Bargain Hunting In Tech: Analyzing Undervalued Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bargain Hunting in Tech: Analyzing Undervalued Stocks for Smart Investors

The tech sector, known for its rapid growth and volatility, presents unique opportunities for savvy investors. While some tech giants command hefty price tags, a closer look reveals a landscape of undervalued stocks ripe for the picking. This article delves into the strategies for identifying these hidden gems and navigating the complexities of the tech market to maximize your returns.

Understanding Undervalued Tech Stocks:

Identifying undervalued stocks requires a keen eye and a methodical approach. Simply looking at a low stock price isn't enough; you need to analyze the company's fundamentals and compare its valuation to its peers and its potential. Several key metrics come into play:

-

Price-to-Earnings Ratio (P/E): A low P/E ratio relative to industry averages can indicate undervaluation, suggesting the market may be underestimating the company's earnings potential. However, it's crucial to consider the company's growth prospects. A low P/E for a company experiencing significant losses isn't necessarily a good sign.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue. A lower P/S ratio compared to competitors can suggest undervaluation, particularly for companies in high-growth sectors where profitability may lag behind revenue generation.

-

Debt-to-Equity Ratio: High levels of debt can significantly impact a company's financial health and future prospects. Analyzing this ratio is vital in assessing risk.

-

Growth Potential: Even with a seemingly low valuation, a company lacking growth potential is unlikely to deliver significant returns. Consider factors like market share, innovation, and competitive landscape.

Strategies for Identifying Undervalued Tech Stocks:

Several strategies can help you unearth undervalued tech stocks:

-

Fundamental Analysis: Thoroughly examine a company's financial statements, including income statements, balance sheets, and cash flow statements. Look for trends and anomalies that might indicate undervaluation.

-

Comparative Analysis: Compare a company's valuation metrics (P/E, P/S, etc.) to those of its competitors. A significantly lower valuation might point to an undervaluation. Remember to compare apples to apples – consider companies of similar size and business model.

-

Industry Research: Stay informed about industry trends and technological advancements. Emerging technologies and shifts in market demand can significantly impact a company's valuation. Following reputable tech news sources and industry analysts is crucial. [Link to a reputable tech news source]

-

Technical Analysis (Optional): While not a primary indicator of undervaluation, technical analysis can provide insights into price trends and potential support levels. Combine technical analysis with fundamental analysis for a more comprehensive view.

Risks and Considerations:

Investing in undervalued stocks, particularly in the volatile tech sector, involves inherent risks. Some seemingly undervalued companies may remain undervalued for a reason – poor management, disruptive technologies, or unforeseen circumstances. Diversification is key to mitigating risk. Don't put all your eggs in one basket!

Conclusion:

Finding undervalued tech stocks requires diligent research and a deep understanding of financial analysis. By employing a combination of fundamental and comparative analysis, coupled with ongoing market monitoring, investors can potentially identify compelling opportunities and capitalize on the fluctuations within the technology sector. Remember to always conduct thorough due diligence before investing and consider consulting with a financial advisor for personalized guidance. This article provides a starting point; thorough research is crucial for successful investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bargain Hunting In Tech: Analyzing Undervalued Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Multiple Car Pile Up Mars The Start Of The 109th Indy 500

May 28, 2025

Multiple Car Pile Up Mars The Start Of The 109th Indy 500

May 28, 2025 -

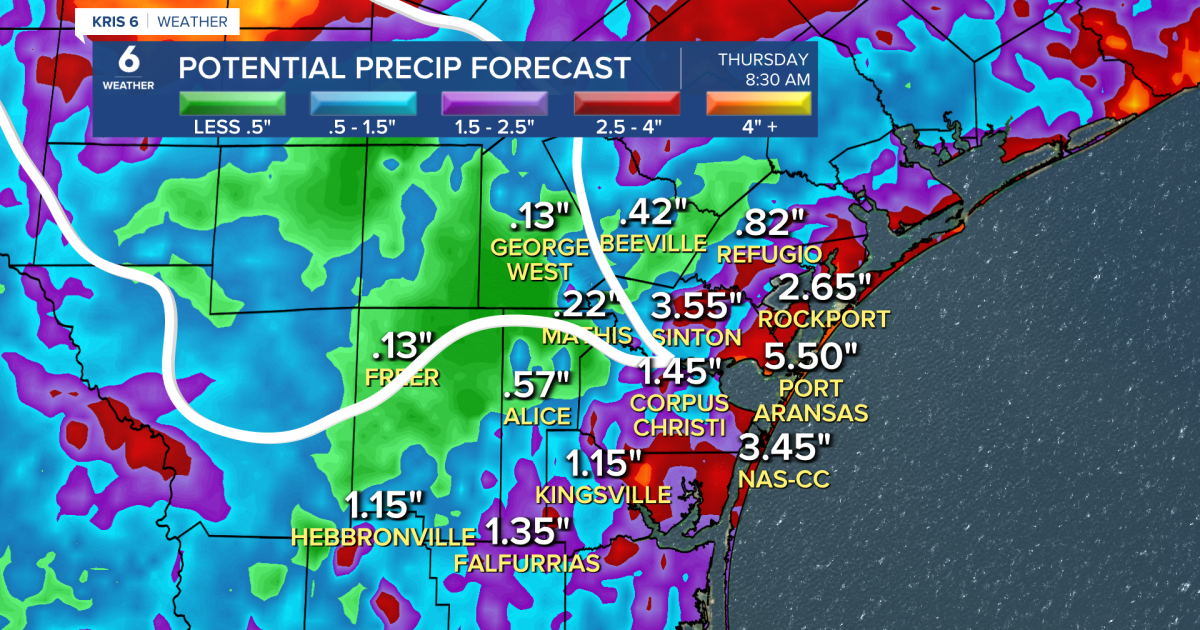

Gulf Moisture Surge To Bring Heavy Rainfall Weather Alert Issued

May 28, 2025

Gulf Moisture Surge To Bring Heavy Rainfall Weather Alert Issued

May 28, 2025 -

Playoff Update Thunder Build 3 1 Lead Against Timberwolves

May 28, 2025

Playoff Update Thunder Build 3 1 Lead Against Timberwolves

May 28, 2025 -

From 20 Down To Victory Knicks Game 3 Comeback Against Pacers

May 28, 2025

From 20 Down To Victory Knicks Game 3 Comeback Against Pacers

May 28, 2025 -

Pacers Admit To Poor Performance In Knicks Game 3 Loss

May 28, 2025

Pacers Admit To Poor Performance In Knicks Game 3 Loss

May 28, 2025