Are Experian (LON:EXPN)'s Return Trends A Red Flag For Investors?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Experian (LON:EXPN)'s Return Trends a Red Flag for Investors?

Experian (LON:EXPN), a global leader in information services, has seen its share price fluctuate recently, prompting investors to question the company's future performance. While Experian boasts a strong brand and a history of consistent growth, certain trends raise concerns about its long-term trajectory. This article delves into these trends, examining whether they signal a genuine cause for alarm or are merely temporary market corrections.

Experian's Recent Performance: A Mixed Bag

Experian's financial performance has been a mixed bag in recent years. While revenue growth remains positive, driven largely by increasing demand for its credit reporting and data analytics services, profit margins have shown some signs of compression. This squeeze on profitability can be attributed to several factors, including increased competition, rising operating costs, and investments in new technologies. Understanding these underlying factors is crucial for assessing the validity of any "red flag" concerns.

Concerns for Investors:

Several factors contribute to the current investor apprehension surrounding Experian:

- Slowing Revenue Growth: While revenue is still growing, the rate of expansion has slowed compared to previous years. This deceleration, coupled with margin compression, can signal a potential saturation of certain markets or challenges in maintaining its competitive advantage.

- Increased Competition: The data analytics and credit reporting market is becoming increasingly competitive. New players, as well as established tech giants, are encroaching on Experian's territory, intensifying the pressure on pricing and profitability.

- Regulatory Scrutiny: The information services sector faces increasing regulatory scrutiny globally. Changes in data privacy regulations (like GDPR and CCPA) and antitrust investigations could impact Experian's operations and profitability.

- Debt Levels: Experian's debt levels have also raised concerns amongst some analysts. While manageable currently, a significant increase in borrowing could restrict future investment opportunities and potentially increase financial risk.

Counterarguments & Positive Aspects:

It's important to consider the counterarguments before prematurely labeling Experian's trends as a definitive "red flag":

- Strong Brand Recognition and Market Position: Experian enjoys a strong brand reputation and significant market share globally. This provides a degree of resilience against competitive pressures.

- Diversification Across Multiple Markets: Experian's diversified business model, spanning various sectors and geographic regions, mitigates risk. This diversification helps to offset potential weaknesses in any single market.

- Continued Investment in Innovation: Experian continues to invest heavily in research and development, striving to innovate and maintain its competitive edge. This commitment to technological advancement could drive future growth.

The Verdict: Cautious Optimism

While the recent trends at Experian warrant cautious monitoring, it's premature to declare them definitive red flags. The company's strong brand, diversified business model, and ongoing investments in innovation provide a degree of resilience. However, investors should remain vigilant, carefully tracking revenue growth, profit margins, and competitive dynamics. Further scrutiny of debt levels and regulatory risks is also recommended.

What should investors do?

Conduct thorough due diligence, analyze financial statements carefully, and stay updated on industry news and regulatory changes. Consider diversifying your portfolio to mitigate potential risks associated with any single investment. Consulting with a financial advisor is highly recommended before making any significant investment decisions.

This analysis serves as an informational overview and should not be considered as financial advice. Always conduct your own thorough research before making any investment decisions. Remember to consult with a qualified financial professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Experian (LON:EXPN)'s Return Trends A Red Flag For Investors?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

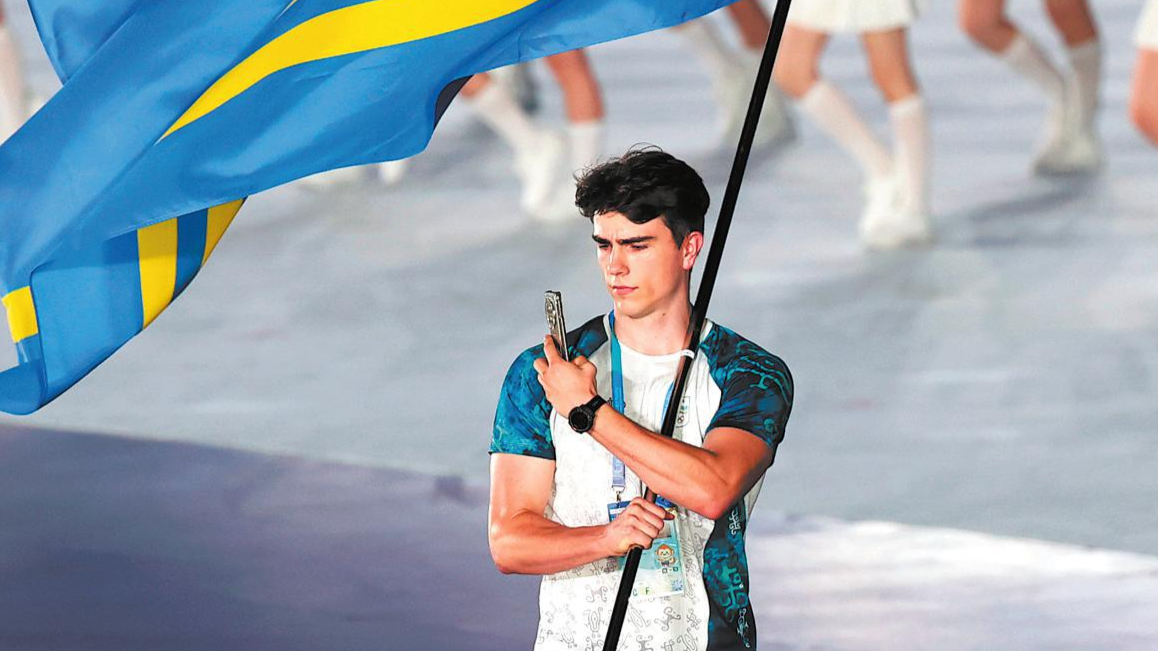

Aruban Karate Triumph A World Games Spotlight In Chengdu

Aug 12, 2025

Aruban Karate Triumph A World Games Spotlight In Chengdu

Aug 12, 2025 -

Addressing The Critical Global Physician Shortage The Aruba Approach

Aug 12, 2025

Addressing The Critical Global Physician Shortage The Aruba Approach

Aug 12, 2025 -

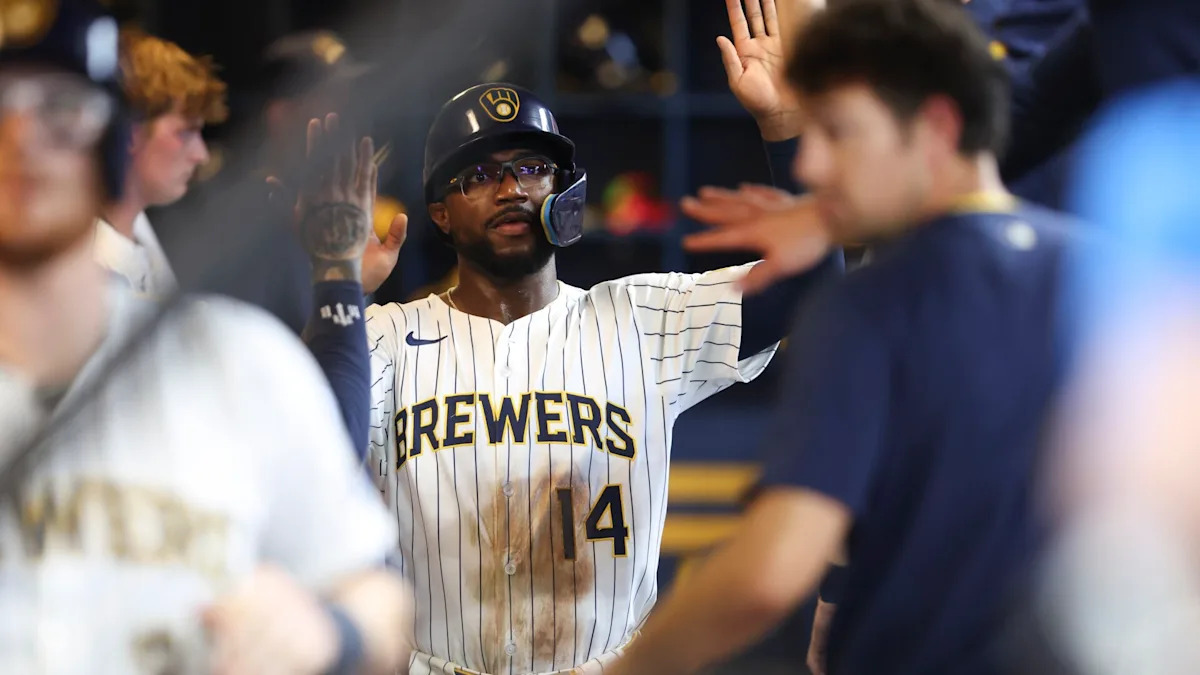

Pirates Vs Brewers Prediction August 11th Game Odds Expert Picks And Betting Trends

Aug 12, 2025

Pirates Vs Brewers Prediction August 11th Game Odds Expert Picks And Betting Trends

Aug 12, 2025 -

Experian Lon Expn Analysis Of Diminishing Investor Returns

Aug 12, 2025

Experian Lon Expn Analysis Of Diminishing Investor Returns

Aug 12, 2025 -

Three Time Champion Alex Palous Historic Indycar Victory

Aug 12, 2025

Three Time Champion Alex Palous Historic Indycar Victory

Aug 12, 2025

Latest Posts

-

Pga Star Scottie Schefflers Caddie Leaves Tournament For Family Matter

Aug 12, 2025

Pga Star Scottie Schefflers Caddie Leaves Tournament For Family Matter

Aug 12, 2025 -

End Of Coding Jobs One Techies Experience Highlights Tech Industry Downturn

Aug 12, 2025

End Of Coding Jobs One Techies Experience Highlights Tech Industry Downturn

Aug 12, 2025 -

Palous Precision Analyzing His Latest Indycar Victory

Aug 12, 2025

Palous Precision Analyzing His Latest Indycar Victory

Aug 12, 2025 -

Liverpool Vs Crystal Palace Penalty Shootout Decides Community Shield Winner

Aug 12, 2025

Liverpool Vs Crystal Palace Penalty Shootout Decides Community Shield Winner

Aug 12, 2025 -

Aaron Boones Ejection Yankees Manager Tossed From Game Five Times In 2024

Aug 12, 2025

Aaron Boones Ejection Yankees Manager Tossed From Game Five Times In 2024

Aug 12, 2025