Allstate's Catastrophe Losses Reach $2.387 Billion: Impact And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Allstate's Catastrophe Losses Reach $2.387 Billion: Impact and Analysis

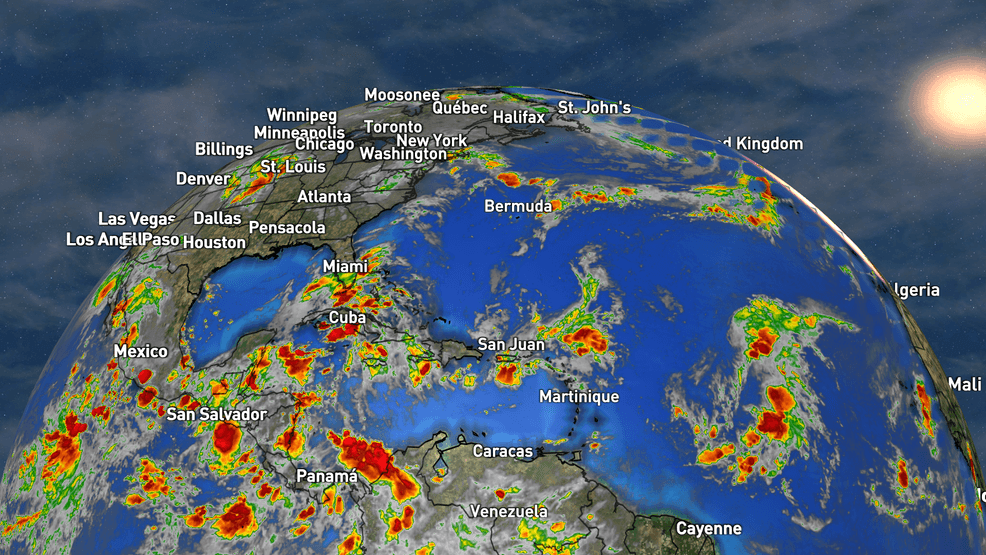

Allstate Corporation, a leading name in the insurance industry, recently announced staggering catastrophe losses totaling $2.387 billion for the first half of 2024. This significant figure has sent ripples through the financial markets and raised concerns about the increasing impact of climate change and extreme weather events on the insurance sector. This article delves into the details of Allstate's losses, analyzes their impact, and explores the broader implications for the insurance industry and consumers.

A Devastating First Half of the Year:

The $2.387 billion in catastrophe losses represents a substantial blow to Allstate's bottom line. This figure includes losses from a range of severe weather events across the United States, including hurricanes, wildfires, and severe thunderstorms. These events resulted in widespread property damage, leading to a surge in insurance claims. The company's pre-tax catastrophe losses were significantly higher than the $1.1 billion reported in the first half of 2023, highlighting the escalating frequency and intensity of extreme weather phenomena. This dramatic increase underscores the growing financial burden placed on insurers due to climate change.

Breaking Down the Losses:

-

Severe Convective Storms: A significant portion of Allstate's losses stemmed from severe convective storms, characterized by damaging hail, high winds, and torrential rainfall. These events, often localized but intensely destructive, caused widespread damage to homes and vehicles across numerous states.

-

Wildfires: Devastating wildfires, particularly in the western United States, contributed substantially to Allstate's catastrophe losses. The destruction of property and the associated costs of rebuilding are significant factors in these losses.

-

Hurricanes: While the first half of 2024 didn't see the major hurricanes of previous years, the impact of even smaller storms can be substantial when considering the cumulative effect across numerous policies.

Impact and Analysis:

Allstate's significant losses are not an isolated incident. The entire insurance industry is facing increasing pressure from climate change and the resulting rise in extreme weather events. This leads to several key implications:

-

Increased Insurance Premiums: Insurers are likely to pass on the increased costs associated with catastrophe losses to consumers through higher insurance premiums. This will particularly affect those living in areas prone to severe weather.

-

Reduced Profitability: The significant increase in catastrophe losses will undoubtedly impact the profitability of insurance companies, potentially leading to reduced dividends or slower growth.

-

Increased Scrutiny of Climate Risk: The magnitude of Allstate's losses will likely increase scrutiny on how insurance companies are assessing and managing climate risk. Regulators and investors are increasingly demanding greater transparency and more robust risk management strategies.

-

Innovation in Risk Management: The industry needs to invest in innovative risk management techniques, including improved forecasting models, advanced building codes, and potentially new insurance products designed to mitigate climate-related risks.

Looking Ahead:

Allstate's announcement serves as a stark reminder of the escalating costs associated with climate change. The insurance industry needs to adapt to this new reality, developing strategies to mitigate risk and manage the financial burden of increasingly frequent and severe weather events. Consumers, too, should be prepared for potential increases in insurance premiums and take steps to protect their homes and property against extreme weather. Understanding and preparing for these risks is crucial in navigating the changing landscape of insurance in the coming years. Further analysis and industry-wide collaboration will be essential in mitigating future losses and ensuring the long-term sustainability of the insurance sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Allstate's Catastrophe Losses Reach $2.387 Billion: Impact And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dominant Display Kordas 20 Aces Secure Hangzhou 2025 Spot

Sep 20, 2025

Dominant Display Kordas 20 Aces Secure Hangzhou 2025 Spot

Sep 20, 2025 -

Find The Moon Phase For September 18th 2025

Sep 20, 2025

Find The Moon Phase For September 18th 2025

Sep 20, 2025 -

Project Runway A Stirring Pot Of Creativity And Competition

Sep 20, 2025

Project Runway A Stirring Pot Of Creativity And Competition

Sep 20, 2025 -

Allstates Year To Date Catastrophe Losses Top 2 387 Billion

Sep 20, 2025

Allstates Year To Date Catastrophe Losses Top 2 387 Billion

Sep 20, 2025 -

Allstate All Nyse Announces 213 Million In August Catastrophe Losses

Sep 20, 2025

Allstate All Nyse Announces 213 Million In August Catastrophe Losses

Sep 20, 2025

Latest Posts

-

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025 -

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025