Allstate's Catastrophic Cat Losses: August Brings $2.387 Billion Pre-Tax Total

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Allstate's Catastrophic Cat Losses: August 2023 Delivers a $2.387 Billion Pre-Tax Blow

Allstate, one of the nation's largest insurance providers, reported staggering catastrophic losses for August 2023, totaling a pre-tax figure of $2.387 billion. This unprecedented hit underscores the escalating impact of severe weather events and highlights the increasing challenges facing the insurance industry. The sheer magnitude of these losses is sending shockwaves through the financial markets and raising concerns about future insurance premiums.

A Summer of Storms: Unpacking Allstate's August Losses

The astronomical figure represents Allstate's net realized and unrealized losses related to catastrophic events during the month. This includes payouts resulting from a confluence of devastating weather patterns across the country. While Allstate hasn't released a detailed breakdown of specific events, the sheer scale of the losses points to a significant number of large-scale claims stemming from hurricanes, wildfires, and severe thunderstorms. The impact of these events extends beyond the immediate financial losses, impacting homeowners, businesses, and communities across affected regions.

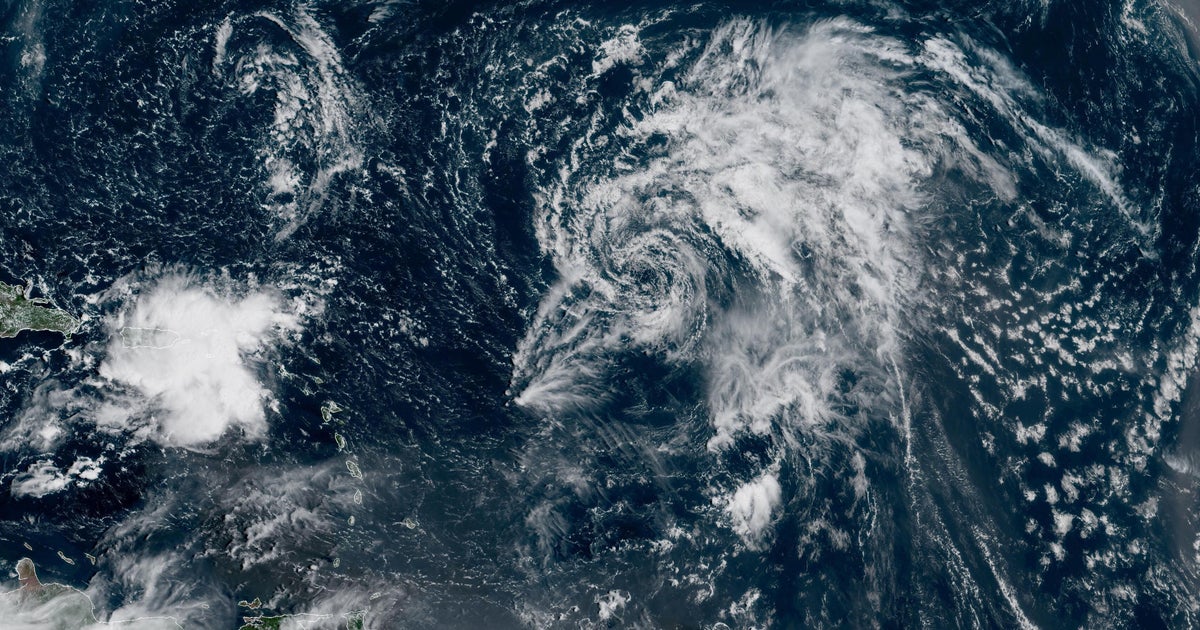

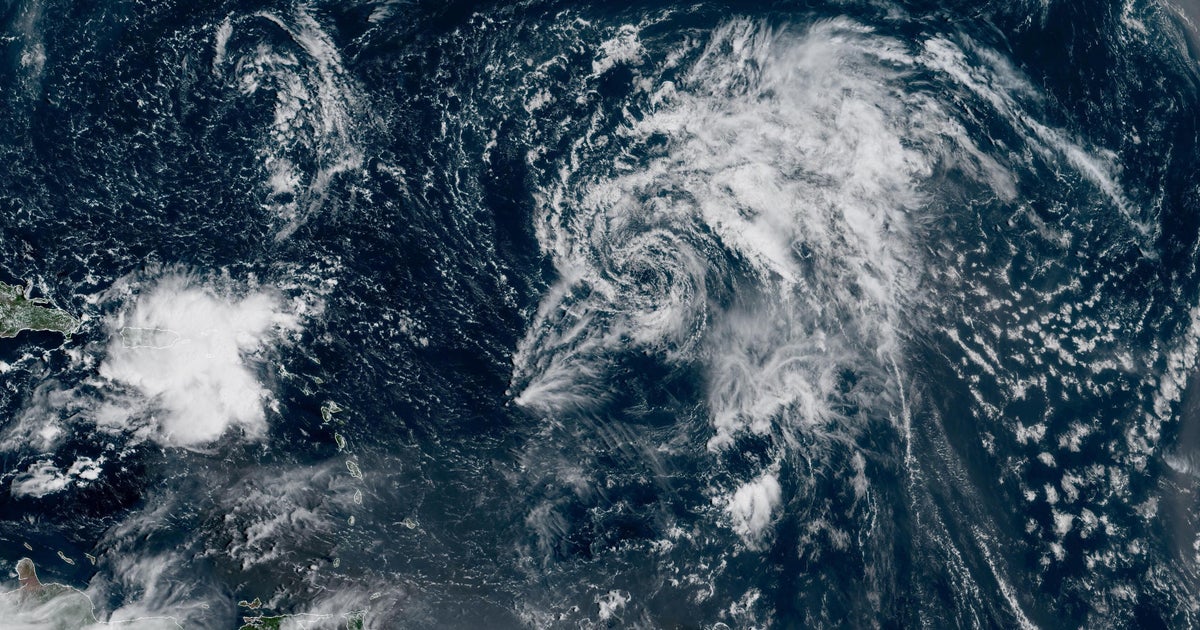

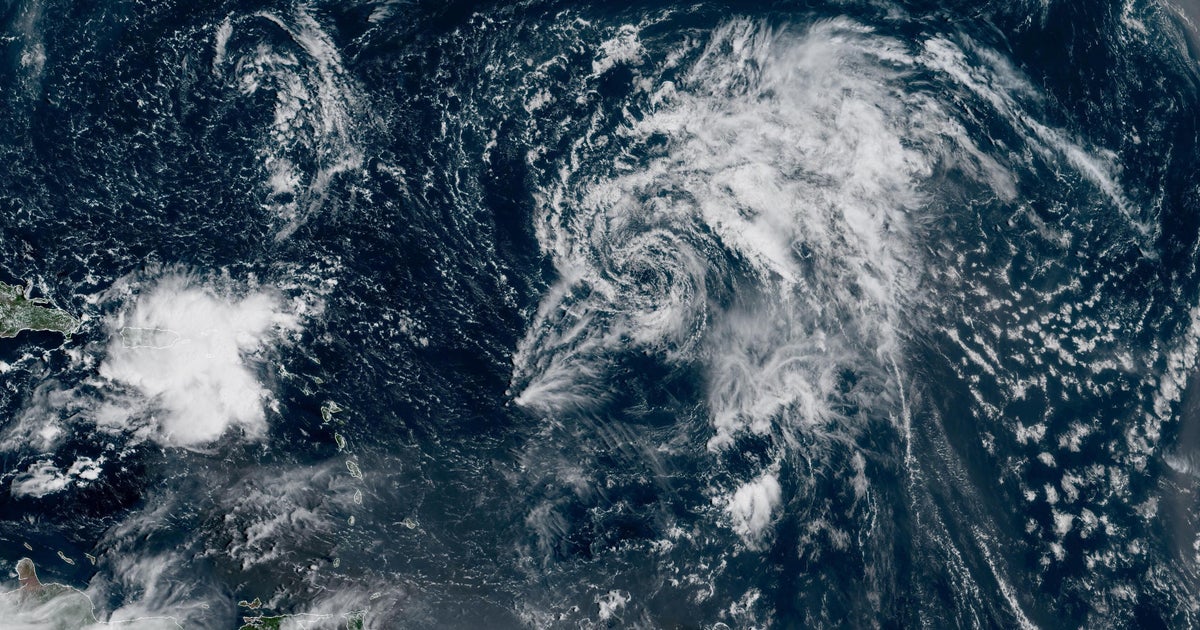

Hurricane Idalia and Beyond: The Impact of Extreme Weather

While Allstate hasn't explicitly linked the losses to specific events, the timing coincides with Hurricane Idalia's landfall in Florida, as well as numerous other significant weather events across the United States. Idalia, in particular, caused widespread damage and flooding, resulting in billions of dollars in insured losses across multiple insurance companies. This underscores the growing threat of climate change and its increasingly frequent and intense impact on weather patterns. The frequency and severity of these extreme weather events are forcing insurers to reassess their risk models and pricing strategies.

The Ripple Effect: Implications for the Insurance Industry and Consumers

Allstate's catastrophic losses have significant implications for both the insurance industry and consumers. We can expect to see:

- Increased Insurance Premiums: The substantial losses are likely to lead to increased insurance premiums for homeowners and businesses across the country, particularly in high-risk areas prone to severe weather events. This is a direct consequence of insurers needing to cover their rising payouts.

- Reassessment of Risk Models: Insurers are likely to re-evaluate their risk models to account for the increased frequency and severity of catastrophic events. This may lead to stricter underwriting guidelines and a more careful assessment of risk profiles.

- Increased Focus on Climate Change Mitigation: The growing impact of climate change on catastrophic events is forcing insurers to increase their focus on climate change mitigation strategies and invest in more resilient infrastructure.

Looking Ahead: Navigating Uncertainty in a Changing Climate

Allstate's significant losses serve as a stark reminder of the financial risks associated with increasingly frequent and severe weather events. The insurance industry is facing an unprecedented challenge, requiring innovative solutions and a proactive approach to risk management. This includes not only adjusting premiums but also investing in technologies and strategies that can help mitigate the impact of future catastrophes. Further updates and detailed breakdowns of Allstate's August losses are anticipated in the coming weeks. The situation continues to evolve, and we will continue to monitor developments and provide timely updates.

Keywords: Allstate, catastrophic losses, insurance, hurricane Idalia, extreme weather, climate change, insurance premiums, risk assessment, financial markets, severe weather, natural disasters, homeowner's insurance, business insurance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Allstate's Catastrophic Cat Losses: August Brings $2.387 Billion Pre-Tax Total. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jordan Mailata Rejects Tush Push Narrative Eagles Win Explained

Sep 19, 2025

Jordan Mailata Rejects Tush Push Narrative Eagles Win Explained

Sep 19, 2025 -

Aces Win Streak Snapped By Storm Game 3 Headed To A Decider

Sep 19, 2025

Aces Win Streak Snapped By Storm Game 3 Headed To A Decider

Sep 19, 2025 -

Nfl Injury News Aaron Jones Ir Designation And Vikings Backfield Depth

Sep 19, 2025

Nfl Injury News Aaron Jones Ir Designation And Vikings Backfield Depth

Sep 19, 2025 -

Korea Open Update Raducanus Performance After Billie Jean King Cup Withdrawal

Sep 19, 2025

Korea Open Update Raducanus Performance After Billie Jean King Cup Withdrawal

Sep 19, 2025 -

Aaron Jones Season Ends Vikings Confirm Injured Reserve Placement

Sep 19, 2025

Aaron Jones Season Ends Vikings Confirm Injured Reserve Placement

Sep 19, 2025

Latest Posts

-

2025 Atlantic Hurricane Season Tracking Tropical Storm Gabrielles Path

Sep 20, 2025

2025 Atlantic Hurricane Season Tracking Tropical Storm Gabrielles Path

Sep 20, 2025 -

Commanders Rfk Stadium Plan Approved By D C Council

Sep 20, 2025

Commanders Rfk Stadium Plan Approved By D C Council

Sep 20, 2025 -

Tropical Storm Gabrielle Forecast Track 2025 Atlantic Hurricane Season Update

Sep 20, 2025

Tropical Storm Gabrielle Forecast Track 2025 Atlantic Hurricane Season Update

Sep 20, 2025 -

Atlantic Hurricane Season 2025 Where Is Tropical Storm Gabrielle Headed

Sep 20, 2025

Atlantic Hurricane Season 2025 Where Is Tropical Storm Gabrielle Headed

Sep 20, 2025 -

Celestial Pairing Observe Venus And The Crescent Moon Before Sunrise September 19

Sep 20, 2025

Celestial Pairing Observe Venus And The Crescent Moon Before Sunrise September 19

Sep 20, 2025