Assessing The Risk: A Deep Dive Into Super Micro Computer's Correction Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Assessing the Risk: A Deep Dive into Super Micro Computer's Correction Potential

Super Micro Computer (SMCI) has experienced a significant surge in its stock price recently, leaving many investors wondering: is this growth sustainable, or is a correction on the horizon? This deep dive analyzes the factors contributing to SMCI's performance and assesses the potential for a near-term correction. Understanding these risks is crucial for informed investment decisions.

Super Micro's Recent Success: A Closer Look

Super Micro's recent success is largely attributed to its strong position in the rapidly expanding data center and cloud computing markets. The company's high-performance computing (HPC) solutions, particularly its servers and storage systems, are in high demand as businesses and organizations grapple with ever-increasing data processing needs. Furthermore, SMCI's commitment to sustainable technology and its innovative designs have solidified its reputation within the industry. This strong market positioning, combined with positive earnings reports, has fueled the recent stock price appreciation.

Factors Suggesting a Potential Correction

While the long-term outlook for Super Micro appears positive, several factors suggest the possibility of a short-term correction:

-

Overvaluation Concerns: Some analysts argue that SMCI's stock price has become overvalued relative to its current earnings and future growth projections. A sharp increase in price without commensurate growth in fundamentals can often precede a correction. Evaluating the Price-to-Earnings (P/E) ratio and other key valuation metrics is essential here.

-

Market Volatility: The broader tech sector, of which Super Micro is a part, remains subject to significant market volatility. Geopolitical events, economic uncertainty, and shifts in investor sentiment can all trigger sudden price drops. Diversification within your portfolio can help mitigate this risk.

-

Supply Chain Challenges: While SMCI has demonstrated resilience in navigating supply chain disruptions, these challenges persist across the tech industry. Any unexpected delays or cost increases could impact profitability and negatively affect the stock price.

-

Competition: The data center and cloud computing market is highly competitive. Established players and emerging competitors constantly vie for market share. Intense competition could pressure SMCI's margins and hinder future growth.

Mitigation Strategies and Investor Considerations

Investors concerned about a potential correction can employ several mitigation strategies:

-

Diversification: Diversifying your investment portfolio across different asset classes and sectors reduces exposure to the risks associated with a single stock.

-

Dollar-Cost Averaging (DCA): This investment strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. DCA mitigates the risk of investing a large sum just before a correction.

-

Stop-Loss Orders: Setting stop-loss orders can help limit potential losses if the stock price falls below a predetermined level.

Conclusion: Navigating the Uncertainty

Super Micro Computer's future prospects appear promising, driven by its strong position in a rapidly growing market. However, several factors point to the possibility of a short-term correction. Investors should carefully analyze the risks and employ appropriate mitigation strategies to manage their exposure. Thorough due diligence, including researching recent financial reports and analyst opinions, is crucial before making any investment decisions. Remember, past performance is not indicative of future results. Consult with a qualified financial advisor to tailor a strategy that aligns with your individual risk tolerance and financial goals.

Keywords: Super Micro Computer, SMCI, Stock Market, Stock Correction, High-Performance Computing, HPC, Data Center, Cloud Computing, Investment Risk, Valuation, Market Volatility, Supply Chain, Competition, Investment Strategy, Dollar-Cost Averaging, Stop-Loss Orders.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Assessing The Risk: A Deep Dive Into Super Micro Computer's Correction Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Oregon Man Sails 2 000 Miles To Hawaii With His Cat After Quitting Job

May 27, 2025

Oregon Man Sails 2 000 Miles To Hawaii With His Cat After Quitting Job

May 27, 2025 -

Live Updates French Open 2025 Day 2 Navarro In Trouble Big Names To Feature

May 27, 2025

Live Updates French Open 2025 Day 2 Navarro In Trouble Big Names To Feature

May 27, 2025 -

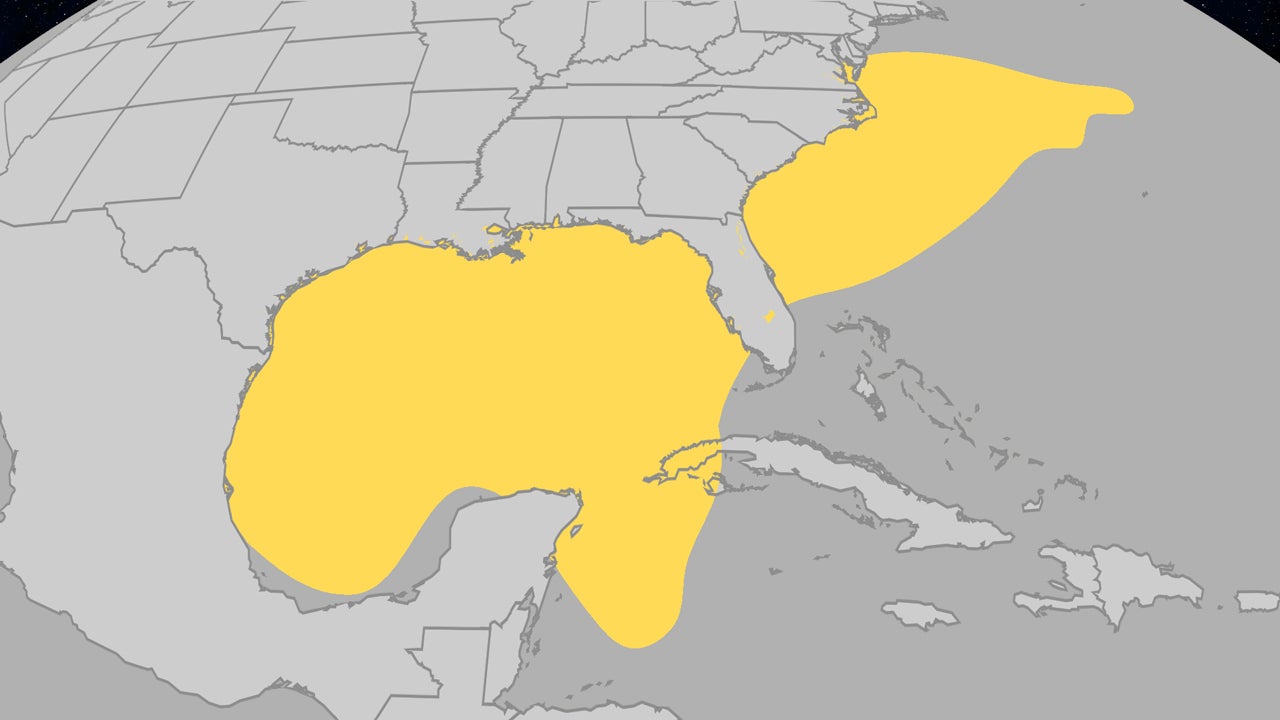

Atlantic Hurricane Season Outlook June Storm Formation And Recent Uptick

May 27, 2025

Atlantic Hurricane Season Outlook June Storm Formation And Recent Uptick

May 27, 2025 -

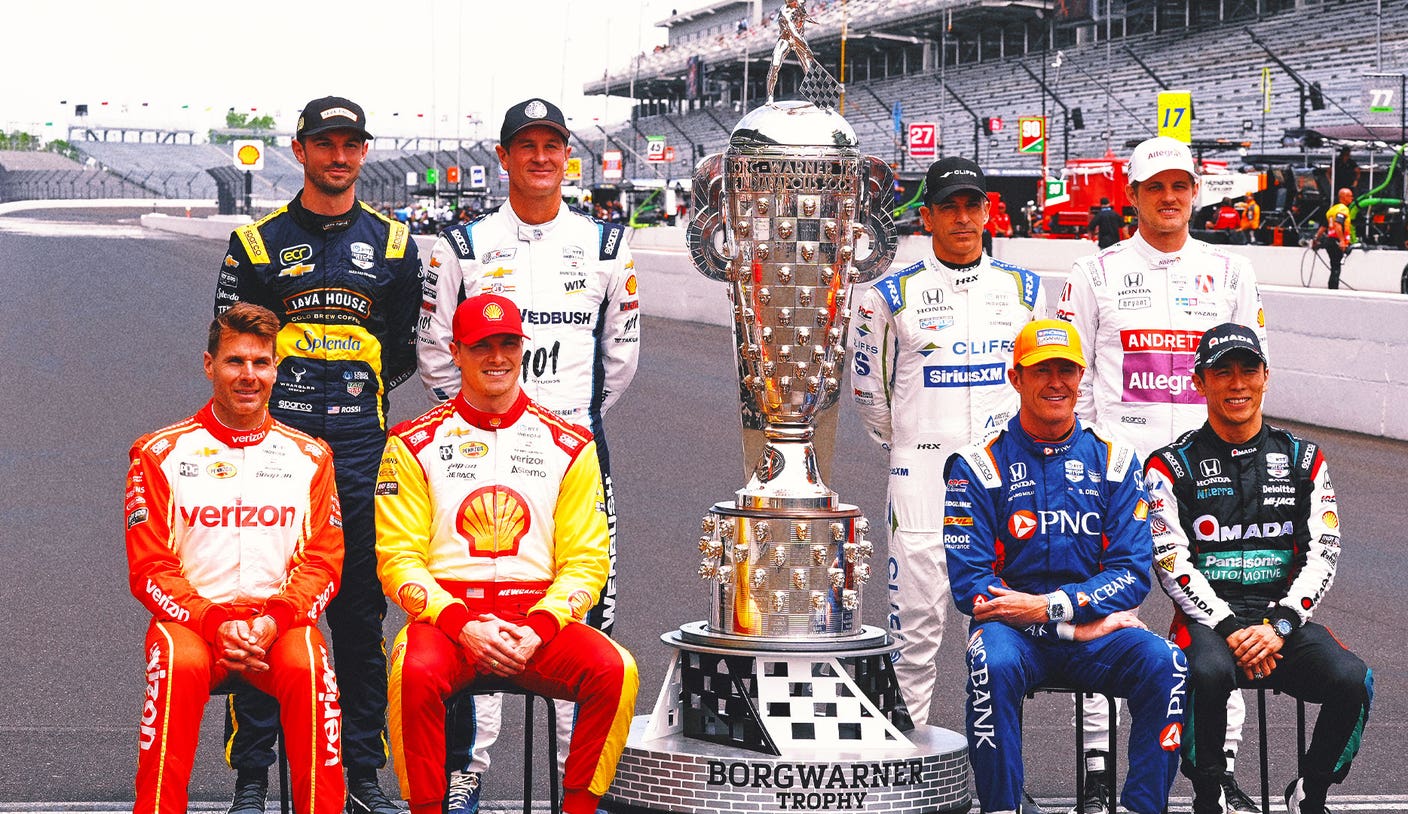

No More Space On The Borg Warner Trophy The Indy 500s Space Dilemma

May 27, 2025

No More Space On The Borg Warner Trophy The Indy 500s Space Dilemma

May 27, 2025 -

Ufl Week 9 Live Game Updates And Top Moments From Panthers Vs Stallions Match

May 27, 2025

Ufl Week 9 Live Game Updates And Top Moments From Panthers Vs Stallions Match

May 27, 2025