AMC Stock Performance Following Deutsche Bank's Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AMC Stock Soars After Deutsche Bank's Positive Investment Outlook

AMC Entertainment Holdings Inc. (AMC) experienced a significant surge in its stock price following a positive investment outlook from Deutsche Bank. The move highlights the continued volatility and fervent interest surrounding the meme stock, even amidst broader market uncertainties. This article delves into the details of Deutsche Bank's upgrade, the subsequent market reaction, and what it might mean for AMC investors going forward.

Deutsche Bank's Bullish Prediction:

On [Insert Date of Deutsche Bank's announcement], Deutsche Bank upgraded its rating on AMC stock from [Previous Rating] to [New Rating], citing [Reasons for upgrade, e.g., stronger-than-expected box office performance, improved debt management, potential for strategic partnerships]. The analysts also revised their price target for AMC, setting it at [New Price Target], significantly higher than the previous target of [Previous Price Target]. This optimistic assessment fueled a significant rally in AMC shares.

This isn't the first time AMC has seen dramatic price swings. The stock has been a favorite among retail investors, often driving significant price increases and volatility unrelated to fundamental company performance. This phenomenon, frequently associated with meme stocks, continues to make AMC a fascinating case study in market behavior. Understanding the underlying factors behind these price movements is crucial for any investor considering a position in AMC.

Market Reaction and Subsequent Trading Activity:

Following the Deutsche Bank announcement, AMC stock experienced a [Percentage]% increase in a single trading session, reaching a [High Price] – a remarkable surge that underscores the influence of analyst ratings on investor sentiment, particularly for highly volatile stocks like AMC. This spike, however, was followed by [Describe subsequent price movement - did it consolidate gains, did it experience a pullback? Include relevant percentage changes]. Such volatility reinforces the need for careful risk management when investing in meme stocks.

Analyzing the Long-Term Outlook for AMC:

While the short-term gains are undeniable, the long-term prospects for AMC remain a subject of debate among analysts. Factors to consider include:

- Box office performance: The success of upcoming movie releases will significantly impact AMC's revenue and profitability.

- Debt levels: AMC continues to carry a substantial debt load, posing a potential risk to its financial stability.

- Competition: The movie theater industry is highly competitive, with streaming services posing a major challenge.

- Retail investor sentiment: The continued involvement of retail investors will likely remain a key driver of AMC's price volatility.

What it Means for Investors:

The recent surge in AMC's stock price, spurred by Deutsche Bank's upgrade, highlights the importance of conducting thorough due diligence before investing. While analyst ratings can be influential, it's crucial to consider the broader market context, the company's fundamental performance, and the inherent risks associated with highly volatile stocks. Investors should carefully weigh the potential rewards against the substantial risks before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Related Articles:

- [Link to an article about meme stocks]

- [Link to an article about AMC's financial performance]

- [Link to an article about the movie industry]

Keywords: AMC stock, AMC Entertainment, Deutsche Bank, stock market, meme stock, stock price, investment, analyst rating, volatility, box office, movie industry, financial performance, risk management, investor sentiment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AMC Stock Performance Following Deutsche Bank's Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Why Is Game Stop Gme Stock Climbing Today A Detailed Look

May 28, 2025

Why Is Game Stop Gme Stock Climbing Today A Detailed Look

May 28, 2025 -

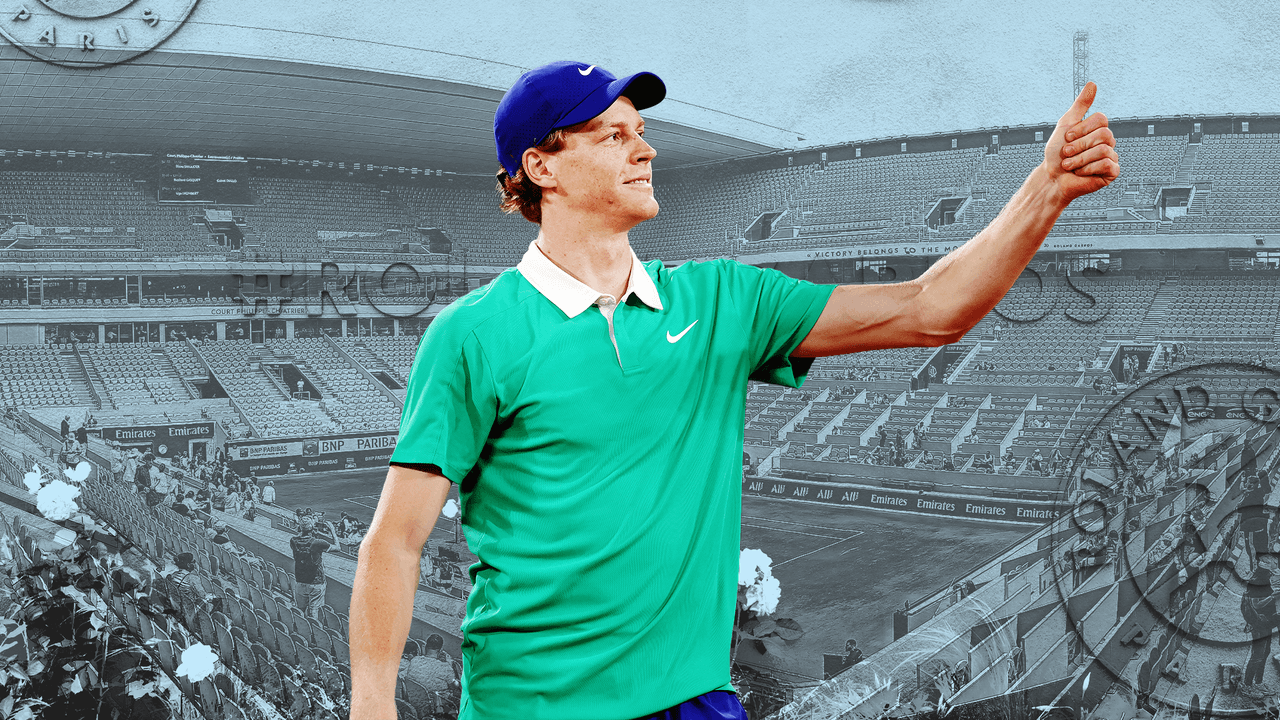

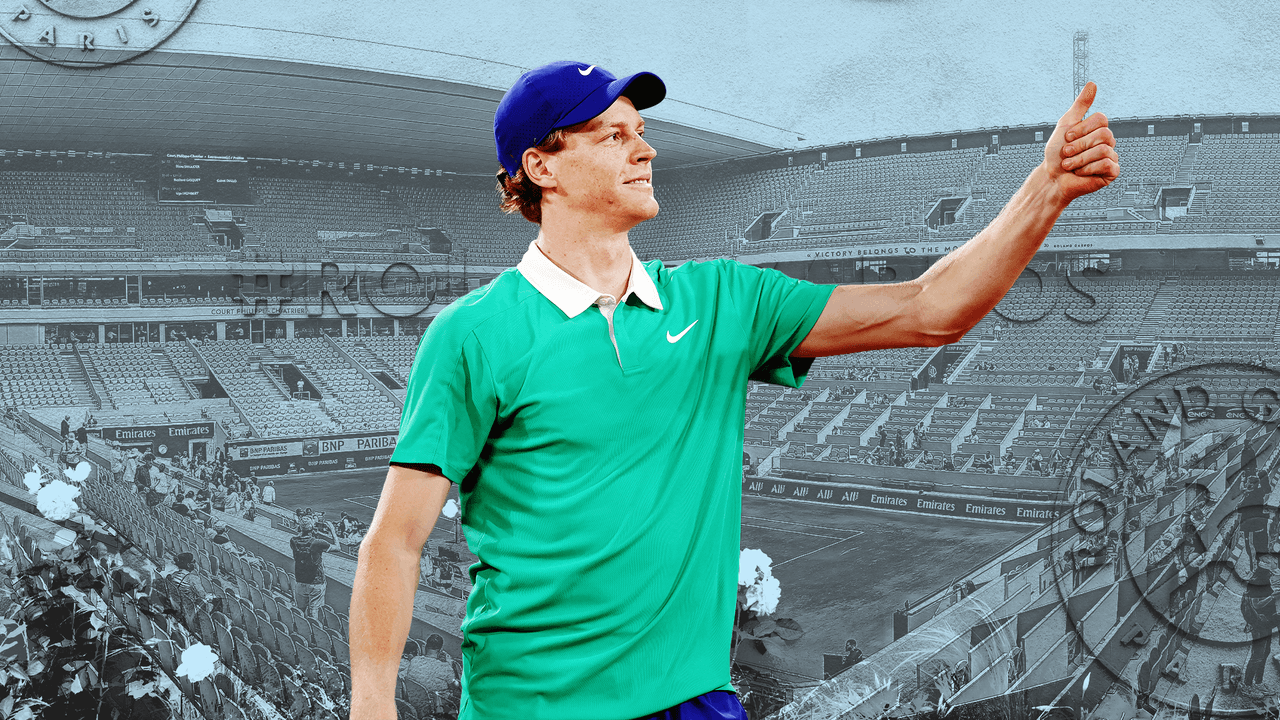

Jannik Sinner Al Roland Garros 2025 Dove Guardare In Streaming Ogni Incontro Dal Secondo Turno Con Gasquet

May 28, 2025

Jannik Sinner Al Roland Garros 2025 Dove Guardare In Streaming Ogni Incontro Dal Secondo Turno Con Gasquet

May 28, 2025 -

Game Stop Gme Stock Price Soars Understanding The Market Drivers

May 28, 2025

Game Stop Gme Stock Price Soars Understanding The Market Drivers

May 28, 2025 -

Watch Best Moments From Defenders Vs Roughnecks Ufl Week 9

May 28, 2025

Watch Best Moments From Defenders Vs Roughnecks Ufl Week 9

May 28, 2025 -

Roland Garros 2025 Streaming Di Tutte Le Partite Di Sinner Contro Gasquet E Altri

May 28, 2025

Roland Garros 2025 Streaming Di Tutte Le Partite Di Sinner Contro Gasquet E Altri

May 28, 2025