Allstate Announces $213 Million In August Catastrophe Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Allstate Announces $213 Million in August Catastrophe Losses: A Deeper Dive into the Impact of Severe Weather

Allstate, a leading name in the insurance industry, recently announced staggering catastrophe losses totaling $213 million for the month of August 2024. This significant figure underscores the increasing financial impact of severe weather events and highlights the growing challenges faced by insurers in navigating a climate of heightened risk. The announcement sent ripples through the financial markets, prompting analysts to reassess the company's outlook and the broader implications for the insurance sector.

Breaking Down the Losses:

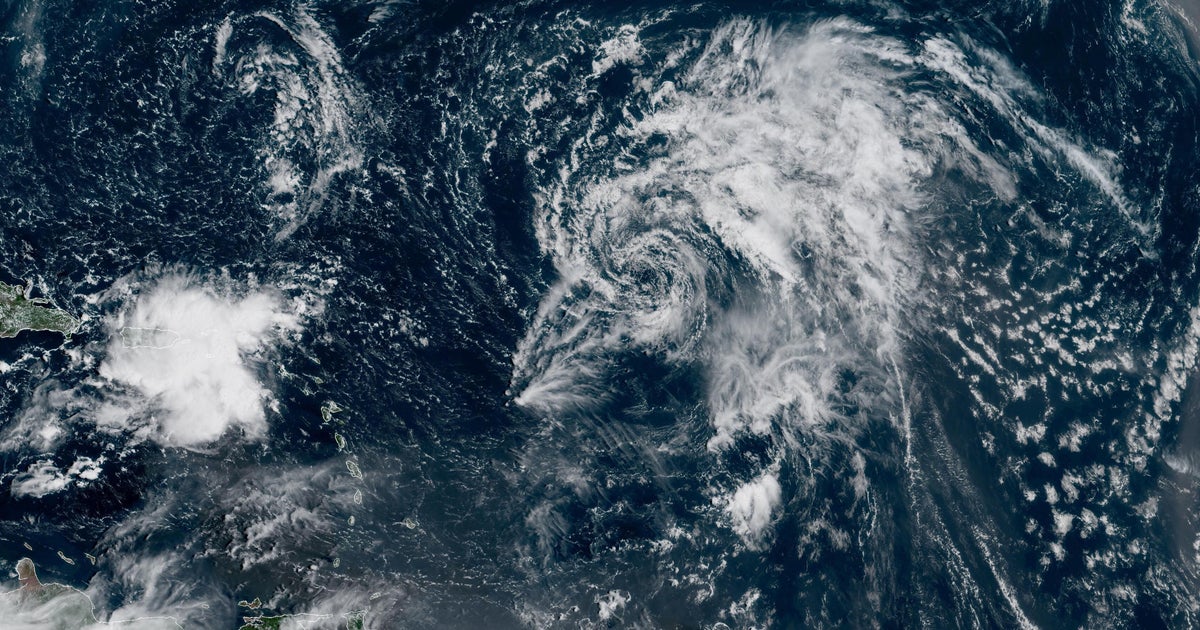

The $213 million in catastrophe losses primarily stems from a series of devastating weather events across the United States. While Allstate hasn't provided a precise breakdown by state or specific event, the month of August saw significant hurricane activity in the Atlantic, along with widespread wildfires and severe thunderstorms across various regions. These events resulted in a surge in claims related to property damage, vehicle damage, and liability.

- Hurricane Impacts: Several hurricanes and tropical storms made landfall during August, causing widespread flooding, wind damage, and power outages. These events are major contributors to Allstate's catastrophe losses, especially in coastal areas.

- Wildfire Devastation: Numerous wildfires raged across the western United States, destroying homes and other property. The costs associated with these devastating events are likely to significantly impact Allstate’s bottom line.

- Severe Thunderstorms and Flooding: Beyond hurricanes and wildfires, widespread severe thunderstorms and associated flooding caused considerable damage across many states, adding to the overall catastrophe loss figure.

Impact on Allstate and the Insurance Industry:

This significant loss announcement serves as a stark reminder of the escalating costs associated with climate change and its impact on the insurance industry. Allstate's experience is not unique; many other insurance companies are facing similar challenges as extreme weather events become more frequent and intense. The rising costs of claims are forcing insurers to re-evaluate their risk assessments, pricing models, and potentially even their coverage offerings.

What This Means for Policyholders:

While Allstate hasn't announced any immediate changes to its policies, it's important for policyholders to understand that these rising catastrophe losses could have implications in the future. This might include:

- Increased Premiums: As insurers face higher payouts, they may need to increase premiums to maintain profitability.

- More Stringent Underwriting: Insurers might become more selective in the risks they underwrite, potentially leading to stricter requirements for policy eligibility.

- Changes in Coverage: There could be adjustments to coverage limits or exclusions to mitigate risk and control payouts.

Looking Ahead: Preparing for Future Catastrophes:

The insurance industry, including Allstate, is actively working to adapt to this changing climate. This involves investments in:

- Improved Risk Modeling: Utilizing advanced technology and data analytics to better predict and assess the risk of catastrophic events.

- Catastrophe Preparedness: Developing more robust emergency response plans to efficiently handle claims and support policyholders during and after major events.

- Advocacy for Climate Change Mitigation: Engaging in discussions and advocating for policies that address climate change at both a local and national level.

This recent announcement from Allstate should serve as a wake-up call, not only for the insurance industry but also for individuals and communities. Preparing for and mitigating the impacts of severe weather events is crucial, not only for protecting property but also for safeguarding lives and livelihoods. Consider reviewing your own insurance policies and ensuring adequate coverage in the face of increasing climate-related risks. Learning more about disaster preparedness measures from resources like [link to FEMA website or similar] can also be beneficial.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Allstate Announces $213 Million In August Catastrophe Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kordas 20 Ace Masterclass Sends Him To Hangzhou 2025 Quarterfinals

Sep 20, 2025

Kordas 20 Ace Masterclass Sends Him To Hangzhou 2025 Quarterfinals

Sep 20, 2025 -

2025 Atlantic Hurricane Season Tracking Tropical Storm Gabrielles Progress

Sep 20, 2025

2025 Atlantic Hurricane Season Tracking Tropical Storm Gabrielles Progress

Sep 20, 2025 -

Following Threats Federal Agencies Increase Security For Charlie Kirks Funeral

Sep 20, 2025

Following Threats Federal Agencies Increase Security For Charlie Kirks Funeral

Sep 20, 2025 -

Oklahoma State Cowboys Vs Tulsa Golden Hurricane 2025 Game Prediction Betting Odds And Analysis

Sep 20, 2025

Oklahoma State Cowboys Vs Tulsa Golden Hurricane 2025 Game Prediction Betting Odds And Analysis

Sep 20, 2025 -

2025 College Football Week 4 Oklahoma State Vs Tulsa Betting Odds And Prediction

Sep 20, 2025

2025 College Football Week 4 Oklahoma State Vs Tulsa Betting Odds And Prediction

Sep 20, 2025

Latest Posts

-

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025 -

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025