Analysis: Are These Falling Tech Stocks A Smart Investment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Are These Falling Tech Stocks a Smart Investment?

The tech sector has taken a significant downturn in recent months, leaving many investors wondering if now is the time to buy the dip or steer clear. Falling tech stocks present a complex scenario, a blend of risk and potential reward. This analysis explores the current climate and offers insights into whether these seemingly discounted giants represent a smart investment strategy.

The Current Tech Landscape: A Sea of Red?

The once-unstoppable rise of tech giants has slowed considerably. Factors contributing to this decline include rising interest rates, increased inflation, a potential recession, and a post-pandemic readjustment of market valuations. Companies that thrived during the pandemic's stay-at-home era are now facing headwinds as consumer spending shifts. This has resulted in significant drops in the share prices of many previously high-flying tech companies.

Identifying Potential Bargains:

While the overall picture seems bleak, savvy investors are looking for opportunities. The key is discerning between companies facing genuine long-term challenges and those experiencing temporary setbacks. Several factors to consider when evaluating falling tech stocks include:

- Fundamental Strength: Analyze the company's financial health. Examine revenue growth, profitability, debt levels, and cash flow. A strong balance sheet can provide a buffer during economic downturns.

- Long-Term Growth Potential: Does the company operate in a growing market with significant future prospects? Consider the company's innovation pipeline and its ability to adapt to changing market conditions.

- Valuation: Compare the current stock price to the company's intrinsic value. Look for companies trading at a significant discount to their perceived worth. Metrics like Price-to-Earnings (P/E) ratios can be helpful but should be used in conjunction with other analysis.

- Management Team: A strong and experienced leadership team is crucial for navigating turbulent times. Research the company's management and their track record.

Specific Examples (Case Studies):

While we cannot offer specific financial advice, analyzing individual companies illustrates the point. For instance, some argue that the current valuation of [insert example of a falling tech stock, e.g., a specific social media company] presents a buying opportunity given its massive user base and potential for future revenue streams through [mention specific revenue streams, e.g., advertising or subscriptions]. Conversely, other companies might be facing more significant structural challenges, requiring a more cautious approach.

Risks to Consider:

Investing in falling tech stocks carries inherent risks. The market could continue its downward trend, leading to further losses. Furthermore, even fundamentally strong companies can be vulnerable to unforeseen events. Diversification is crucial to mitigate these risks.

The Verdict: A Cautious Approach is Key

The current market presents both opportunities and challenges. While some falling tech stocks may indeed be undervalued, careful due diligence is paramount. Rushing into investments based solely on price drops can be detrimental. Thorough research, focusing on fundamental analysis and long-term growth potential, is essential before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: falling tech stocks, tech stock investment, stock market analysis, investment strategy, tech sector downturn, buy the dip, stock valuation, risk assessment, financial analysis, [insert specific company names if applicable], economic downturn.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Are These Falling Tech Stocks A Smart Investment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Assessing The Best Backup Quarterbacks Who Could Spearhead An Nfl Playoff Run In 2024

May 27, 2025

Assessing The Best Backup Quarterbacks Who Could Spearhead An Nfl Playoff Run In 2024

May 27, 2025 -

American Idol 24 Judges Premiere Date And More Big News

May 27, 2025

American Idol 24 Judges Premiere Date And More Big News

May 27, 2025 -

Haddad Maia Vs Baptiste Roland Garros 2025 Match Preview Prediction And Expert Analysis

May 27, 2025

Haddad Maia Vs Baptiste Roland Garros 2025 Match Preview Prediction And Expert Analysis

May 27, 2025 -

401 K Cash Out Fuels Oregon Mans Solo Sailing Trip To Hawaii

May 27, 2025

401 K Cash Out Fuels Oregon Mans Solo Sailing Trip To Hawaii

May 27, 2025 -

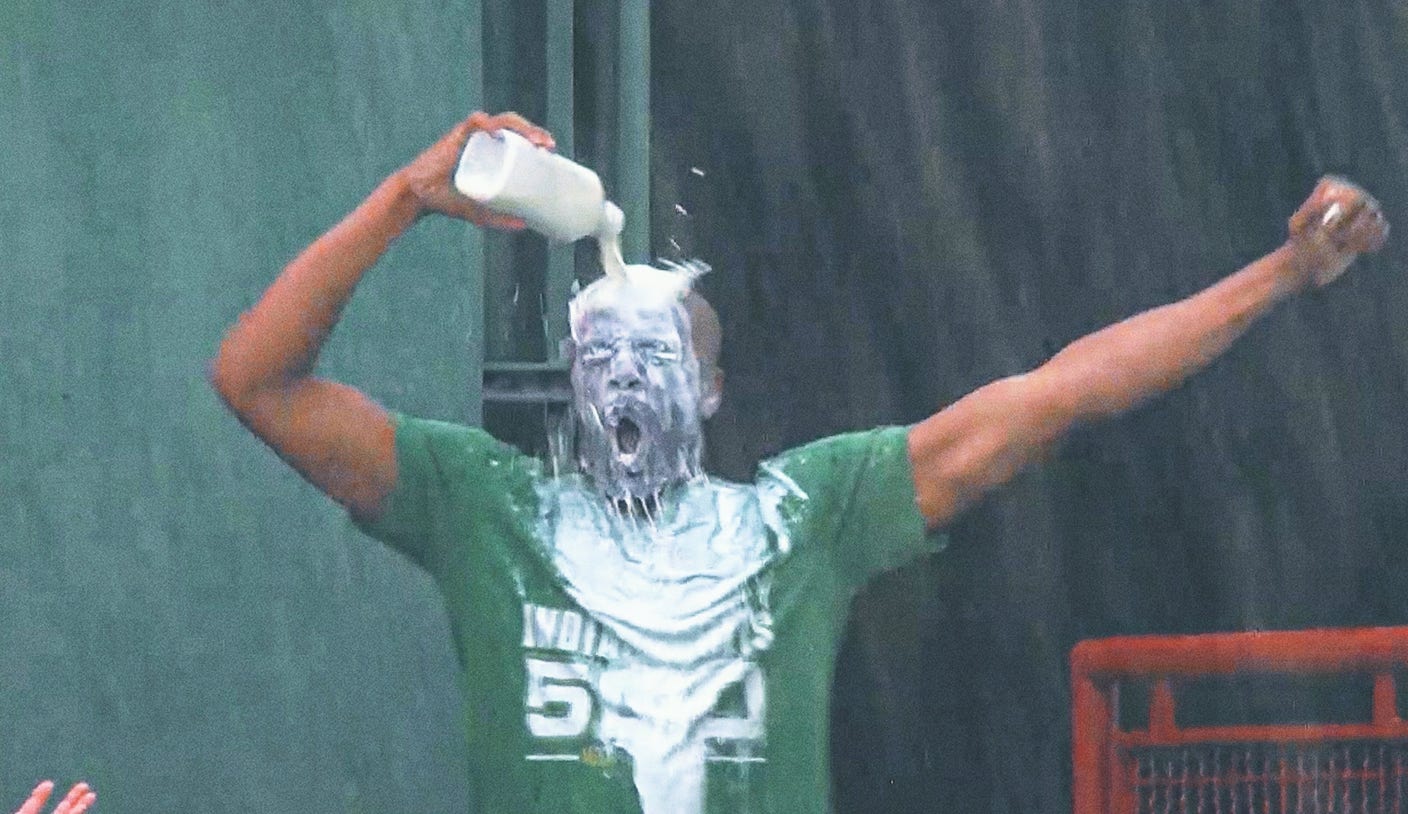

From Indy 500 To Baseball The Unexpected Milk Bath Trend

May 27, 2025

From Indy 500 To Baseball The Unexpected Milk Bath Trend

May 27, 2025