Analyzing Robinhood Stock: Investment Opportunities And Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Robinhood Stock: Investment Opportunities and Risks

Robinhood, the commission-free trading app that stormed onto the financial scene, has become a controversial yet captivating investment opportunity. Its meteoric rise and subsequent fall have left many investors wondering: is now the time to buy, sell, or hold Robinhood stock (HOOD)? This in-depth analysis explores the potential opportunities and significant risks associated with investing in this volatile company.

The Allure of Robinhood: A Democratization of Investing?

Robinhood's initial success stemmed from its user-friendly interface and commission-free trading, attracting a wave of millennial and Gen Z investors. This democratization of investing, previously inaccessible to many due to high brokerage fees, propelled the company to significant growth. Its gamified approach, complete with stock market notifications and celebratory confetti, further cemented its appeal to a younger demographic. This innovative approach disrupted the traditional brokerage model and, for a time, positioned Robinhood as a market leader.

A Closer Look at the Risks:

While the Robinhood narrative initially seemed compelling, the reality is more nuanced. Several factors present significant risks for potential investors:

-

Regulatory Scrutiny: Robinhood has faced intense regulatory scrutiny, including investigations into its practices and allegations of prioritizing profit over customer protection. These legal battles can lead to hefty fines and reputational damage, impacting the stock price negatively.

-

Increased Competition: The commission-free trading model is no longer unique. Established brokerages and newer fintech companies are fiercely competing for market share, putting pressure on Robinhood's margins and growth prospects.

-

Dependence on Trading Volume: Robinhood's revenue is heavily reliant on transaction-based revenue. Periods of low trading activity directly impact profitability, making the stock vulnerable to market fluctuations.

-

Financial Performance: Robinhood's financial performance has been erratic, swinging between periods of strong growth and substantial losses. Understanding these fluctuations and their underlying causes is crucial before considering an investment. Analyzing their quarterly earnings reports and SEC filings is essential for informed decision-making. [Link to SEC Filings for Robinhood]

-

Meme Stock Volatility: Robinhood's association with meme stocks and volatile trading activity exposes it to significant market risks. The unpredictable nature of these stocks can lead to dramatic swings in the company's valuation.

Potential Investment Opportunities:

Despite the risks, some argue that Robinhood still holds potential for future growth. These arguments often center on:

-

Expansion into New Markets: Robinhood's expansion into new financial products and services, such as crypto trading and debit cards, could diversify revenue streams and mitigate reliance on trading volume.

-

Growing User Base: While competition is fierce, Robinhood still boasts a substantial user base. Further engagement and retention of this user base could drive future growth.

-

Technological Innovation: Robinhood's continued investment in technology and user experience could potentially lead to further innovation and market differentiation.

Conclusion: A Calculated Gamble?

Investing in Robinhood stock is undeniably a gamble. While the potential for growth exists, the risks are substantial and require careful consideration. Potential investors should thoroughly research the company's financial performance, regulatory landscape, and competitive environment before making any investment decisions. Diversification within a broader investment portfolio is crucial to mitigate risk. Remember to consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about market trends and regulatory developments affecting Robinhood and other fintech companies by subscribing to our newsletter [Link to Newsletter Signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Robinhood Stock: Investment Opportunities And Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Secure Your Future Hsbc Mutual Funds Retire To More Campaign Details

Jun 05, 2025

Secure Your Future Hsbc Mutual Funds Retire To More Campaign Details

Jun 05, 2025 -

Halle Berrys Go To This Neck Cream Tightens Skin

Jun 05, 2025

Halle Berrys Go To This Neck Cream Tightens Skin

Jun 05, 2025 -

Last Nights Dodgers Game Freemans Performance Fuels Comeback

Jun 05, 2025

Last Nights Dodgers Game Freemans Performance Fuels Comeback

Jun 05, 2025 -

Australian Big Battery Supplier Faces Collapse A Warning For The Energy Sector

Jun 05, 2025

Australian Big Battery Supplier Faces Collapse A Warning For The Energy Sector

Jun 05, 2025 -

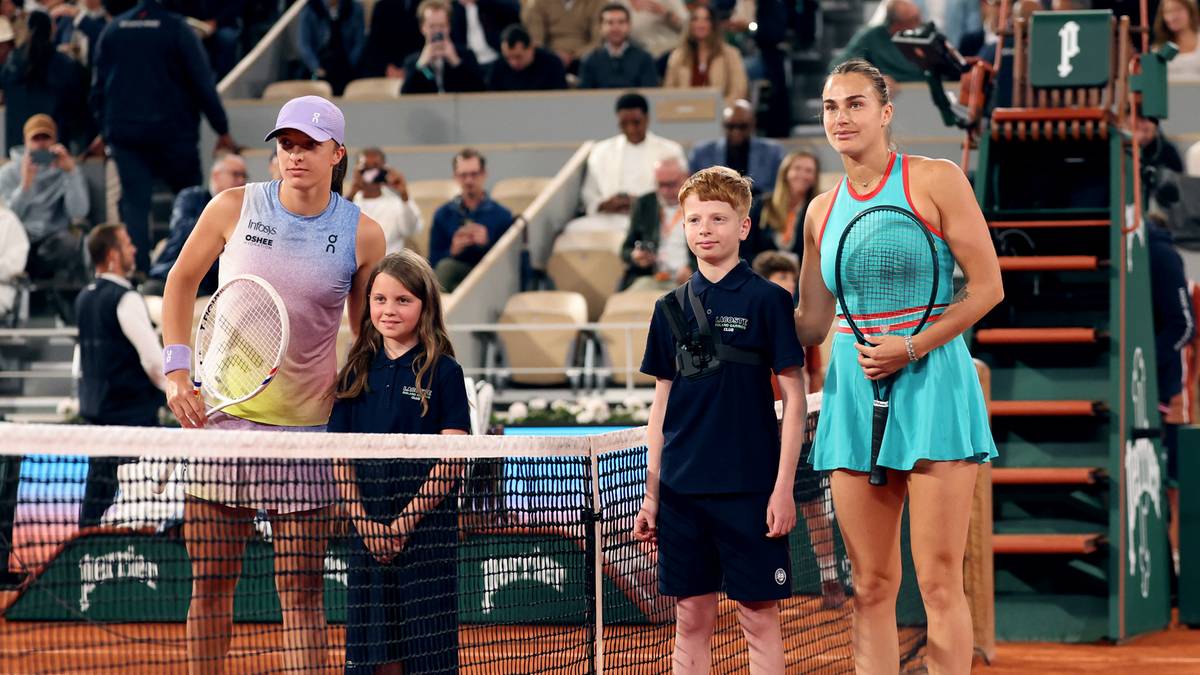

Roland Garros Swiatek Sabalenka Relacja Live I Wynik Online

Jun 05, 2025

Roland Garros Swiatek Sabalenka Relacja Live I Wynik Online

Jun 05, 2025