Beaten-Down Tech Stocks: Are They A Buy Or A Sell?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beaten-Down Tech Stocks: Are They a Buy or a Sell?

The tech sector has taken a significant beating in recent months. After years of explosive growth, many tech giants and smaller players alike have seen their valuations plummet. This downturn has left many investors wondering: are these beaten-down tech stocks a buying opportunity, or is further decline inevitable? The answer, as with most investment questions, is nuanced and depends heavily on individual circumstances and risk tolerance.

This article delves into the current state of the tech market, examining the factors driving the decline and offering insights to help you make informed decisions about your investment strategy.

The Tech Stock Bloodbath: Understanding the Downturn

Several key factors contributed to the current slump in tech stocks. Firstly, rising interest rates have significantly impacted valuations. Higher interest rates increase borrowing costs for companies, reducing profitability and making future growth projections less certain. This is especially true for high-growth tech companies that rely heavily on future earnings to justify their current valuations.

Secondly, inflation and concerns about a potential recession have fueled investor anxieties. During economic uncertainty, investors often flock to safer assets, leading to a sell-off in riskier investments like tech stocks. This "flight to safety" has exacerbated the downturn.

Thirdly, the post-pandemic slowdown has impacted demand for certain tech products and services. The rapid growth experienced during the pandemic proved unsustainable, leading to a correction in several sectors.

Identifying Potential Winners Amidst the Wreckage

While the overall tech sector is struggling, not all tech stocks are created equal. Some companies are better positioned to weather the storm than others. Identifying these resilient players requires careful analysis. Look for companies with:

- Strong fundamentals: Analyze revenue growth, profitability, and debt levels. Companies with solid financial foundations are better equipped to navigate economic headwinds.

- Sustainable competitive advantages: Companies with strong brand recognition, unique technologies, or significant market share are less vulnerable to competition.

- Adaptability and innovation: Companies that are actively adapting to changing market conditions and investing in innovation are more likely to thrive in the long term.

Specific Examples: A Closer Look at Individual Stocks

While we cannot offer specific financial advice, analyzing individual companies provides a useful illustration. For example, some consider companies like [mention a resilient tech company with a link to relevant financial news] to be relatively well-positioned, while others, like [mention a struggling tech company with a link to relevant financial news], are facing more significant challenges. Remember to conduct thorough due diligence before making any investment decisions.

The Verdict: Buy, Sell, or Hold?

The decision to buy, sell, or hold beaten-down tech stocks depends entirely on your individual risk tolerance, investment horizon, and understanding of the specific companies involved. For long-term investors with a high-risk tolerance, the current downturn may present attractive buying opportunities. However, investors with a shorter time horizon or lower risk tolerance may be better off waiting for greater market stability.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves significant risk, and you could lose money. Always consult with a qualified financial advisor before making any investment decisions.

Further Reading:

- [Link to a reputable source on interest rate impacts on the stock market]

- [Link to a reputable source on recessionary pressures]

- [Link to a reputable source on tech sector analysis]

By understanding the factors driving the current downturn and carefully analyzing individual companies, you can make more informed decisions about your investment in the tech sector. Remember to always prioritize responsible investing and diversify your portfolio.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beaten-Down Tech Stocks: Are They A Buy Or A Sell?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Womens Predictions Day 2 Analysis Including Rybakina Riera

May 27, 2025

French Open Womens Predictions Day 2 Analysis Including Rybakina Riera

May 27, 2025 -

Emlyat Nfs Gyr Atsh Nshanan Njat Nwjwan Grftar Dr Dywar Tbryz

May 27, 2025

Emlyat Nfs Gyr Atsh Nshanan Njat Nwjwan Grftar Dr Dywar Tbryz

May 27, 2025 -

Alex Palou Indy 500 Win Knicks Pacers Game A Champions Indiana Experience

May 27, 2025

Alex Palou Indy 500 Win Knicks Pacers Game A Champions Indiana Experience

May 27, 2025 -

Knicks Game 3 Starting Lineup Decision Hart Or Robinson

May 27, 2025

Knicks Game 3 Starting Lineup Decision Hart Or Robinson

May 27, 2025 -

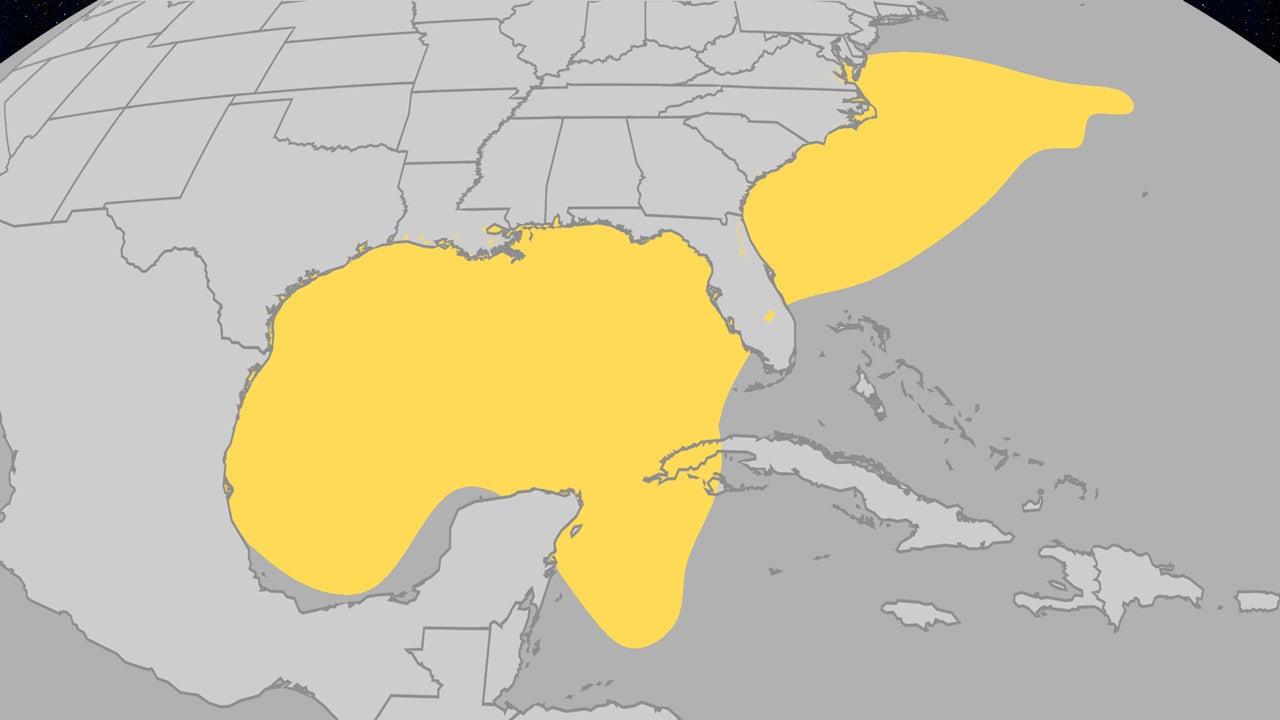

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025