Apple Stock Or AMD Stock? Morgan Stanley's Expert Recommendation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Apple Stock or AMD Stock? Morgan Stanley Weighs In

Should you invest in Apple or AMD? Morgan Stanley's recent recommendation has sent ripples through the investment community, prompting many to re-evaluate their tech stock portfolios. The tech sector remains a powerhouse in the stock market, but choosing the right company can be a daunting task. This analysis delves into Morgan Stanley's expert opinion, exploring the arguments for and against each tech giant, and offering insights to help you make an informed investment decision.

Morgan Stanley's Take: While specifics of the internal Morgan Stanley report may not be publicly available in full detail, news outlets reported that analysts favored Apple (AAPL) over Advanced Micro Devices (AMD) in the near term. This isn't necessarily a definitive "buy Apple, sell AMD" recommendation, but rather a reflection of current market conditions and projected performance.

Why Apple (AAPL)?

- Consistent Growth & Stability: Apple consistently delivers strong financial results, showcasing remarkable resilience even amidst economic uncertainty. Their diversified product ecosystem, ranging from iPhones and Macs to wearables and services, provides a robust revenue stream. This stability makes Apple a relatively low-risk investment for many investors.

- Strong Brand Loyalty: Apple boasts an intensely loyal customer base, ensuring consistent demand for its products. This brand loyalty translates to predictable sales and revenue, a key factor in attracting conservative investors.

- Services Revenue Growth: Apple's services sector (including Apple Music, iCloud, and the App Store) continues to demonstrate explosive growth, mitigating reliance on hardware sales alone. This diversification strengthens Apple's long-term prospects.

Why AMD (AMD)?

- High Growth Potential: AMD is a high-growth stock, positioned to benefit from the continued expansion of the semiconductor market. Their strong presence in CPUs and GPUs for both personal computers and data centers positions them for significant future gains.

- Market Share Gains: AMD has been steadily gaining market share against its main competitor, Intel, in recent years. This success indicates strong product innovation and market acceptance.

- Data Center Growth: The increasing demand for high-performance computing in data centers fuels AMD's growth trajectory. This sector presents significant opportunities for long-term revenue expansion.

The Key Differences: Risk vs. Reward

The core difference lies in the inherent risk versus reward profile. Apple offers relative stability and predictable growth, making it a more conservative investment. AMD, on the other hand, presents higher growth potential but with increased volatility. This aligns with a higher-risk, higher-reward investment strategy.

Making Your Investment Decision:

Morgan Stanley's recommendation should be considered alongside your own risk tolerance and investment goals. Before investing in any stock, it's crucial to:

- Conduct thorough research: Understand the financial performance, competitive landscape, and future prospects of both companies.

- Consult a financial advisor: A qualified professional can help you align your investments with your personal financial goals and risk tolerance.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversification helps mitigate risk across your investments.

Conclusion:

Morgan Stanley's leaning towards Apple in the near term highlights the differing risk-reward profiles of these two tech giants. While Apple offers stability and consistent growth, AMD presents a higher-risk, higher-reward opportunity for investors seeking significant returns. Ultimately, the best choice depends on your individual circumstances and investment strategy. Remember to always conduct thorough research and seek professional advice before making any investment decisions. Learn more about investing in tech stocks by exploring resources like [link to a reputable financial website].

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple Stock Or AMD Stock? Morgan Stanley's Expert Recommendation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amc Stock Performance Following Deutsche Banks Share Purchase

May 27, 2025

Amc Stock Performance Following Deutsche Banks Share Purchase

May 27, 2025 -

Apple And Amd Stock Analysis Morgan Stanleys Recommendation

May 27, 2025

Apple And Amd Stock Analysis Morgan Stanleys Recommendation

May 27, 2025 -

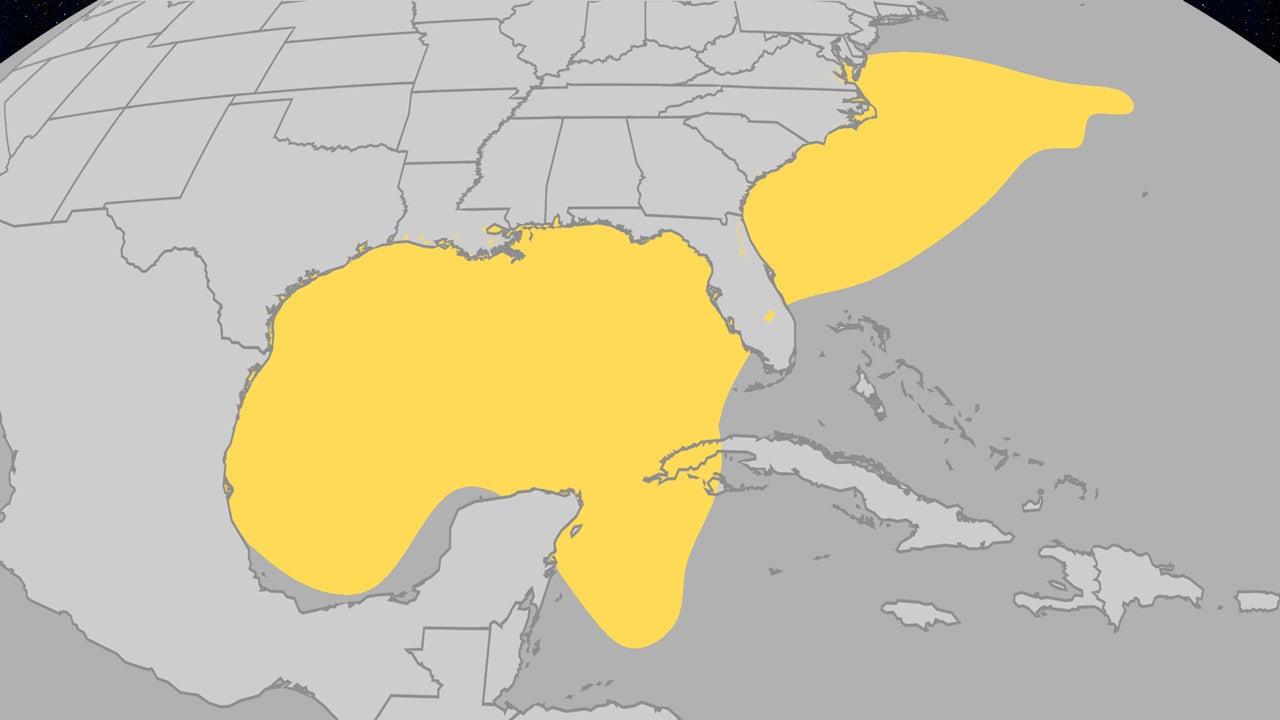

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025

Where Do Atlantic Hurricanes Form In June Examining Recent Storm Development

May 27, 2025 -

Spanish Driver Alex Palou Wins Indy 500 A Landmark Achievement

May 27, 2025

Spanish Driver Alex Palou Wins Indy 500 A Landmark Achievement

May 27, 2025 -

Knicks Game 3 Comeback From 20 Down To Victory Over Pacers

May 27, 2025

Knicks Game 3 Comeback From 20 Down To Victory Over Pacers

May 27, 2025