August Catastrophes Cost Allstate $213 Million: Impact On Q3 Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

August Catastrophes Cost Allstate $213 Million: Impact on Q3 Earnings

Allstate's Q3 earnings outlook dimmed by a summer of extreme weather. August 2024 proved to be a costly month for Allstate, with a staggering $213 million in catastrophe losses impacting the company's third-quarter earnings. This significant financial hit underscores the growing impact of climate change and extreme weather events on the insurance industry. The losses highlight the increasing need for robust disaster preparedness and innovative risk management strategies within the sector.

A Summer of Storms: Unpacking the Losses

The $213 million in catastrophe losses reported by Allstate represents a substantial blow to the company's bottom line. These figures specifically relate to the significant weather events that ravaged parts of the United States throughout August. While Allstate hasn't detailed the precise breakdown of events, reports suggest a combination of hurricanes, wildfires, and severe thunderstorms contributed to the hefty payout. This isn't an isolated incident; the insurance industry as a whole is facing increased pressure from more frequent and intense weather events.

Impact on Q3 Earnings and Future Projections

The impact of these August catastrophes will undoubtedly be reflected in Allstate's third-quarter earnings report. Analysts predict a significant reduction in profitability compared to the same period last year. This emphasizes the vulnerability of the insurance sector to unpredictable and increasingly severe weather patterns. The company will likely need to re-evaluate its risk models and pricing strategies to account for these escalating costs. This could lead to increased premiums for consumers in high-risk areas.

The Broader Implications for the Insurance Industry

Allstate's experience serves as a stark warning for the entire insurance industry. The escalating costs associated with climate-related disasters are unsustainable in the long run. The industry needs to adapt to this new reality by:

- Improving risk assessment models: More sophisticated models are needed to accurately predict and price the risks associated with extreme weather.

- Developing innovative insurance products: Products tailored to specific climate risks, such as parametric insurance, could offer more effective solutions.

- Investing in disaster preparedness: Collaborating with communities and governments on mitigation strategies can help reduce the overall impact of disasters.

- Advocating for climate action: The insurance industry has a crucial role to play in advocating for policies that address climate change.

What this means for consumers: While the full impact on consumer premiums remains to be seen, it's highly likely that insurers will need to adjust their pricing to reflect the increased risk. Consumers in areas prone to extreme weather events may experience higher premiums in the coming years.

Looking Ahead: Navigating Uncertainty in a Changing Climate

The financial burden shouldered by Allstate in August underscores the urgent need for the insurance industry to adapt to the changing climate. The coming years will likely see further challenges as extreme weather events become more frequent and severe. The industry's ability to innovate, adapt, and collaborate will be crucial in ensuring its long-term sustainability and its ability to protect its policyholders. This situation also highlights the importance of individual preparedness against natural disasters. Knowing your risk level and having an emergency plan in place can mitigate the financial and personal impact of unforeseen events.

Keywords: Allstate, Q3 earnings, catastrophe losses, August weather, insurance industry, climate change, extreme weather, hurricane, wildfire, thunderstorm, risk assessment, insurance premiums, disaster preparedness, parametric insurance, climate risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on August Catastrophes Cost Allstate $213 Million: Impact On Q3 Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jim Harbaugh Greatest Football Coach In History Colin Cowherd Thinks So

Sep 20, 2025

Jim Harbaugh Greatest Football Coach In History Colin Cowherd Thinks So

Sep 20, 2025 -

Week 4 College Football Must See Matchups This Weekend

Sep 20, 2025

Week 4 College Football Must See Matchups This Weekend

Sep 20, 2025 -

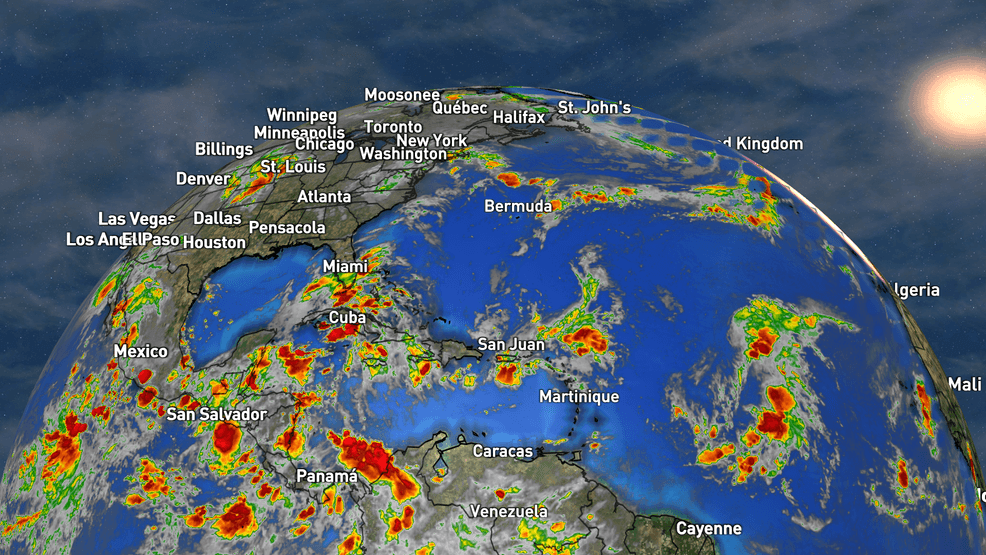

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025 -

Iranian Hardliners Brace For Potential Un Sanctions From Europe

Sep 20, 2025

Iranian Hardliners Brace For Potential Un Sanctions From Europe

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Latest Posts

-

Ohtanis Exit Blue Jays Giants Cubs And Angels Paths To Mlb Success In The Upcoming Offseason

Sep 20, 2025

Ohtanis Exit Blue Jays Giants Cubs And Angels Paths To Mlb Success In The Upcoming Offseason

Sep 20, 2025 -

Nfl Week 3 Commanders Defensive Line Gets A Boost With Veteran Addition

Sep 20, 2025

Nfl Week 3 Commanders Defensive Line Gets A Boost With Veteran Addition

Sep 20, 2025 -

Wnba Playoffs Mercury Defeat Liberty In Game 3 Despite Stewarts Effort

Sep 20, 2025

Wnba Playoffs Mercury Defeat Liberty In Game 3 Despite Stewarts Effort

Sep 20, 2025 -

Hardline Iranian Faction Gathers Strength As European Nations Push For Un Sanctions

Sep 20, 2025

Hardline Iranian Faction Gathers Strength As European Nations Push For Un Sanctions

Sep 20, 2025 -

Valkyries Power Lynx To Wnba Semifinals Victory A 17 Point Rally

Sep 20, 2025

Valkyries Power Lynx To Wnba Semifinals Victory A 17 Point Rally

Sep 20, 2025