AlpInvest's New $4.1 Billion Co-Investment Fund: A Carlyle Success Story

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AlpInvest's New $4.1 Billion Co-Investment Fund: A Carlyle Success Story

AlpInvest Partners, the dedicated co-investment arm of Carlyle, has announced the successful close of its latest fund, AlpInvest Partners Fund VIII, at a staggering $4.1 billion. This monumental achievement underscores AlpInvest's consistent growth and solidifies its position as a leading player in the global co-investment market. The new fund surpasses its predecessor, highlighting the continued strong investor confidence in AlpInvest's proven strategy and track record.

This substantial capital injection marks a significant milestone not only for AlpInvest but also for Carlyle, demonstrating the success of its co-investment strategy. The sheer size of Fund VIII speaks volumes about the attractiveness of this investment approach and the trust placed in AlpInvest's team's expertise.

What is Co-Investment and Why is it Successful?

Co-investment, in the context of private equity, involves investing alongside established private equity firms in already identified deals. This approach offers several advantages:

- Reduced Risk: Co-investments often carry less risk than direct investments because they benefit from the due diligence and management expertise of the lead investor.

- Higher Returns: While potentially offering lower returns than direct investments in the early stages, co-investments can still generate attractive returns, often with less management overhead.

- Access to Premium Deals: Co-investors gain access to a pipeline of high-quality deals that might not otherwise be available.

- Diversification: Co-investment strategies allow for portfolio diversification across different geographies, sectors, and investment stages.

AlpInvest’s success in this arena is attributed to its rigorous investment process, its deep industry expertise, and its strong relationships with leading private equity firms worldwide.

AlpInvest's Strategic Advantages

AlpInvest's success isn't just about capital; it's about strategy. Their ability to consistently attract top-tier limited partners (LPs) speaks to their:

- Strong Track Record: Years of delivering consistent returns has built immense credibility within the investment community.

- Global Network: AlpInvest leverages Carlyle's extensive global network, giving them access to a wide range of investment opportunities.

- Experienced Team: Their team comprises seasoned professionals with deep expertise in co-investment and various sectors.

- Selective Approach: AlpInvest doesn't chase volume; they focus on carefully selecting high-quality opportunities, ensuring strong risk-adjusted returns.

Implications for the Private Equity Market

The success of AlpInvest Partners Fund VIII signals a positive trend within the private equity landscape. The significant amount of capital committed highlights the increasing attractiveness of co-investment strategies for institutional investors seeking diversification and strong returns. This success also points to a broader trend of increased capital flowing into alternative investments.

Looking Ahead

With $4.1 billion under management, AlpInvest is well-positioned to capitalize on future opportunities. We can expect to see continued expansion and further strengthening of their position as a market leader in the global co-investment space. The future looks bright for AlpInvest, and this latest fund close serves as a testament to their enduring success. This success story underlines the significant potential of co-investment as a viable and lucrative strategy within the private equity market.

Keywords: AlpInvest, Carlyle, Co-investment, Private Equity, Fund VIII, $4.1 Billion, Investment, Alternative Investments, Portfolio Diversification, Return on Investment, Global Investment, Institutional Investors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AlpInvest's New $4.1 Billion Co-Investment Fund: A Carlyle Success Story. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gabe Davis Free Agency Decision Steelers Visit Fuels Speculation

Jun 04, 2025

Gabe Davis Free Agency Decision Steelers Visit Fuels Speculation

Jun 04, 2025 -

Assessing Backup Qb Potential 2024 Nfl Playoff Predictions

Jun 04, 2025

Assessing Backup Qb Potential 2024 Nfl Playoff Predictions

Jun 04, 2025 -

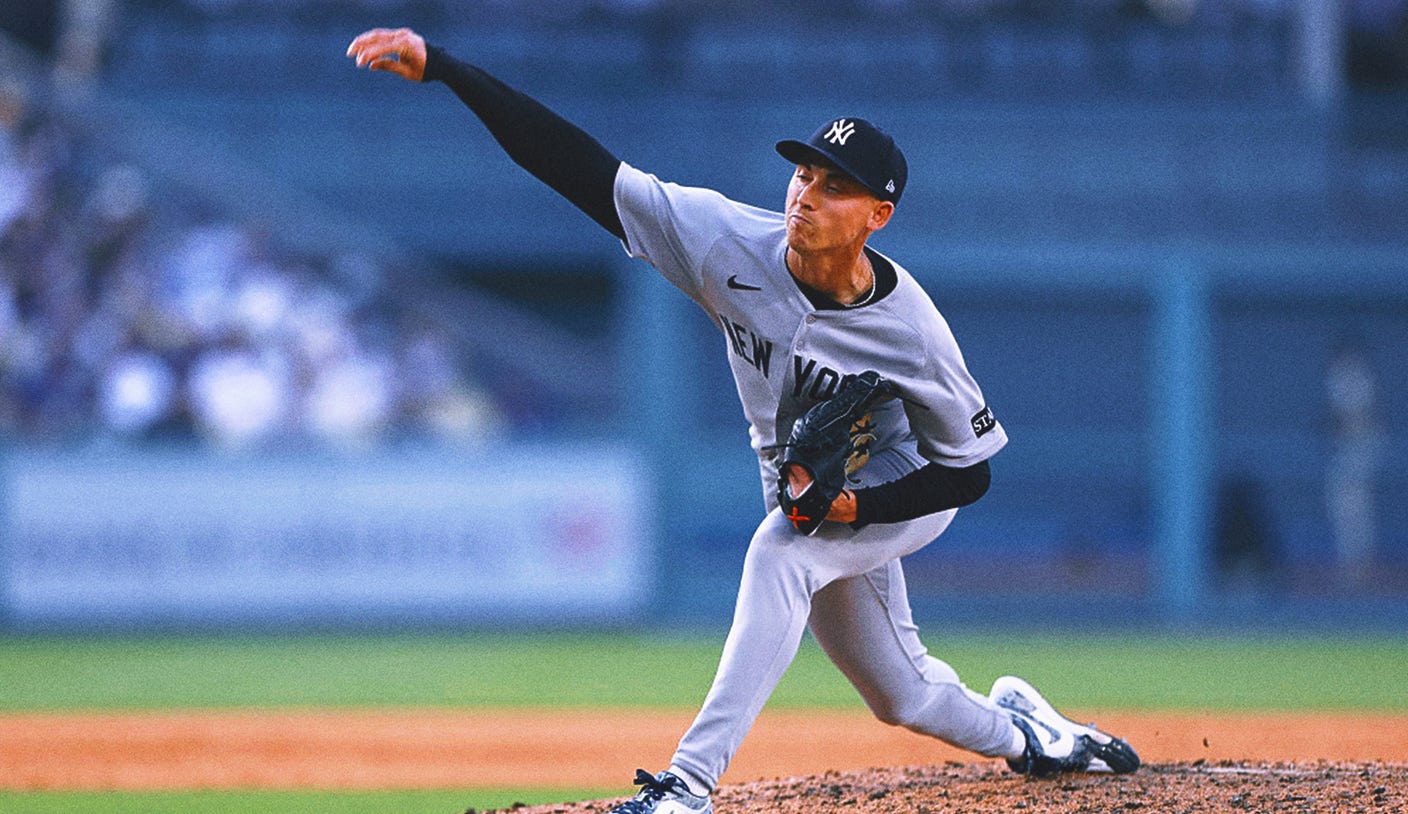

Latest Update Yankees Reliever Luke Weavers Injured List Status

Jun 04, 2025

Latest Update Yankees Reliever Luke Weavers Injured List Status

Jun 04, 2025 -

Tom Daleys Biopic Why He Wants Tom Holland To Star

Jun 04, 2025

Tom Daleys Biopic Why He Wants Tom Holland To Star

Jun 04, 2025 -

David Vs Goliath Wright States Upset Win Against Vanderbilt In Ncaa Regionals

Jun 04, 2025

David Vs Goliath Wright States Upset Win Against Vanderbilt In Ncaa Regionals

Jun 04, 2025