Analysis: Warren Buffett's Sale Of Two Major US Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Warren Buffett's Sale of Two Major US Holdings Sends Shockwaves Through the Market

Oracle of Omaha's moves always make headlines, and his recent divestment from two significant US holdings has sent ripples throughout the financial world. The sale of a substantial portion of Berkshire Hathaway's stakes in Bank of America and Chevron has left investors and analysts scrambling to understand the implications. What motivated these seemingly contradictory moves from the legendary investor? Let's delve into the details and explore potential interpretations.

The Sales: A Closer Look

Berkshire Hathaway, the investment conglomerate headed by Warren Buffett, recently announced the reduction of its holdings in both Bank of America and Chevron. While the specific reasons remain undisclosed, several factors likely played a crucial role in this strategic decision.

Bank of America: A Prudent Restructuring?

Berkshire Hathaway's decreased stake in Bank of America (BAC) represents a significant shift, given its long-standing investment in the financial giant. While the exact amount sold remains unclear, the move suggests a potential reassessment of the bank's future prospects in a changing economic landscape. Several analysts suggest this could be a strategic repositioning, allowing Berkshire to allocate capital to other potentially more lucrative opportunities. The current banking sector climate, with rising interest rates and potential recessionary pressures, could have influenced this decision. This isn't necessarily a bearish signal on Bank of America itself, but rather a reflection of Berkshire's dynamic portfolio management strategy.

Chevron: Profit-Taking or Shifting Priorities?

The reduction of Berkshire's stake in Chevron (CVX) presents a different narrative. Chevron, a major player in the energy sector, has seen substantial growth recently, largely driven by increased energy prices. This sale could be interpreted in a few ways: profit-taking after a period of significant gains, a diversification strategy to reduce reliance on a single sector, or a potential shift in Buffett's outlook on the long-term future of the oil and gas industry. The ongoing global transition towards renewable energy sources may be a factor influencing this decision.

Interpreting Buffett's Moves: What Do They Mean?

Warren Buffett's investment decisions are rarely impulsive. His moves are meticulously calculated and often reflect a deep understanding of macro-economic trends and individual company performance. While we can only speculate on the exact reasoning behind these sales, several key factors could be at play:

- Market Volatility: The current economic climate is marked by significant uncertainty. Rising inflation, potential recession, and geopolitical instability create a volatile investment environment. These sales could be a precautionary measure, reducing exposure to risk.

- Portfolio Rebalancing: Buffett is known for his pragmatic approach to portfolio management. These sales could simply represent a rebalancing act, aiming for a more diversified and resilient portfolio.

- Seeking New Opportunities: The sale of existing holdings could free up capital for investment in other sectors or companies that Buffett believes have greater growth potential.

The Impact on the Market:

These sales have undoubtedly sent waves through the market, causing some volatility in the stock prices of both Bank of America and Chevron. However, it's crucial to avoid overreacting. Buffett's decisions are often based on a long-term perspective, and these adjustments likely reflect a strategic recalibration rather than a sudden change in his overall investment philosophy.

Conclusion:

While the precise reasons behind Warren Buffett's recent sales remain unclear, the moves underscore the dynamic nature of investment strategies even for the most experienced investors. Analyzing these decisions provides valuable insight into the evolving economic landscape and the strategies employed by top-tier investors to navigate market uncertainty. It remains to be seen where Berkshire Hathaway will allocate its freed-up capital, but one thing is certain: the market will be watching closely.

Keywords: Warren Buffett, Berkshire Hathaway, Bank of America, BAC, Chevron, CVX, stock market, investment strategy, portfolio management, economic analysis, market volatility, financial news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Warren Buffett's Sale Of Two Major US Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Former Indiana Team Physician Accused Of Sexual Misconduct By Multiple Men Espn Report

Jun 05, 2025

Former Indiana Team Physician Accused Of Sexual Misconduct By Multiple Men Espn Report

Jun 05, 2025 -

Broadcom Avgo Stock Post Earnings Price Predictions From Top Traders

Jun 05, 2025

Broadcom Avgo Stock Post Earnings Price Predictions From Top Traders

Jun 05, 2025 -

Belmont Stakes 2025 Post Positions Horses And Broadcast Information

Jun 05, 2025

Belmont Stakes 2025 Post Positions Horses And Broadcast Information

Jun 05, 2025 -

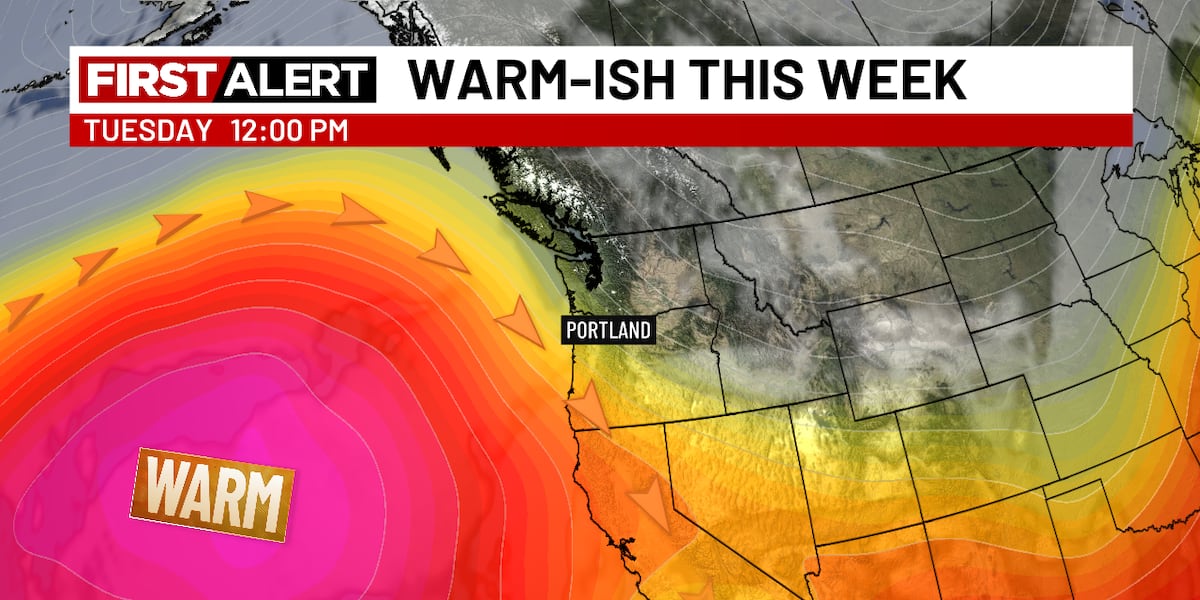

Enjoy The Sunshine Warm And Dry Conditions To Begin June

Jun 05, 2025

Enjoy The Sunshine Warm And Dry Conditions To Begin June

Jun 05, 2025 -

Hitowy Mecz W Paryzu Swiatek Kontra Sabalenka O Final Roland Garros

Jun 05, 2025

Hitowy Mecz W Paryzu Swiatek Kontra Sabalenka O Final Roland Garros

Jun 05, 2025