Analyzing The 1000% Jump In SBET Stock Price: Factors And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the 1000% Jump in SBET Stock Price: Factors and Future Outlook

The recent meteoric rise of SBET stock, experiencing a staggering 1000% increase, has sent shockwaves through the financial markets. This unprecedented surge begs the question: what fueled this dramatic climb, and what does the future hold for SBET investors? Understanding the factors behind this phenomenal growth is crucial for navigating the complexities of this volatile market.

The Catalysts Behind SBET's Explosive Growth:

Several key factors contributed to SBET's astonishing 1000% price jump. It's important to analyze these factors critically to avoid simply attributing the rise to pure speculation.

-

Positive Earnings Reports: Stronger-than-expected earnings reports, showcasing significant revenue growth and improved profitability, undoubtedly played a major role. These reports likely exceeded market expectations, prompting a wave of buying pressure. Investors often react positively to companies demonstrating consistent financial health and growth potential. [Link to SBET's latest earnings report - if publicly available].

-

Strategic Partnerships and Acquisitions: SBET's recent strategic partnerships and acquisitions may have also significantly boosted investor confidence. Expanding into new markets or acquiring key technologies can signal a company's commitment to innovation and growth, making it a more attractive investment. Specific details on these partnerships and acquisitions should be thoroughly researched for a complete understanding. [Link to news article about partnerships/acquisitions - if publicly available].

-

Increased Market Demand: A surge in market demand for SBET's products or services can lead to increased revenue and profitability, further driving up the stock price. Analyzing the specific market trends and factors affecting demand is crucial for assessing the sustainability of this growth. Understanding the company's market position and competitive landscape is vital.

-

Positive Media Coverage and Analyst Upgrades: Favorable media coverage and positive analyst ratings can significantly influence investor sentiment. Positive press and upgraded ratings often lead to increased investor interest and buying pressure, pushing the stock price higher. It's essential, however, to critically evaluate the source and potential bias of this coverage.

-

Short Squeeze: In some cases, a rapid price increase can be attributed to a "short squeeze," where investors who bet against the stock (short selling) are forced to buy back shares to limit their losses, further driving up the price. This scenario is often characterized by high trading volume and volatility.

Future Outlook: Sustained Growth or a Bubble?

While the 1000% jump is undeniably impressive, it’s crucial to approach the future outlook with caution. Such rapid growth rarely sustains itself indefinitely. Several factors need consideration:

-

Valuation: Assessing SBET's current valuation against its fundamentals is critical. Is the current stock price justified by its earnings, assets, and future growth prospects, or is it overvalued and potentially susceptible to a correction? Independent financial analysis is vital here.

-

Market Competition: The competitive landscape will play a significant role in SBET's future performance. The emergence of new competitors or intensified competition from existing players could negatively impact its market share and growth trajectory.

-

Economic Conditions: Broader economic conditions and market sentiment will also influence SBET's stock price. Recessions or market downturns can significantly impact investor confidence and lead to price corrections.

-

Regulatory Changes: Changes in regulations affecting SBET's industry could also significantly influence its future performance. Any new legislation or regulatory scrutiny should be carefully considered.

Conclusion:

The 1000% jump in SBET's stock price is a significant event, driven by a confluence of factors ranging from strong financial performance to market sentiment. However, investors should approach this situation with a healthy dose of skepticism and conduct thorough due diligence before making any investment decisions. Understanding the underlying factors driving this growth and considering potential risks is crucial for making informed investment choices. Remember to consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The 1000% Jump In SBET Stock Price: Factors And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uma Festa Portuguesa Receitas Musica E Decoracao Para Uma Celebracao Memoravel

May 30, 2025

Uma Festa Portuguesa Receitas Musica E Decoracao Para Uma Celebracao Memoravel

May 30, 2025 -

Newark Airport Air Traffic Control System Upgrade A Slower Than Anticipated Rollout

May 30, 2025

Newark Airport Air Traffic Control System Upgrade A Slower Than Anticipated Rollout

May 30, 2025 -

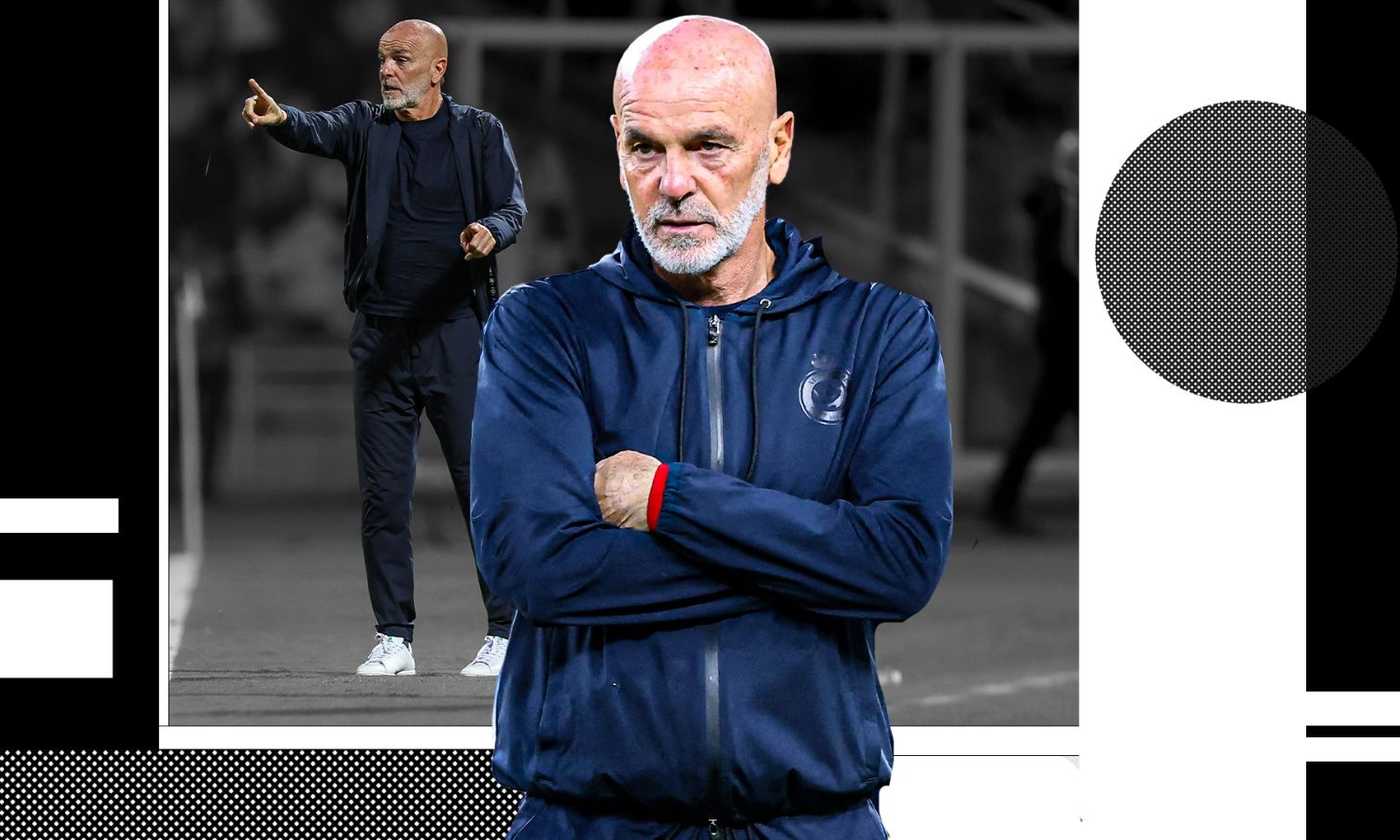

Dopo Gasperini Pioli All Atalanta Ecco Cosa Sappiamo

May 30, 2025

Dopo Gasperini Pioli All Atalanta Ecco Cosa Sappiamo

May 30, 2025 -

From Playoffs To Finals Analyzing The Okc Thunders Rise And The Minnesota Timberwolves Fall

May 30, 2025

From Playoffs To Finals Analyzing The Okc Thunders Rise And The Minnesota Timberwolves Fall

May 30, 2025 -

No More Starting Strokes Pga Tour Announces Tour Championship Format Change

May 30, 2025

No More Starting Strokes Pga Tour Announces Tour Championship Format Change

May 30, 2025