Assessing The Current Return Trends At Experian (LON:EXPN)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Assessing the Current Return Trends at Experian (LON:EXPN)

Experian (LON:EXPN), a global leader in information services, has consistently delivered strong returns for investors over the years. However, understanding current return trends requires a nuanced look at its recent performance, future prospects, and the broader economic landscape. This article delves into the key factors influencing Experian's returns, offering investors a comprehensive assessment.

Experian's Recent Performance: A Mixed Bag

Experian's share price has seen fluctuations in recent months, reflecting both positive and negative influences. While the company continues to report robust revenue growth, driven by strong demand for its credit reporting and data analytics services, several factors have impacted investor sentiment. These include concerns about:

- Global Economic Slowdown: A potential recession in major markets could impact consumer spending and credit activity, ultimately affecting Experian's revenue streams. The impact of inflation and rising interest rates also remains a key concern.

- Increased Competition: The data analytics market is becoming increasingly competitive, with both established players and new entrants vying for market share. Experian needs to continuously innovate to maintain its competitive edge.

- Regulatory Scrutiny: The company operates in a heavily regulated environment, and changes in data privacy laws and regulations could influence its operating costs and revenue potential.

Positive Indicators for Future Returns

Despite these challenges, several factors suggest potential for continued strong returns from Experian:

- Diversified Revenue Streams: Experian's business is diversified across various sectors and geographies, mitigating risk associated with reliance on a single market or product. This resilience is crucial in uncertain economic times.

- Strategic Acquisitions and Investments: Experian's history of strategic acquisitions and investments in new technologies positions it well for future growth. This proactive approach enables them to expand their offerings and tap into emerging market opportunities.

- Strong Brand Reputation and Customer Base: Experian enjoys a strong reputation and a large, loyal customer base, providing a solid foundation for future growth.

Analyzing Key Financial Metrics

Analyzing Experian's key financial metrics, including revenue growth, profit margins, and debt levels, is crucial for assessing its future return potential. Investors should consult Experian's financial reports and analyst forecasts for the most up-to-date information. Resources like the provide access to this data.

Long-Term Outlook and Investment Considerations

The long-term outlook for Experian remains positive, driven by the increasing demand for data analytics and credit reporting services globally. However, investors should be aware of the inherent risks associated with investing in the stock market, particularly in a volatile economic climate. A well-diversified investment portfolio is always recommended.

Conclusion: A Cautiously Optimistic View

Experian's current return trends present a mixed picture. While the company faces challenges related to the global economy and increased competition, its diversified business model, strategic investments, and strong brand reputation offer a degree of resilience. Investors should conduct thorough due diligence, considering both the potential rewards and risks before making any investment decisions. Staying informed about Experian's financial performance and industry developments is key to making informed investment choices. Remember to consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Assessing The Current Return Trends At Experian (LON:EXPN). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Caddie Ted Scott Absences From Scottie Schefflers Tournament Explained

Aug 12, 2025

Caddie Ted Scott Absences From Scottie Schefflers Tournament Explained

Aug 12, 2025 -

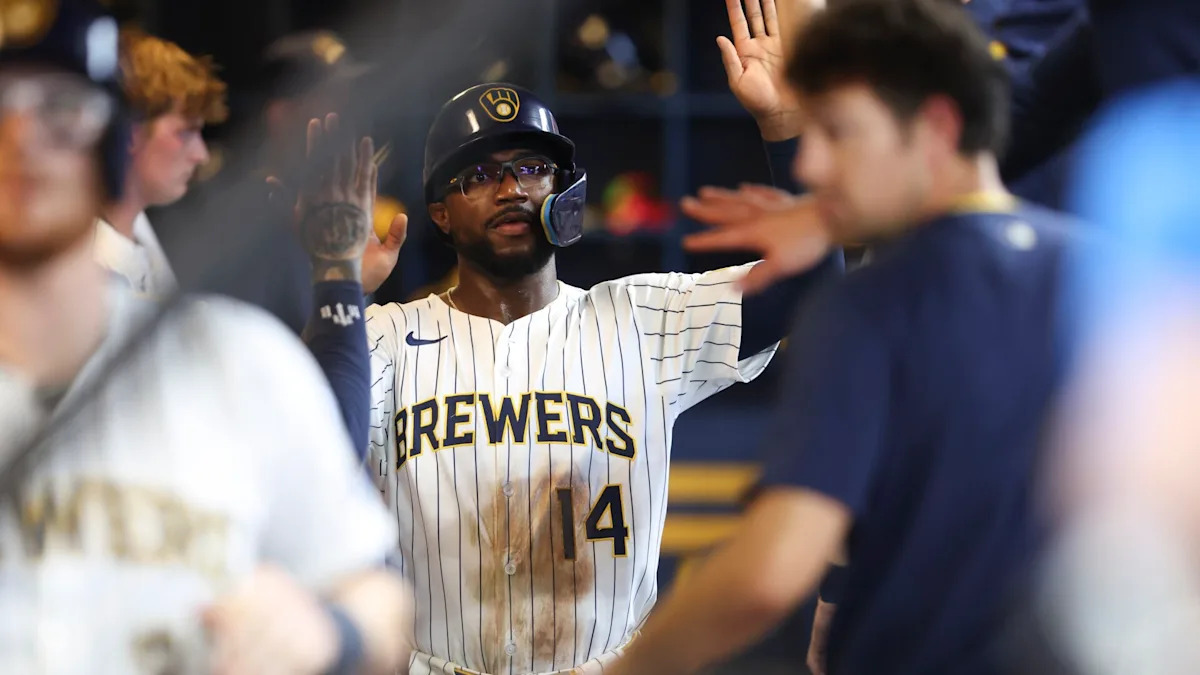

Pirates Brewers Comprehensive Betting Preview Predictions And Key Stats August 11

Aug 12, 2025

Pirates Brewers Comprehensive Betting Preview Predictions And Key Stats August 11

Aug 12, 2025 -

Fantasy Football Cheat Sheet 2024 Top Picks Sleepers And Busts

Aug 12, 2025

Fantasy Football Cheat Sheet 2024 Top Picks Sleepers And Busts

Aug 12, 2025 -

Dominate Your League The Ultimate Fantasy Football Draft Guide

Aug 12, 2025

Dominate Your League The Ultimate Fantasy Football Draft Guide

Aug 12, 2025 -

Transportation Network And Route News Weekly Digest August 11 2025

Aug 12, 2025

Transportation Network And Route News Weekly Digest August 11 2025

Aug 12, 2025

Latest Posts

-

Will The Dodgers Break Their Angels Losing Streak

Aug 13, 2025

Will The Dodgers Break Their Angels Losing Streak

Aug 13, 2025 -

Plainclothes Trailer Tom Blyth Navigates A Perilous Romance While Investigating

Aug 13, 2025

Plainclothes Trailer Tom Blyth Navigates A Perilous Romance While Investigating

Aug 13, 2025 -

Hailee Steinfeld Reaches Milestone Josh Allens Touching Response

Aug 13, 2025

Hailee Steinfeld Reaches Milestone Josh Allens Touching Response

Aug 13, 2025 -

Will Trent Season 4 Det Wilks Gets A Bigger Role

Aug 13, 2025

Will Trent Season 4 Det Wilks Gets A Bigger Role

Aug 13, 2025 -

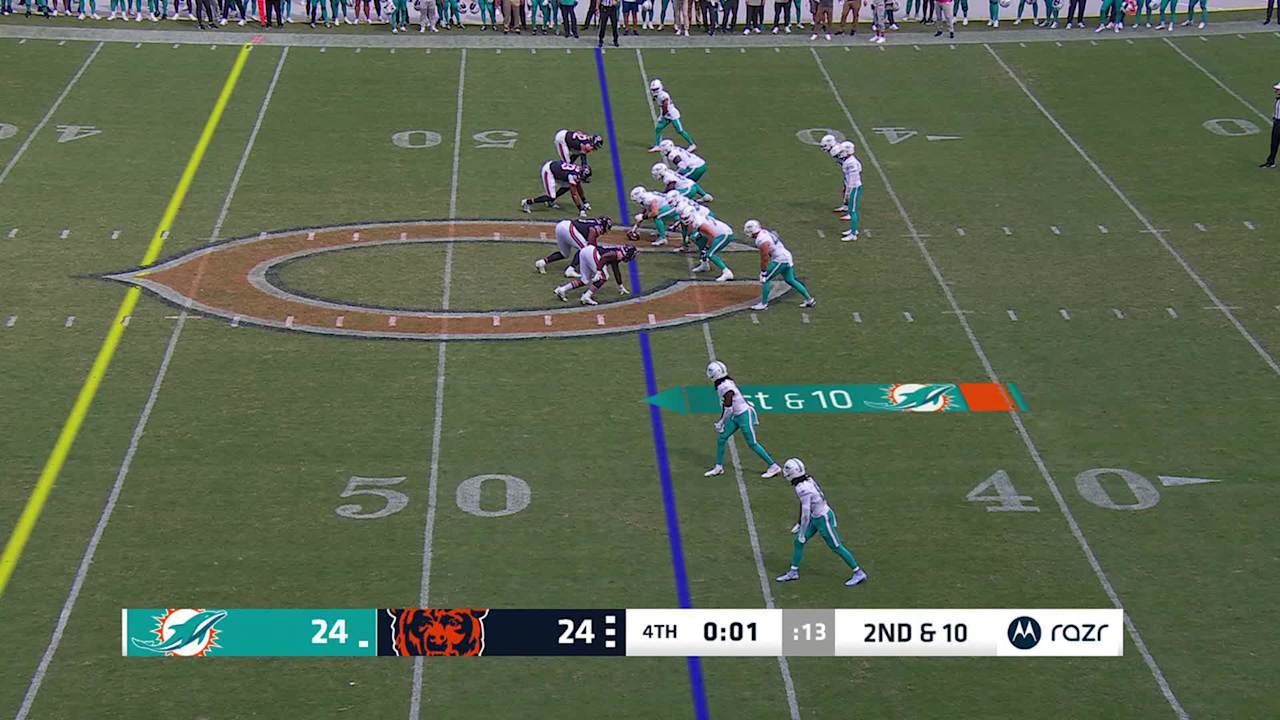

Last Second Tie Dolphins And Bears Dramatic Game

Aug 13, 2025

Last Second Tie Dolphins And Bears Dramatic Game

Aug 13, 2025