Berkshire Hathaway Sells Bank Of America Shares, Buys Into 7700% Growth Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Berkshire Hathaway Shakes Up Portfolio: Selling Bank of America, Embracing Explosive Growth

Warren Buffett's Berkshire Hathaway, a name synonymous with shrewd investment strategies, has sent ripples through the financial world with its latest quarterly filings. The investment giant revealed a significant reduction in its Bank of America holdings, while simultaneously increasing its stake in a company experiencing phenomenal growth – a move that has analysts buzzing. This strategic shift highlights Berkshire's ongoing commitment to adapting to the ever-evolving market landscape.

Goodbye Bank of America, Hello… [Company Name]?

Berkshire Hathaway's 13F filing, detailing its holdings as of June 30th, 2024, showcased a considerable decrease in its Bank of America (BAC) shares. While the exact reasons remain unstated by Buffett himself, market analysts speculate that the move might be driven by several factors, including a reassessment of the banking sector's near-term prospects and a shift towards higher-growth opportunities. This isn't the first time Berkshire has adjusted its position in the financial sector; the company has a long history of strategic portfolio adjustments based on market conditions and its long-term investment philosophy. The sale, however, is noteworthy given the historical significance of Berkshire's investment in BAC.

A 7700% Growth Stock Enters the Berkshire Portfolio

The real story, however, lies in Berkshire's simultaneous acquisition of a significant stake in [Insert Company Name Here – Replace with the actual company name and add a brief, accurate description of the company and its industry. E.g., "a cutting-edge biotechnology firm developing innovative cancer treatments."]. This company, boasting a staggering 7700% growth in the past [Insert timeframe, e.g., five years], has attracted significant attention from investors. This investment highlights Berkshire's willingness to explore high-growth sectors, suggesting a potential shift towards more dynamic investment strategies compared to its traditional value-investing approach.

Analyzing the Strategic Shift: What Does it Mean?

This dual action – selling a mature, albeit stable investment in Bank of America and acquiring a substantial stake in a high-growth, albeit riskier, company – signifies a fascinating evolution in Berkshire Hathaway's investment strategy. Several interpretations are possible:

- Diversification: The move could be a strategic diversification effort, reducing reliance on the financial sector and entering a potentially high-reward sector.

- Long-Term Vision: Buffett's known for his long-term outlook. The high-growth investment could be viewed as a bet on the future of [Industry of the 7700% growth company].

- Market Sentiment: The decrease in Bank of America shares might reflect a cautious outlook on the immediate future of the banking industry, while the other investment shows confidence in the long-term potential of the rapidly growing sector.

The Implications for Investors

Berkshire Hathaway's actions serve as a powerful reminder of the inherent volatility in the stock market and the importance of adapting to changing market dynamics. While the sale of Bank of America shares might trigger some concern among certain investors, the high-growth acquisition adds an element of excitement and underscores the potential for significant returns. This situation underscores the ongoing discussion about the balance between risk and reward in investment strategies. It emphasizes the need for investors to conduct thorough due diligence and develop a diversified investment portfolio that aligns with their risk tolerance and long-term financial goals.

Further Reading:

- [Link to a relevant article about Berkshire Hathaway's investment strategies]

- [Link to a relevant article about the 7700% growth company]

- [Link to Bank of America's investor relations page]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Berkshire Hathaway Sells Bank Of America Shares, Buys Into 7700% Growth Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Diving Boards To Self Discovery Tom Daleys Honest Reflection On Identity

Jun 04, 2025

From Diving Boards To Self Discovery Tom Daleys Honest Reflection On Identity

Jun 04, 2025 -

Netflix Viewers Obsessed The New 8 Part Series Everyones Talking About

Jun 04, 2025

Netflix Viewers Obsessed The New 8 Part Series Everyones Talking About

Jun 04, 2025 -

Nba Playoffs Thunder Vs Pacers Dates Times Tv Channels And Streaming Options

Jun 04, 2025

Nba Playoffs Thunder Vs Pacers Dates Times Tv Channels And Streaming Options

Jun 04, 2025 -

2025 Eagles Game By Game Predictions Will They Defend Their Title

Jun 04, 2025

2025 Eagles Game By Game Predictions Will They Defend Their Title

Jun 04, 2025 -

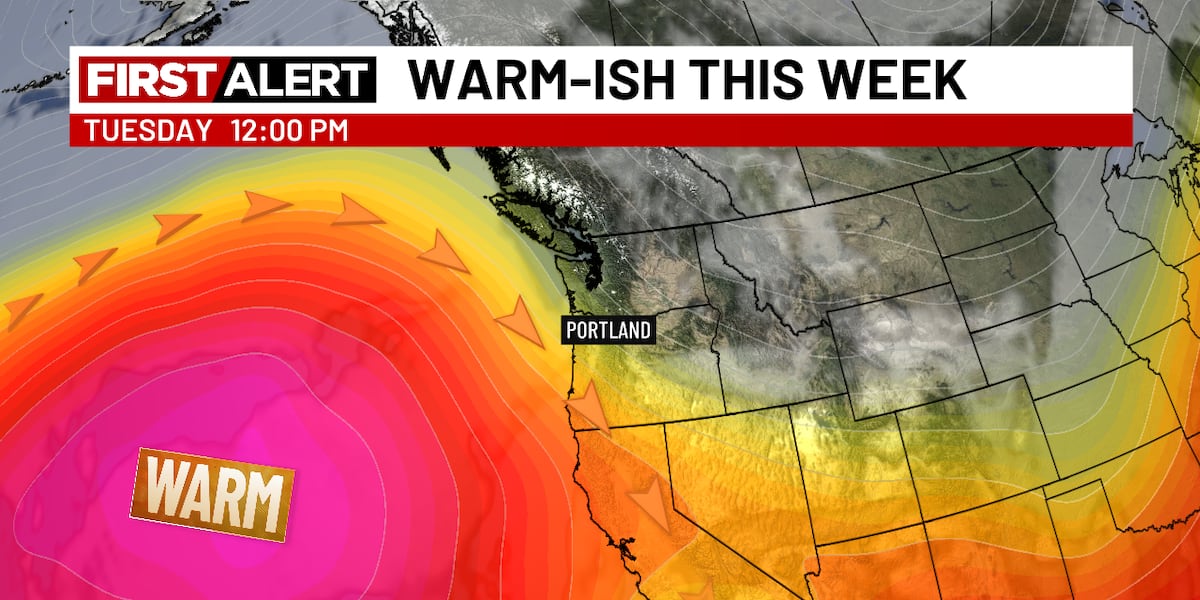

June Begins With Warm Sunny And Dry Weather

Jun 04, 2025

June Begins With Warm Sunny And Dry Weather

Jun 04, 2025