Apple And AMD Stock: Morgan Stanley's Expert Investment Opinion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Apple and AMD Stock: Morgan Stanley's Bullish Outlook Sparks Investor Interest

Apple (AAPL) and Advanced Micro Devices (AMD) are two tech giants that have consistently captured investor attention. Recently, a bullish outlook from Morgan Stanley, a leading global financial services firm, has sent ripples through the market, prompting renewed interest in both stocks. This article delves into Morgan Stanley's investment opinion and analyzes the factors contributing to their positive assessment.

Morgan Stanley's Upbeat Prediction:

Morgan Stanley analyst Katy Huberty recently reiterated her positive stance on Apple, maintaining an "Overweight" rating and a price target of $210. This bullish forecast stems from several key factors, including strong iPhone sales, particularly in the high-end segment, and the growing adoption of Apple's services. Huberty highlighted the increasing revenue generated from Apple's services ecosystem, a segment showing impressive resilience and sustained growth. This diversification beyond hardware sales makes Apple less susceptible to market fluctuations.

Simultaneously, Morgan Stanley also expressed confidence in AMD's future prospects. While specific details regarding their rating and price target for AMD weren't publicly released in the same report, the overall positive sentiment towards the semiconductor industry from the firm suggests a favorable view of AMD's position within it. This is largely due to AMD's strong performance in the CPU and GPU markets, fueled by increasing demand from both the gaming and data center sectors.

Factors Driving the Positive Outlook:

Several macroeconomic and industry-specific factors underpin Morgan Stanley's optimistic view of Apple and AMD:

- Strong Consumer Demand: Despite economic headwinds, demand for premium electronics and high-performance computing remains robust, benefiting both Apple and AMD.

- Technological Innovation: Both companies are known for their continuous innovation, releasing new products and services that cater to evolving consumer needs. Apple's advancements in its ecosystem and AMD's progress in chip technology are key drivers of their growth.

- Supply Chain Improvements: The global semiconductor shortage is easing, allowing both companies to better meet demand and avoid production bottlenecks.

- Data Center Growth: The burgeoning data center market presents a significant growth opportunity for AMD, particularly its server processors.

Investment Implications and Risks:

While Morgan Stanley's outlook is positive, investors should always consider potential risks:

- Economic Slowdown: A potential global economic slowdown could negatively impact consumer spending and reduce demand for electronics.

- Competition: Both Apple and AMD face intense competition in their respective markets.

- Geopolitical Uncertainty: Geopolitical factors can significantly impact the semiconductor industry and supply chains.

Conclusion:

Morgan Stanley's positive assessment of Apple and AMD reflects the underlying strength and growth potential of these tech giants. While risks always exist in the investment market, the strong fundamentals and positive industry trends suggest a potentially rewarding opportunity for long-term investors. However, it's crucial to conduct thorough due diligence and consult with a financial advisor before making any investment decisions. This analysis is for informational purposes only and should not be considered financial advice.

Further Reading:

- (Replace with actual link if available)

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Apple And AMD Stock: Morgan Stanley's Expert Investment Opinion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Dark Chapter To Golden Age Wedbushs Bullish Tesla Autonomous Driving Forecast

May 27, 2025

From Dark Chapter To Golden Age Wedbushs Bullish Tesla Autonomous Driving Forecast

May 27, 2025 -

Hadthh Ejyb Njat Psr 14 Salh Az Byn Dw Dywar

May 27, 2025

Hadthh Ejyb Njat Psr 14 Salh Az Byn Dw Dywar

May 27, 2025 -

From 20 Down Knicks Incredible Comeback Stuns Pacers

May 27, 2025

From 20 Down Knicks Incredible Comeback Stuns Pacers

May 27, 2025 -

Unpredictable Finale American Idol Ep Reflects On Season 23s Journey

May 27, 2025

Unpredictable Finale American Idol Ep Reflects On Season 23s Journey

May 27, 2025 -

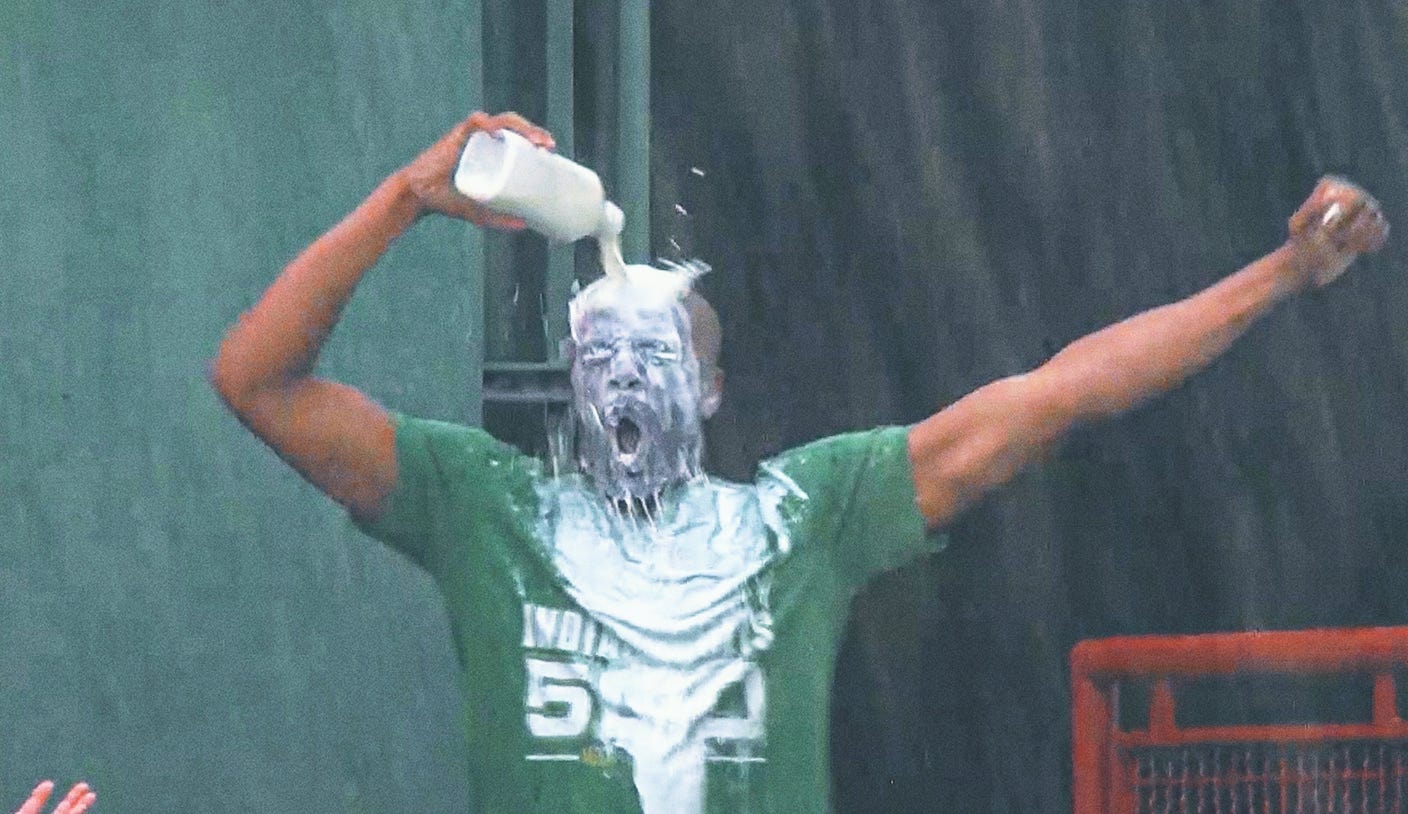

Indy 500 Excitement Mirrors Baseballs Milk Soaked Home Run Celebrations

May 27, 2025

Indy 500 Excitement Mirrors Baseballs Milk Soaked Home Run Celebrations

May 27, 2025