Allstate's Year-to-Date Cat Loss Reaches $2.387 Billion: Impact Of Recent Hurricanes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Allstate's Mounting Cat Loss: $2.387 Billion and Counting – The Impact of Recent Hurricanes

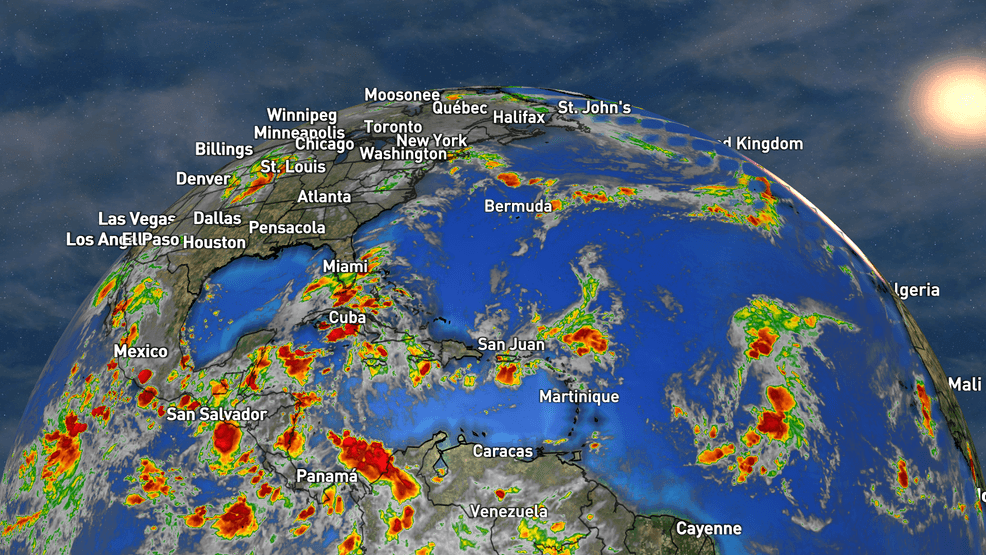

Allstate, one of the nation's largest insurers, has reported a staggering year-to-date catastrophe loss of $2.387 billion. This monumental figure is primarily attributed to the devastating impact of recent hurricanes, highlighting the escalating costs associated with extreme weather events and their significant impact on the insurance industry. The sheer scale of these losses raises concerns about future insurance premiums and the long-term financial stability of insurers facing increasingly frequent and intense natural disasters.

The Hurricane Factor: A Devastating Blow

The recent hurricane season has proven exceptionally costly for Allstate. While the company hasn't explicitly broken down the losses by individual storm, the impact of major hurricanes like [Insert names of relevant hurricanes, e.g., Hurricane Ian, Hurricane Idalia] is undeniable. These storms caused widespread damage, including flooding, wind damage, and infrastructure destruction, leading to a surge in insurance claims. The sheer volume of claims, coupled with the high cost of repairs and rebuilding, has significantly impacted Allstate's bottom line.

Beyond the Numbers: The Human Cost

While the $2.387 billion figure represents a substantial financial burden for Allstate, it's crucial to remember the human cost behind these numbers. Thousands of individuals and families have suffered immense losses due to these hurricanes, facing displacement, property damage, and emotional distress. Allstate's role extends beyond financial compensation; it involves providing support and resources to help policyholders rebuild their lives.

Implications for the Insurance Industry and Consumers

Allstate's significant catastrophe losses serve as a stark warning for the entire insurance industry. The increasing frequency and intensity of extreme weather events, largely attributed to climate change, are forcing insurers to reassess their risk models and pricing strategies. This is likely to translate into higher insurance premiums for consumers in vulnerable areas.

- Rising Premiums: Expect to see increases in homeowner's and auto insurance premiums, particularly in regions prone to hurricanes and other natural disasters.

- Increased Scrutiny: Regulatory bodies will likely increase scrutiny of insurance companies' risk management practices and financial stability in the face of these mounting losses.

- Adaptation and Innovation: The industry will need to adapt and innovate, exploring new technologies and risk mitigation strategies to better manage the financial impact of future catastrophes.

Looking Ahead: Preparing for Future Storms

The future of insurance in the face of climate change remains uncertain. Allstate's experience underscores the urgent need for proactive measures, including:

- Improved Building Codes: Strengthening building codes and infrastructure to withstand extreme weather events is crucial in mitigating future losses.

- Enhanced Disaster Preparedness: Investing in better disaster preparedness and response mechanisms can minimize the impact of hurricanes and other natural disasters.

- Climate Change Mitigation: Addressing the root causes of climate change is essential to reducing the frequency and intensity of extreme weather events.

Allstate's $2.387 billion catastrophe loss is a stark reminder of the significant financial and human costs associated with extreme weather. The insurance industry must adapt to the changing climate, and consumers should be prepared for potential increases in insurance premiums. Staying informed about these developments and taking proactive steps to protect your property and family is more critical than ever.

(Note: Replace bracketed information with specific hurricane names and dates as relevant.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Allstate's Year-to-Date Cat Loss Reaches $2.387 Billion: Impact Of Recent Hurricanes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Commanders Rfk Stadium Plan Approved By D C Council

Sep 20, 2025

Commanders Rfk Stadium Plan Approved By D C Council

Sep 20, 2025 -

Ben Johnson Tom Bradys Success Wont Impact Bears Offensive Game Plan

Sep 20, 2025

Ben Johnson Tom Bradys Success Wont Impact Bears Offensive Game Plan

Sep 20, 2025 -

Increased Security Federal Agencies Respond To Threats Targeting Charlie Kirks Funeral

Sep 20, 2025

Increased Security Federal Agencies Respond To Threats Targeting Charlie Kirks Funeral

Sep 20, 2025 -

2025 Nfl Weekday Betting Lines Expert Analysis Of Ravens Lions Matchup

Sep 20, 2025

2025 Nfl Weekday Betting Lines Expert Analysis Of Ravens Lions Matchup

Sep 20, 2025 -

Increased Hurricane Activity In The Atlantic What To Expect During Peak Season

Sep 20, 2025

Increased Hurricane Activity In The Atlantic What To Expect During Peak Season

Sep 20, 2025

Latest Posts

-

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025 -

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025