Analysis: Why Warren Buffett Sold These Two Major US Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Why Warren Buffett Sold These Two Major US Stocks

The Oracle of Omaha's recent portfolio adjustments have sent shockwaves through the investment world. Warren Buffett's Berkshire Hathaway offloaded significant stakes in two major US companies, leaving many wondering: what prompted these moves? This analysis delves into the potential reasons behind these surprising sales.

The recent filings revealed Berkshire Hathaway's reduction in holdings of Bank of America (BAC) and Verizon Communications (VZ). These weren't minor tweaks; they represented significant decreases in Berkshire's overall portfolio allocation. This unexpected shift has sparked intense speculation and raised important questions for investors.

Understanding Buffett's Investment Philosophy

Before examining the specific reasons for these divestments, it's crucial to understand Buffett's core investment principles. Buffett famously favors companies with strong fundamentals, durable competitive advantages (what he calls "moats"), and competent management teams. He prioritizes long-term value creation over short-term market fluctuations. His approach is often described as value investing. This long-term perspective is key to interpreting his recent actions.

Bank of America (BAC): A Shifting Landscape?

Berkshire Hathaway's reduction in its Bank of America stake might be attributed to several factors. Rising interest rates, while beneficial for banks in the short term, could also signal a potential slowdown in the economy. This could impact loan demand and ultimately affect Bank of America's long-term profitability. Furthermore, increased regulatory scrutiny and potential changes in the financial landscape could have influenced Buffett's decision. The increasing prevalence of fintech companies also presents a competitive challenge to traditional banking institutions like Bank of America.

- Key factors potentially influencing the BAC sale:

- Rising interest rates and potential economic slowdown

- Increased regulatory scrutiny

- Growing competition from fintech companies

Verizon Communications (VZ): A Telecom Sector Slowdown?

The sale of Verizon shares could be linked to the competitive dynamics within the telecommunications sector. The industry faces intense competition, with the emergence of new players and the ever-increasing demand for faster and more reliable data services. Verizon's growth prospects, while still positive, might be perceived as less compelling compared to other sectors where Berkshire Hathaway sees stronger potential for long-term growth. Furthermore, technological advancements and the need for significant capital investments to maintain a competitive edge could also have played a role.

- Key factors potentially influencing the VZ sale:

- Intense competition in the telecom sector

- Technological advancements requiring significant capital expenditure

- Slower growth prospects compared to other sectors

What Does This Mean for Investors?

Buffett's decisions, while surprising, shouldn't be interpreted as a bearish signal for the entire market. Instead, it highlights the dynamic nature of investing and the importance of continuous portfolio rebalancing. It underscores the need for investors to conduct their own thorough due diligence and understand their individual risk tolerance. While Buffett's moves are certainly noteworthy, they don't necessarily predict future market trends.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Further Reading:

This article uses relevant keywords like "Warren Buffett," "Berkshire Hathaway," "Bank of America," "Verizon," "stock sale," "investment analysis," and "value investing" naturally throughout the text. It also employs headings, bullet points, and a call to action (consult a financial advisor) to enhance readability and engagement. Remember to replace the example links with actual, relevant links.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Why Warren Buffett Sold These Two Major US Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

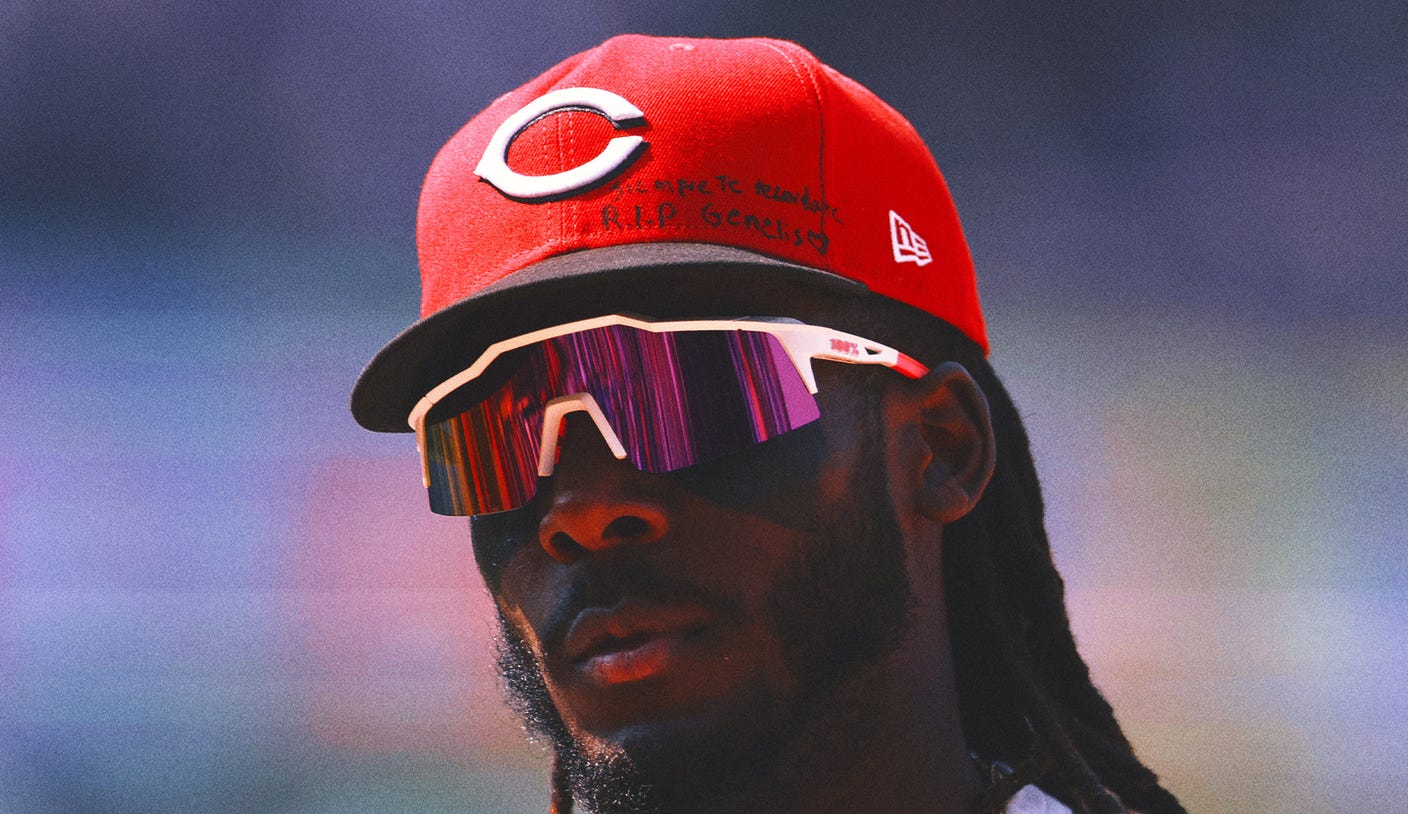

Grief And Glory Elly De La Cruzs Emotional Home Run Following Sisters Passing

Jun 04, 2025

Grief And Glory Elly De La Cruzs Emotional Home Run Following Sisters Passing

Jun 04, 2025 -

India Announces Strengthened A Squad With Senior Batsmen For England Clash

Jun 04, 2025

India Announces Strengthened A Squad With Senior Batsmen For England Clash

Jun 04, 2025 -

Rockies Sweep Extends Losing Streak Near Record Pace For 50 Losses

Jun 04, 2025

Rockies Sweep Extends Losing Streak Near Record Pace For 50 Losses

Jun 04, 2025 -

Updated Wnba Power Rankings Top Spots Unchanged

Jun 04, 2025

Updated Wnba Power Rankings Top Spots Unchanged

Jun 04, 2025 -

Mets Call Up Top Prospect Ronny Mauricio Is He Ready For The Majors

Jun 04, 2025

Mets Call Up Top Prospect Ronny Mauricio Is He Ready For The Majors

Jun 04, 2025