Allstate Reports $2.387 Billion In Pre-Tax Cat Losses For 2023

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Allstate's $2.387 Billion Pre-Tax Catastrophe Loss: A Deep Dive into 2023's Impact

Allstate, a leading name in the insurance industry, recently reported staggering pre-tax catastrophe losses totaling $2.387 billion for 2023. This substantial figure underscores the significant impact of severe weather events and the growing challenges faced by insurers in an era of climate change. The announcement sent ripples through the financial markets and raised questions about the future of insurance pricing and the increasing costs of natural disasters.

This article delves into the key details surrounding Allstate's substantial losses, examining the contributing factors and their implications for the company, its policyholders, and the broader insurance sector.

The Breakdown of Allstate's Catastrophe Losses

The $2.387 billion pre-tax catastrophe loss represents a significant hit to Allstate's bottom line. While the company hasn't provided a complete breakdown of every individual event, it's clear that a multitude of factors contributed to this substantial figure. These likely include:

-

Hurricane Ian: One of the most devastating hurricanes in recent history, Hurricane Ian caused widespread damage across Florida and other states, resulting in billions of dollars in insured losses across the industry. Allstate, with its significant presence in Florida, undoubtedly absorbed a substantial portion of these claims.

-

Other Significant Weather Events: 2023 saw a surge in severe weather events across the United States, including wildfires, tornadoes, and severe thunderstorms. These events, while perhaps individually less impactful than Hurricane Ian, cumulatively contributed to Allstate's overall catastrophe losses.

-

Rising Inflation: The increased cost of materials and labor significantly impacts the cost of repairing and rebuilding damaged properties, leading to higher insurance payouts and ultimately contributing to increased losses for insurers like Allstate.

Implications for Allstate and the Insurance Industry

Allstate's substantial losses have several key implications:

-

Increased Premiums: It's highly probable that policyholders can expect to see increases in their insurance premiums in the coming year. Insurers need to recoup losses and maintain profitability, and this often translates into higher costs for consumers.

-

Reinsurance Strategies: Allstate, like other major insurers, relies heavily on reinsurance to mitigate risk. However, the sheer scale of the losses in 2023 underscores the need for insurers to re-evaluate their reinsurance strategies and potentially seek increased coverage.

-

Climate Change Concerns: The frequency and intensity of severe weather events are directly linked to climate change. This highlights the growing systemic risk facing the insurance industry and the need for proactive measures to address the long-term impacts of climate change on insurance pricing and risk management.

Looking Ahead: What to Expect

Allstate's 2023 catastrophe losses serve as a stark reminder of the significant financial risks associated with extreme weather events. The insurance industry is facing a period of unprecedented challenges, requiring innovative solutions and proactive adaptation strategies. We can anticipate further analysis of these losses, potential changes in insurance policies, and ongoing discussions about the role of climate change in shaping the future of the industry. Further updates and analysis from financial analysts will be crucial in understanding the full long-term impact.

Stay informed about the evolving insurance landscape. Follow our news section for the latest updates and insights. (This is a subtle CTA)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Allstate Reports $2.387 Billion In Pre-Tax Cat Losses For 2023. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

17 Point Rally How The Lynx Secured Their Spot In The Wnba Semifinals

Sep 20, 2025

17 Point Rally How The Lynx Secured Their Spot In The Wnba Semifinals

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Espn Reports Messis Inter Miami Extension Imminent

Sep 20, 2025

Espn Reports Messis Inter Miami Extension Imminent

Sep 20, 2025 -

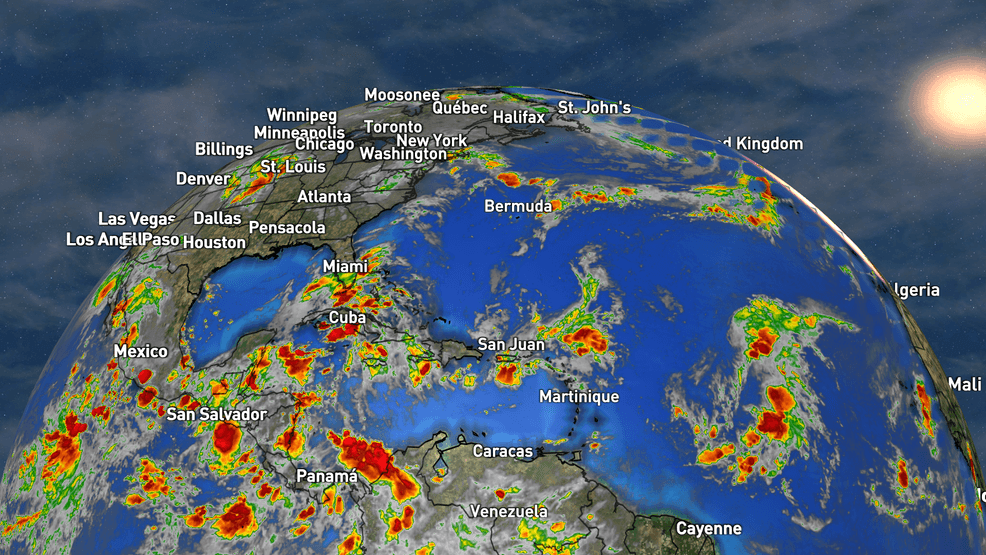

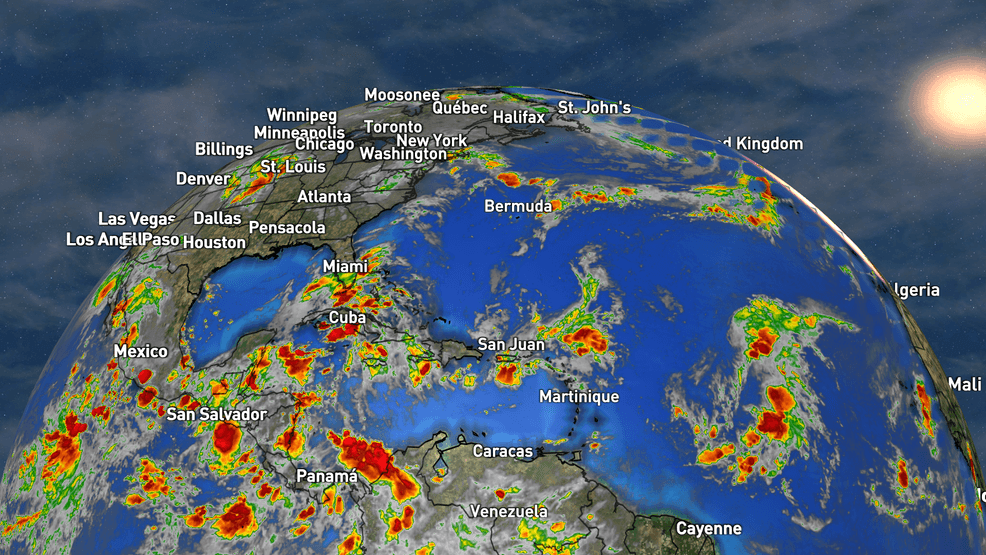

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025 -

Wnba Playoffs Lynxs Dramatic 17 Point Rally Secures Semifinals Berth

Sep 20, 2025

Wnba Playoffs Lynxs Dramatic 17 Point Rally Secures Semifinals Berth

Sep 20, 2025

Latest Posts

-

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025 -

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025

Early Peak Atlantic Hurricane Season Heats Up

Sep 20, 2025