025 Nfl Season Predicting The Kansas City Chiefs Game Outcomes

Jun 05, 2025 -

Portlands Energy Sector Another Company Facing Closure

Jun 05, 2025

Portlands Energy Sector Another Company Facing Closure

Jun 05, 2025 -

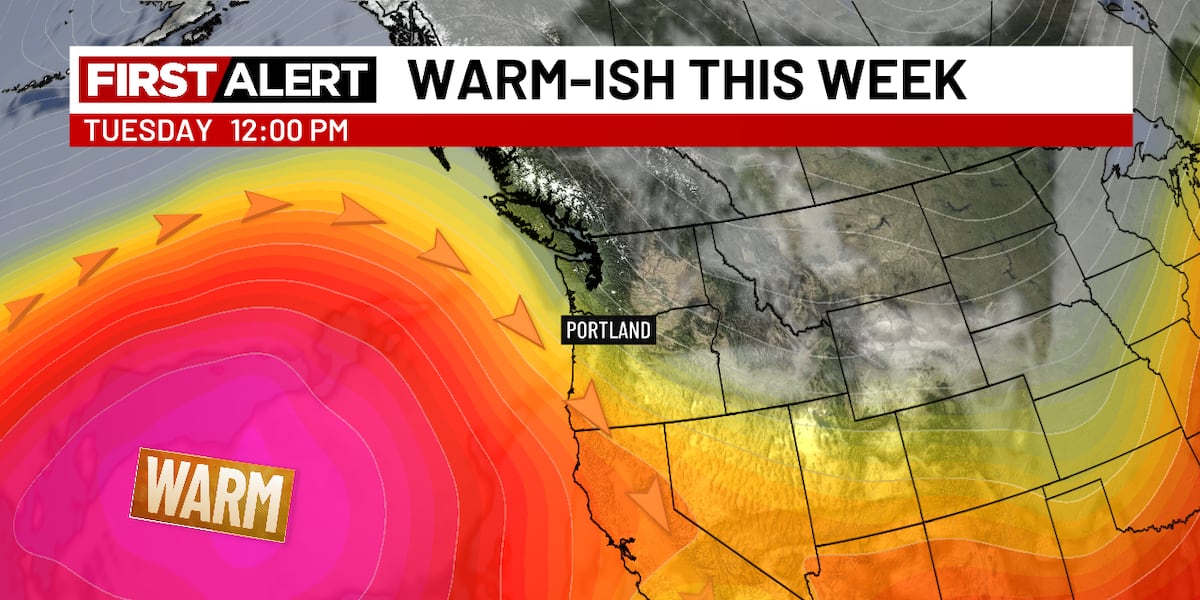

Junes Sunny Start Warm Dry Weather Forecast

Jun 05, 2025

Junes Sunny Start Warm Dry Weather Forecast

Jun 05, 2025 -

Another Portland Energy Firm Threatened With Closure

Jun 05, 2025

Another Portland Energy Firm Threatened With Closure

Jun 05, 2025