Bargain Hunting In Tech: Analyzing Beaten-Down Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bargain Hunting in Tech: Analyzing Beaten-Down Stocks

The tech sector has taken a significant beating in recent months, with many once-high-flying stocks plummeting to levels unseen in years. While this downturn presents risks, it also creates opportunities for savvy investors seeking bargain buys. This article delves into the world of bargain hunting in the tech sector, analyzing what to look for and the potential pitfalls to avoid.

Understanding the Tech Stock Slump:

The recent decline in tech stock prices is multifaceted. Factors contributing to the slump include rising interest rates, increased inflation, concerns about a potential recession, and a post-pandemic slowdown in growth for some sectors. This has led to a widespread sell-off, creating a landscape ripe for bargain hunting. However, it's crucial to remember that not all beaten-down stocks are bargains. A company’s low stock price might reflect genuine underlying problems, not just market volatility.

Identifying Potential Bargains:

So how do you separate the wheat from the chaff? Here are some key factors to consider when analyzing beaten-down tech stocks:

-

Fundamental Analysis: Look beyond the share price. Analyze the company's financial statements, including revenue growth, profitability (earnings per share or EPS), debt levels, and cash flow. Strong fundamentals suggest a company's resilience even amidst market turmoil. Consult resources like for financial filings.

-

Valuation Metrics: Use valuation metrics like the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and Price-to-Book ratio (P/B) to compare a company's current valuation to its historical performance and industry peers. A low P/E ratio, for example, could indicate the stock is undervalued. However, remember that these metrics should be considered in context, not in isolation.

-

Growth Prospects: Assess the company's future growth potential. Does it operate in a growing market? Does it have innovative products or services in the pipeline? Long-term growth potential is crucial for justifying a purchase even if the current situation looks bleak.

-

Competitive Landscape: Analyze the company's competitive position within its industry. Is it a market leader with a strong brand? Or is it facing intense competition that could further erode its market share?

-

Management Team: A strong and experienced management team is vital for navigating challenging times. Research the leadership's track record and their strategic vision for the company's future.

Risks and Considerations:

While bargain hunting can be rewarding, it's essential to acknowledge the inherent risks:

-

Value Trap: A company's low share price might reflect legitimate problems, not just temporary market conditions. This is often referred to as a "value trap," where the stock appears cheap but remains stagnant or continues to decline.

-

Market Volatility: The tech sector is known for its volatility. Even seemingly strong companies can experience further price drops, especially during periods of economic uncertainty.

-

Lack of Diversification: Concentrating too heavily on beaten-down tech stocks can significantly increase your investment risk. Diversification across different sectors and asset classes is crucial for mitigating risk.

Conclusion:

Bargain hunting in the tech sector requires careful research, a thorough understanding of financial statements, and a realistic assessment of both opportunities and risks. While the potential for significant returns exists, it's crucial to proceed cautiously and avoid impulsive decisions. Remember to conduct thorough due diligence and consider seeking advice from a qualified financial advisor before making any investment decisions. The current market downturn presents challenges, but for those with the patience and the expertise to analyze the situation effectively, there are opportunities to find real value.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bargain Hunting In Tech: Analyzing Beaten-Down Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

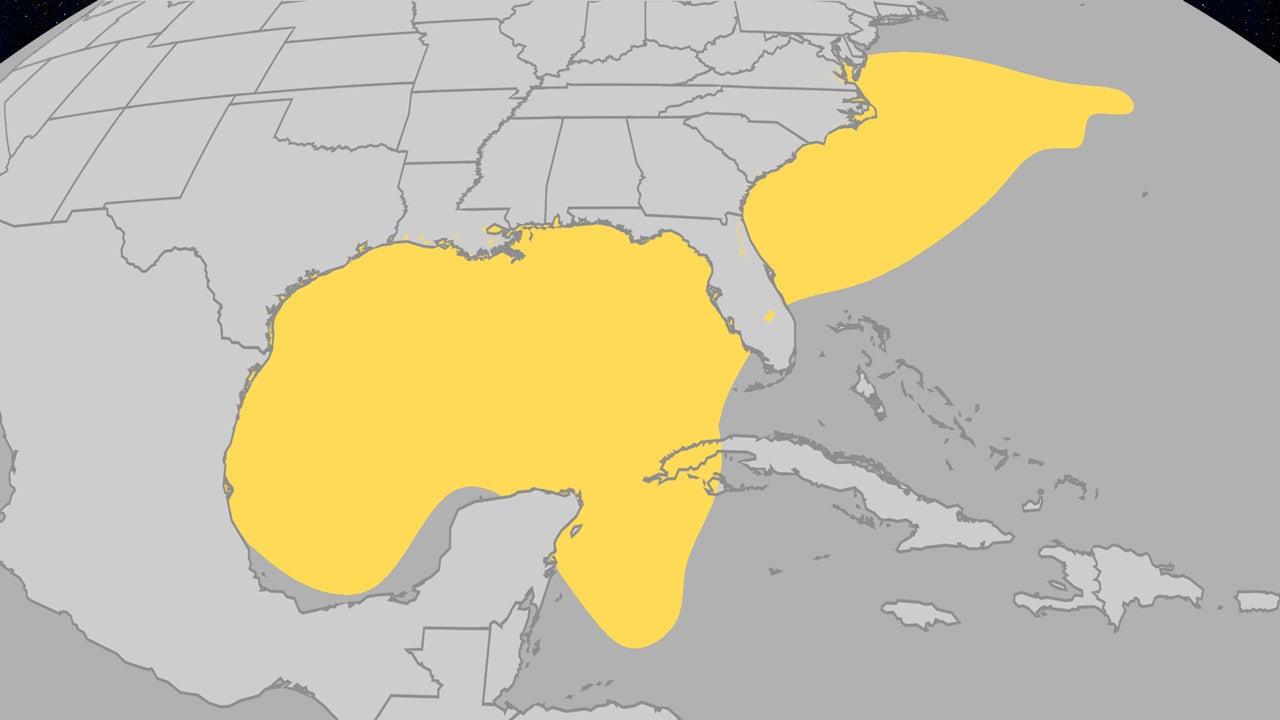

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025 -

Nascar Star Kyle Larson Prepares For Back To Back Races Indy Road Course And Charlotte

May 27, 2025

Nascar Star Kyle Larson Prepares For Back To Back Races Indy Road Course And Charlotte

May 27, 2025 -

Underdog Alert The Most Realistic Fringe Nfl Teams To Reach The 2023 Playoffs

May 27, 2025

Underdog Alert The Most Realistic Fringe Nfl Teams To Reach The 2023 Playoffs

May 27, 2025 -

Nio Stock Price Prediction And Investment Strategy Is It Time To Buy

May 27, 2025

Nio Stock Price Prediction And Investment Strategy Is It Time To Buy

May 27, 2025 -

Anthony Edwards Leads Timberwolves To Crucial Game 3 Victory Over Opponent Name

May 27, 2025

Anthony Edwards Leads Timberwolves To Crucial Game 3 Victory Over Opponent Name

May 27, 2025