AMC Stock Performance: Impact Of Deutsche Bank's Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMC Stock Performance: A Rollercoaster Ride Fueled by Deutsche Bank's Investment

AMC Entertainment Holdings Inc. (AMC), the world's largest movie theater chain, has experienced significant stock price volatility in recent months, largely influenced by a confluence of factors, most notably a substantial investment from Deutsche Bank. This article delves into the impact of this investment, analyzing the subsequent stock performance and exploring the broader implications for the company and the entertainment industry.

The initial announcement of Deutsche Bank's investment sent ripples through the market, causing a noticeable surge in AMC's stock price. This injection of capital offered a lifeline to the company, which had struggled financially during the pandemic and its aftermath. However, the subsequent performance has been far from predictable, showcasing the complex interplay between investor sentiment, market conditions, and the company's own operational performance.

Understanding the Deutsche Bank Investment:

The exact details of Deutsche Bank's investment in AMC are crucial to understanding the subsequent stock fluctuations. While the specifics might not be publicly available in their entirety, analyzing news reports and financial disclosures reveals key information about the size, nature, and terms of the investment. Understanding the investment's structure (equity, debt, etc.) helps to clarify its influence on AMC's overall financial health and investor confidence.

Analyzing the Post-Investment Stock Performance:

Following the investment, AMC's stock price experienced a period of significant volatility. This can be attributed to several factors:

- Increased Investor Interest: The news generated considerable media attention, attracting both retail and institutional investors. This heightened interest led to increased trading volume and price fluctuations.

- Market Sentiment: Overall market conditions, including broader economic trends and investor risk appetite, heavily influenced AMC's stock performance. Positive market sentiment generally boosted AMC's price, while negative sentiment had the opposite effect.

- AMC's Operational Performance: The company's own financial results, including box office revenue, operating costs, and debt levels, played a critical role in determining investor confidence and, consequently, the stock price. Strong box office numbers, for instance, tended to correlate with positive stock movement.

Long-Term Implications and Future Outlook:

The long-term impact of Deutsche Bank's investment on AMC remains to be seen. Several key factors will determine the company's future trajectory:

- Box Office Performance: The continued success of major film releases is crucial for AMC's financial health and investor confidence.

- Debt Management: Successfully managing AMC's substantial debt burden will be critical for long-term stability.

- Competitive Landscape: The company's ability to compete effectively with streaming services and other entertainment options will significantly impact its future growth.

While the Deutsche Bank investment provided a much-needed boost, AMC's long-term success hinges on its ability to adapt to the evolving entertainment landscape and deliver strong operational performance. Investors should carefully consider these factors when assessing the risk and potential rewards associated with investing in AMC stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you should consult with a qualified financial advisor before making any investment decisions. Always conduct thorough research before investing in any company. This article includes links to relevant news sources but does not endorse any specific financial products or services.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMC Stock Performance: Impact Of Deutsche Bank's Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tesla Stocks Future Expert Analysis Following Musks Positive Outlook

May 28, 2025

Tesla Stocks Future Expert Analysis Following Musks Positive Outlook

May 28, 2025 -

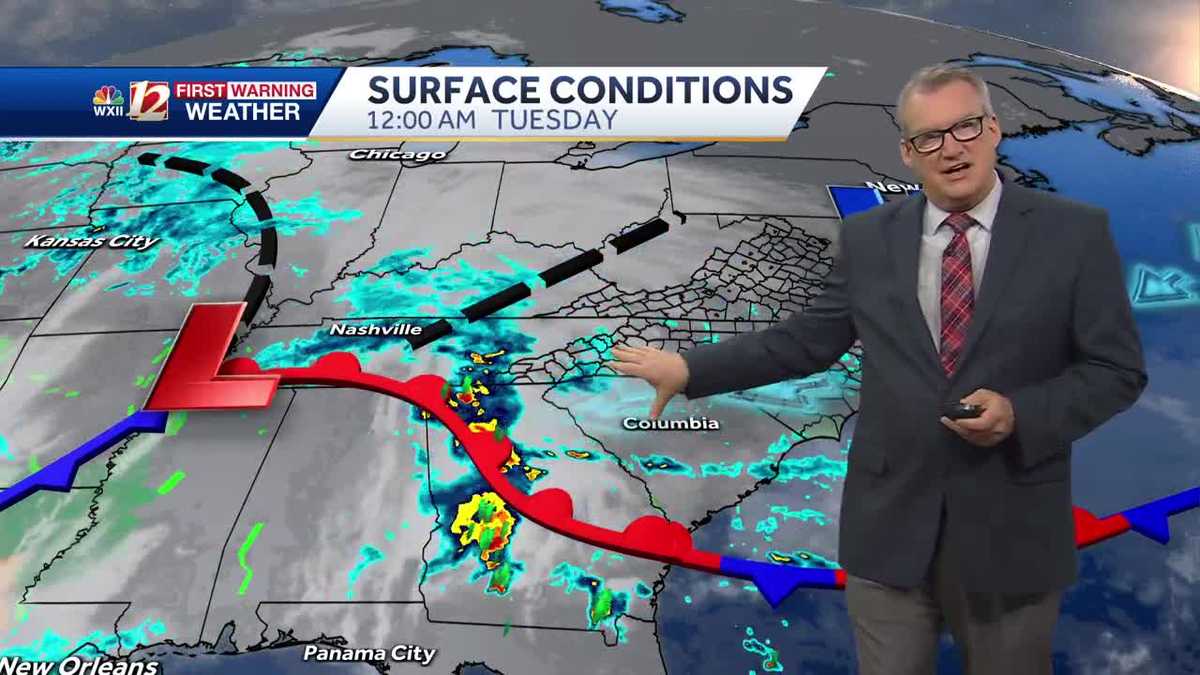

Prepare For A Cool Wet Tuesday Your Detailed Weather Guide

May 28, 2025

Prepare For A Cool Wet Tuesday Your Detailed Weather Guide

May 28, 2025 -

Stallions Wr Cade Johnsons Highlight Reel Catch Best Of Ufl Week 9

May 28, 2025

Stallions Wr Cade Johnsons Highlight Reel Catch Best Of Ufl Week 9

May 28, 2025 -

Las Vegas Raiders Lock Up Punter Aj Cole With Long Term Contract

May 28, 2025

Las Vegas Raiders Lock Up Punter Aj Cole With Long Term Contract

May 28, 2025 -

2 Top S And P 500 Stocks To Consider Buying On The Recent Dip

May 28, 2025

2 Top S And P 500 Stocks To Consider Buying On The Recent Dip

May 28, 2025