AMD Stock Price Target Doubled: What This Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMD Stock Price Target Doubled: What This Means for Investors

AMD's stock price is soaring, with several analysts significantly raising their price targets. This surge has left many investors wondering: what does this mean for the future of AMD and their portfolios? The recent doubling of price targets by some prominent financial institutions signifies a renewed wave of optimism surrounding Advanced Micro Devices (AMD). This article delves into the reasons behind this bullish sentiment, examining the factors driving AMD's growth and providing insights for investors considering adding AMD to their portfolios or adjusting their existing holdings.

The Catalyst for the Surge:

Several factors are contributing to the increased confidence in AMD's future performance. These include:

-

Strong CPU and GPU Market Share Gains: AMD has been aggressively expanding its market share in both the central processing unit (CPU) and graphics processing unit (GPU) markets, eating into Intel's and Nvidia's dominance. This success is attributed to innovative product lines, competitive pricing, and strong performance.

-

Data Center Growth: The burgeoning data center market presents a significant opportunity for AMD's EPYC server processors. Increasing demand for high-performance computing (HPC) and cloud services is fueling AMD's growth in this crucial sector. The company's inroads into this previously Intel-dominated market have significantly impressed analysts.

-

Technological Innovation: AMD's continuous investment in research and development is paying off. The company's cutting-edge technologies, such as its Zen architecture for CPUs and RDNA architecture for GPUs, are consistently pushing the boundaries of performance and efficiency. This commitment to innovation ensures AMD remains a competitive force.

-

Positive Earnings Reports: Recent earnings reports have exceeded expectations, further solidifying the positive sentiment surrounding AMD. Strong revenue growth and increasing profitability are key indicators of the company's health and potential for future success.

What the Doubled Price Targets Mean for Investors:

The doubling of price targets by analysts suggests a significant upward potential for AMD's stock price. However, it's crucial to remember that these are predictions, not guarantees. Investors should carefully consider their own risk tolerance and investment strategy before making any decisions based on these projections.

H2: Analyzing the Risk:

While the outlook is positive, it's important to acknowledge potential risks:

- Competition: The semiconductor industry is highly competitive. Intel and Nvidia remain formidable competitors, and new players are constantly emerging.

- Economic Uncertainty: Global economic conditions can significantly impact the demand for semiconductors. Recessions or other economic downturns could negatively affect AMD's sales.

- Supply Chain Issues: The ongoing challenges in the global supply chain could impact AMD's ability to meet demand.

H2: Investment Strategies for AMD:

For investors interested in AMD, several strategies could be considered:

-

Long-Term Investment: Given the company's growth trajectory and technological advancements, AMD could be a suitable long-term investment for those with a higher risk tolerance.

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy can help mitigate risk associated with market volatility.

-

Diversification: It's crucial to diversify your portfolio to minimize risk. Don't put all your eggs in one basket, even if that basket seems promising.

Conclusion:

The doubling of AMD's price target represents a significant vote of confidence in the company's future. However, investors should conduct thorough due diligence and consider the inherent risks before making any investment decisions. Staying informed about AMD's performance and the broader semiconductor market is crucial for navigating this exciting but potentially volatile sector. Consult with a financial advisor before making any investment decisions. Remember, past performance is not indicative of future results. This information is for educational purposes only and is not financial advice.

(External Links - Example: Link to AMD's Investor Relations page, Link to a reputable financial news source discussing AMD)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMD Stock Price Target Doubled: What This Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

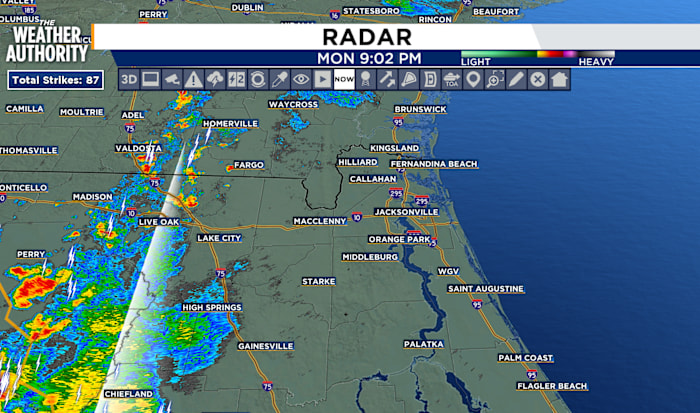

Increased Development Probability For Invest 93 Amidst Persistent Rain

Jul 16, 2025

Increased Development Probability For Invest 93 Amidst Persistent Rain

Jul 16, 2025 -

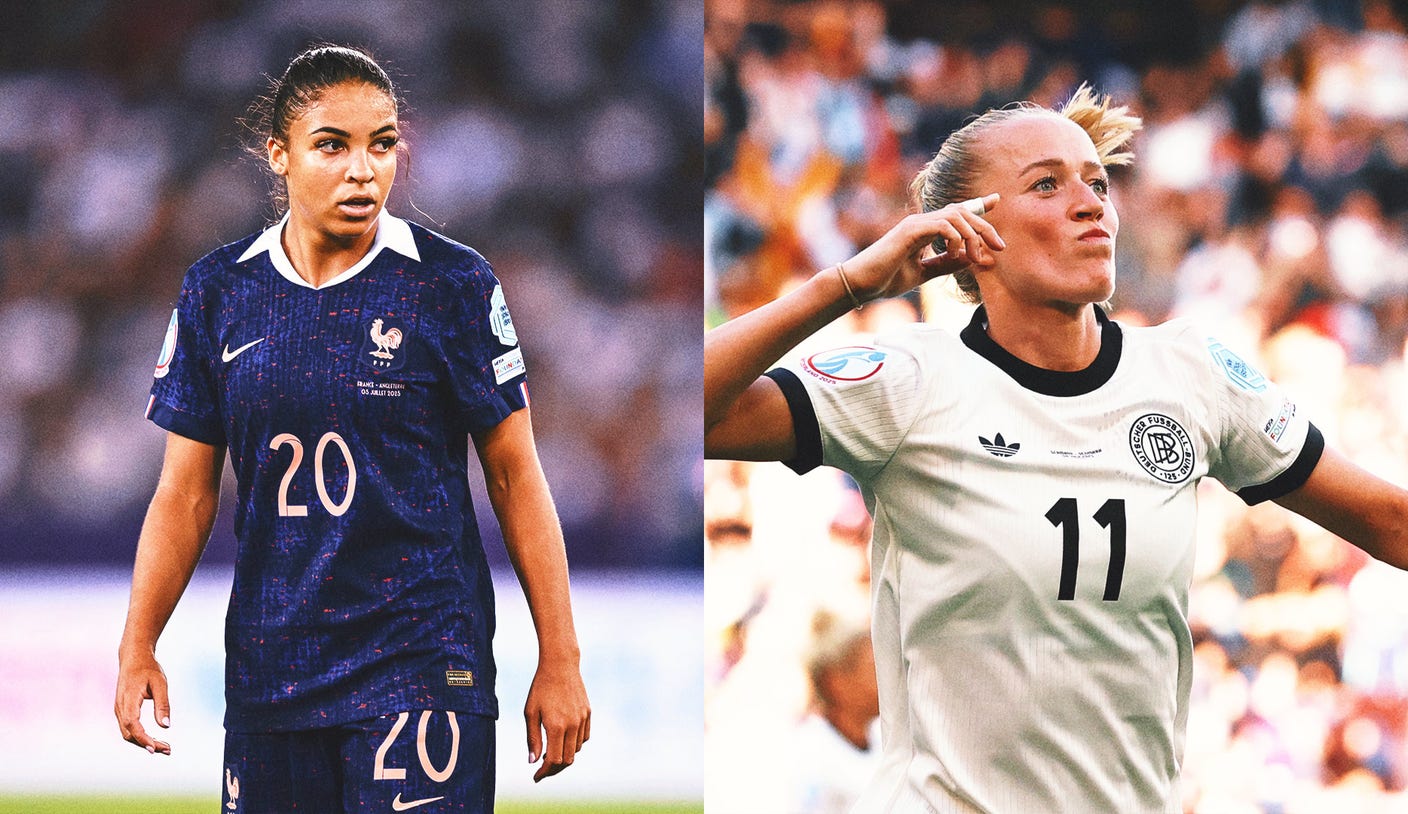

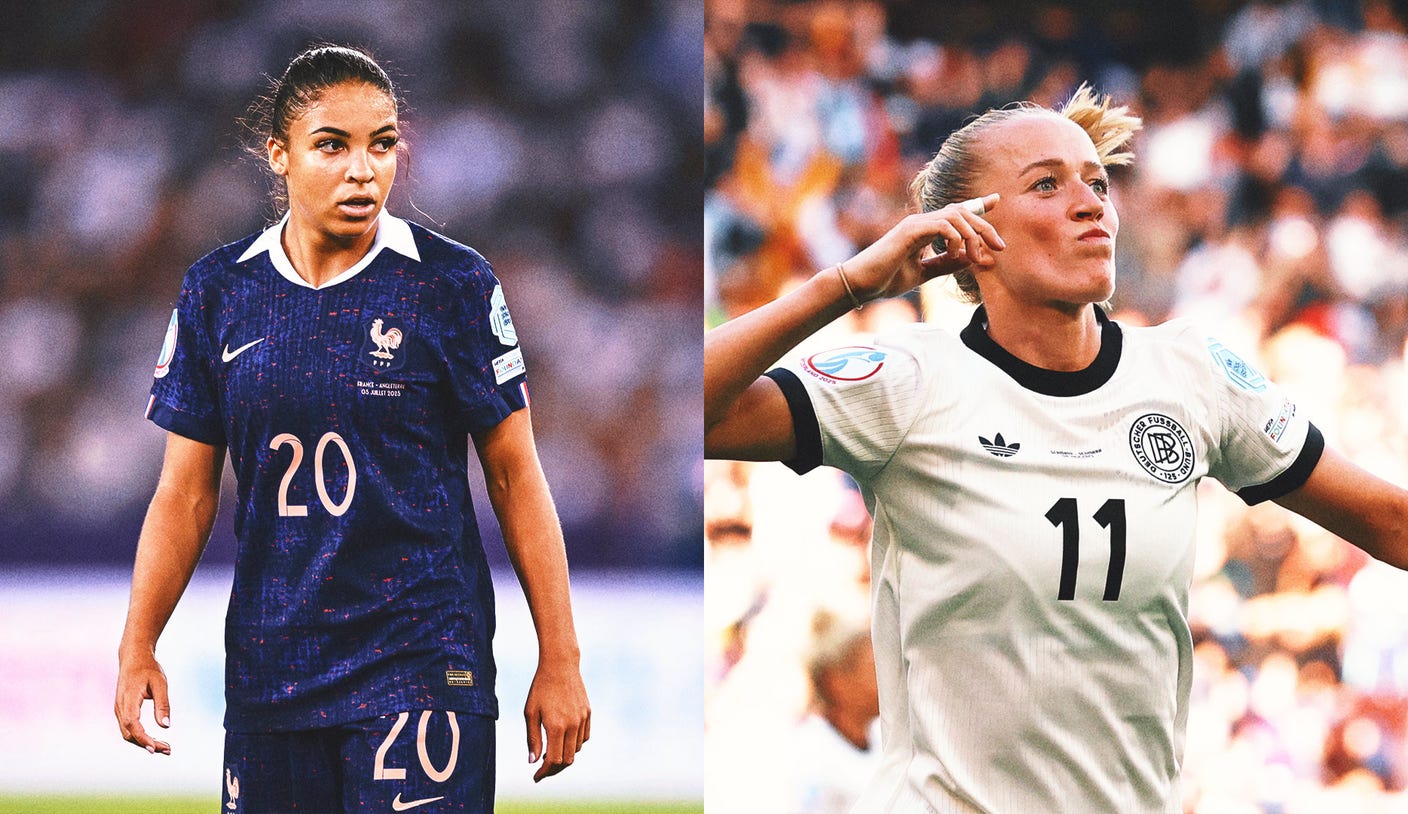

Uefa Womens Euro 2025 France Vs Germany Quarterfinal Showdown

Jul 16, 2025

Uefa Womens Euro 2025 France Vs Germany Quarterfinal Showdown

Jul 16, 2025 -

Tropical Disturbance Invest 93 L Forecasts And Preparedness Advice For Florida

Jul 16, 2025

Tropical Disturbance Invest 93 L Forecasts And Preparedness Advice For Florida

Jul 16, 2025 -

Predicting The Winner France Vs Germany In The Uefa Womens Euro 2025 Quarterfinals

Jul 16, 2025

Predicting The Winner France Vs Germany In The Uefa Womens Euro 2025 Quarterfinals

Jul 16, 2025 -

Central Florida Weather Alert Live Updates On Severe Storms

Jul 16, 2025

Central Florida Weather Alert Live Updates On Severe Storms

Jul 16, 2025