Analyzing The Potential For A Super Micro Computer Stock Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Potential for a Super Micro Computer Stock Correction

Super Micro Computer (SMCI) has enjoyed a remarkable run, fueled by strong demand for its server products in the booming AI sector. However, this impressive growth trajectory raises a crucial question for investors: is a stock correction on the horizon? This article delves into the factors suggesting potential volatility and examines the indicators investors should watch closely.

The AI Boom and SMCI's Success:

Super Micro Computer's recent success is inextricably linked to the explosive growth of artificial intelligence. The company's high-performance computing (HPC) servers are in high demand, powering data centers worldwide that are driving AI advancements. This surge in demand has propelled SMCI's stock price to significant heights, making it a compelling investment for many. However, this rapid growth often precedes periods of market correction.

Signs Pointing to a Potential SMCI Stock Correction:

Several factors warrant a cautious approach:

- Overvaluation Concerns: While SMCI's fundamentals are strong, some analysts argue the stock price may be exceeding its intrinsic value. A high price-to-earnings (P/E) ratio compared to industry peers suggests potential overvaluation, increasing vulnerability to a correction. Investors should carefully analyze the company's financial statements and compare them to similar companies in the sector.

- Supply Chain Challenges: The global semiconductor shortage, though easing, still presents challenges for manufacturers like Super Micro. Any disruption to the supply chain could impact production and potentially affect future earnings, leading to a downward pressure on the stock price.

- Economic Uncertainty: The broader macroeconomic environment remains uncertain. Rising interest rates and potential recessionary pressures could negatively impact investor sentiment and lead to a sell-off in technology stocks, including SMCI.

- Increased Competition: While Super Micro holds a strong position, competition in the server market is fierce. The emergence of new players and intensified competition could erode SMCI's market share and put pressure on its margins.

What Investors Should Watch:

To gauge the potential for a correction, investors should monitor these key indicators:

- Earnings Reports: Pay close attention to SMCI's upcoming earnings reports. Any deviation from analysts' expectations could trigger significant market reactions.

- Analyst Ratings: Track changes in analyst ratings and price targets. A significant downgrade in ratings could signal a bearish outlook.

- Technical Indicators: Observe technical indicators like Relative Strength Index (RSI) and moving averages. These can provide insights into potential overbought or oversold conditions. For a detailed explanation of these indicators, consult resources like .

- Competitor Performance: Monitor the performance of Super Micro's key competitors to assess the competitive landscape.

Managing Risk:

Investing in the stock market always involves risk. To mitigate potential losses during a correction, consider diversifying your portfolio, setting stop-loss orders, and employing dollar-cost averaging strategies. Remember to conduct thorough due diligence before making any investment decisions.

Conclusion:

While Super Micro Computer's prospects remain bright thanks to the AI boom, the possibility of a stock correction cannot be ignored. By carefully analyzing the factors discussed above and monitoring key indicators, investors can better position themselves to navigate potential market volatility. Remember, this article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Potential For A Super Micro Computer Stock Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

20 Point Deficit No Match Knicks Incredible Game 3 Comeback

May 27, 2025

20 Point Deficit No Match Knicks Incredible Game 3 Comeback

May 27, 2025 -

Nba Eastern Conference Finals Can The Pacers Recover After Kats Impact On Knicks Game 3

May 27, 2025

Nba Eastern Conference Finals Can The Pacers Recover After Kats Impact On Knicks Game 3

May 27, 2025 -

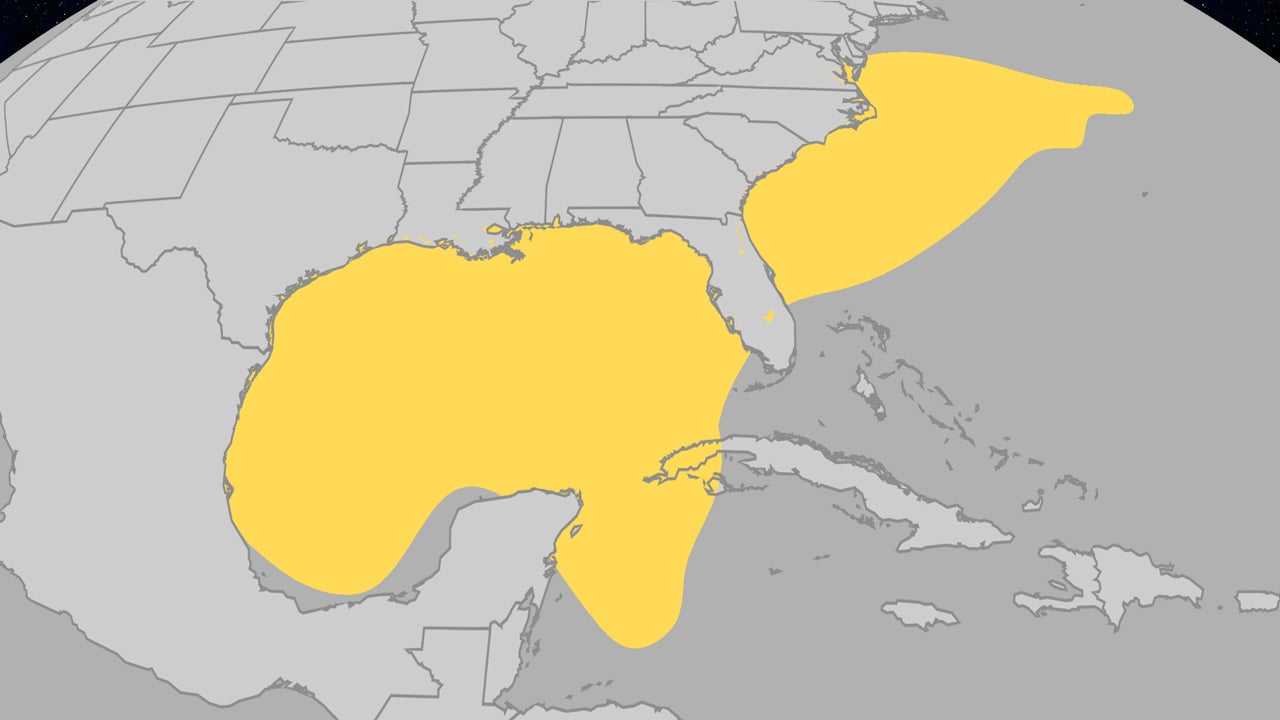

Where Do June Hurricanes Form Atlantic Storm Origins And Recent Uptick

May 27, 2025

Where Do June Hurricanes Form Atlantic Storm Origins And Recent Uptick

May 27, 2025 -

Timberwolves Edwards Leads Resounding Comeback In Game 3 Win

May 27, 2025

Timberwolves Edwards Leads Resounding Comeback In Game 3 Win

May 27, 2025 -

Larsons Indy 500 Double Bid Ends In Crash A Disappointing Finish

May 27, 2025

Larsons Indy 500 Double Bid Ends In Crash A Disappointing Finish

May 27, 2025