August Storms Push Allstate's 2023 Catastrophe Losses To $2.387 Billion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

August Storms Push Allstate's 2023 Catastrophe Losses to $2.387 Billion

Record-breaking weather events across the US leave Allstate facing significant financial impact.

The insurance giant, Allstate, announced today that its catastrophe losses for 2023 have surged to a staggering $2.387 billion, largely driven by the intense and devastating storms that ravaged various parts of the United States throughout August. This figure significantly surpasses previous estimates and underscores the escalating financial burden placed on insurance companies by increasingly frequent and severe weather events. The sheer cost highlights the growing impact of climate change and the urgent need for improved disaster preparedness and mitigation strategies.

This substantial increase in catastrophe losses represents a significant challenge for Allstate, impacting their bottom line and potentially affecting future policy pricing. The company has already seen its stock price fluctuate in response to the news, reflecting investor concerns about the long-term implications of these rising costs.

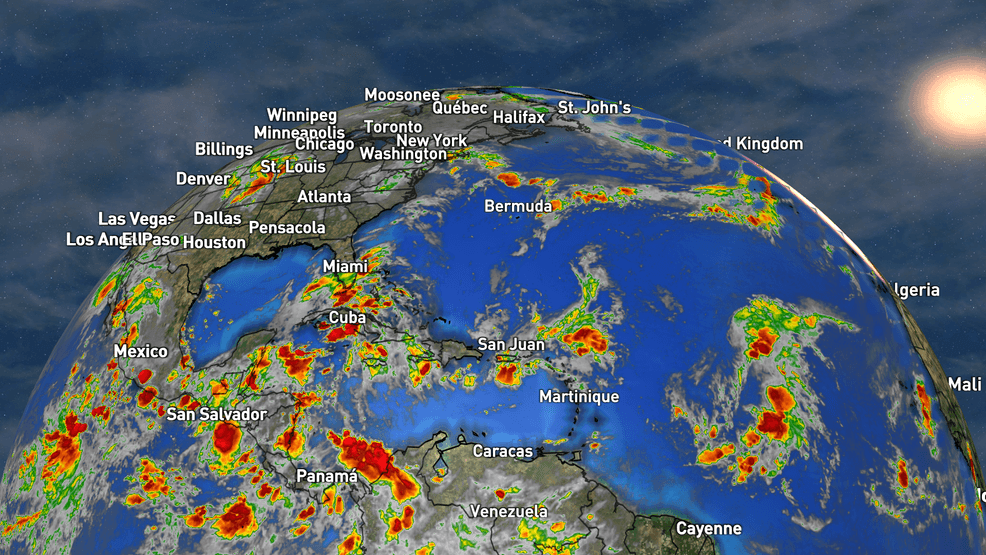

The Impact of August's Devastating Storms

August 2023 witnessed a series of unprecedented weather events across the country. From Hurricane Hilary's torrential rains in California to severe thunderstorms and flash flooding in the Midwest and East Coast, the sheer scale and intensity of these storms caused widespread damage, resulting in numerous claims for Allstate and other insurers. The combination of high winds, heavy rainfall, and flooding led to significant property damage, including:

- Residential damage: Homes sustained extensive damage from flooding, wind damage, and hail. Repair and replacement costs have soared, contributing significantly to the overall loss figure.

- Commercial damage: Businesses were also severely impacted, suffering losses due to flooding, property damage, and business interruption. This further contributes to the economic fallout from these devastating storms.

- Vehicle damage: Numerous vehicles were damaged or destroyed due to flooding and collisions caused by hazardous road conditions.

These factors collectively contributed to the substantial increase in Allstate's catastrophe losses. The company is currently working to process the large volume of claims received, providing support to affected policyholders.

The Growing Threat of Extreme Weather and its Impact on the Insurance Industry

The escalating frequency and intensity of extreme weather events pose a significant challenge not only to Allstate but to the entire insurance industry. This trend, largely attributed to climate change, necessitates a reassessment of risk models and pricing strategies. Insurers are facing increasing pressure to adapt to this changing landscape, potentially leading to:

- Higher insurance premiums: Policyholders may see an increase in premiums to offset the rising costs associated with catastrophic losses.

- Increased scrutiny of risk assessment: Insurance companies are likely to implement more rigorous risk assessment methods to better evaluate and price policies in high-risk areas.

- Innovation in risk mitigation: The industry is actively exploring innovative solutions for risk mitigation, including advanced weather forecasting and disaster preparedness initiatives.

The situation at Allstate serves as a stark reminder of the substantial financial risks associated with extreme weather events and the urgent need for both individual and collective action to address climate change and build more resilient communities.

What's Next for Allstate and the Insurance Industry?

Allstate is likely to undertake a comprehensive review of its risk management strategies in light of these substantial losses. This could involve adjustments to policy pricing, a more refined risk assessment model, and increased investment in disaster preparedness and mitigation efforts. The future of the insurance industry hinges on its ability to adapt to the changing climate and to develop innovative solutions to manage the escalating costs associated with extreme weather. The coming months will be critical in determining how the industry, and Allstate in particular, responds to this new reality.

For more information on disaster preparedness and insurance, consult resources like [link to FEMA website] and [link to a reputable insurance information website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on August Storms Push Allstate's 2023 Catastrophe Losses To $2.387 Billion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Commanders Rfk Stadium Plan Approved By D C Council

Sep 20, 2025

Commanders Rfk Stadium Plan Approved By D C Council

Sep 20, 2025 -

Current Moon Phase Full Moon And The Beginning Of The Waning Cycle

Sep 20, 2025

Current Moon Phase Full Moon And The Beginning Of The Waning Cycle

Sep 20, 2025 -

After Charlie Kirks Assassination Turning Point Usa Announces Erika Kirk As Successor

Sep 20, 2025

After Charlie Kirks Assassination Turning Point Usa Announces Erika Kirk As Successor

Sep 20, 2025 -

Atp Hangzhou Open Day 3 Expert Predictions And Betting Odds

Sep 20, 2025

Atp Hangzhou Open Day 3 Expert Predictions And Betting Odds

Sep 20, 2025 -

Project Runway This Weeks Challenges And Their Impact On The Competition

Sep 20, 2025

Project Runway This Weeks Challenges And Their Impact On The Competition

Sep 20, 2025

Latest Posts

-

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025 -

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025