Air Canada Preliminary Results: Success Of $500 Million Share Repurchase Program

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Air Canada's Q3 Preliminary Results: Share Repurchase Program a Resounding Success

Air Canada announced preliminary results for the third quarter of 2023, highlighting the remarkable success of its $500 million share repurchase program. The program, launched to capitalize on what the airline views as an undervalued stock price, has significantly boosted investor confidence and demonstrates a strong financial position for the airline. This news signals a positive outlook for Air Canada, despite ongoing challenges within the global aviation industry.

Strong Performance Fuels Share Buyback

The successful completion of the share repurchase program underscores Air Canada's robust financial performance in Q3 2023. While specific financial details await the official release of the full quarterly report, preliminary indications suggest strong revenue growth and improved operational efficiency. This strong performance allowed Air Canada to execute its share buyback strategy effectively, returning significant value to shareholders. The program's success reflects the airline's commitment to maximizing shareholder returns and strategically managing its capital allocation.

Why the Share Repurchase Program Matters

The $500 million share repurchase program isn't just a financial maneuver; it's a strategic move with several key implications:

- Increased Shareholder Value: By repurchasing shares, Air Canada reduces the number of outstanding shares, thereby increasing the earnings per share (EPS) for existing shareholders. This directly translates to a higher return on investment.

- Signal of Confidence: The program serves as a strong signal of confidence from Air Canada's management team in the airline's future prospects and financial stability. It suggests that they believe the current share price does not accurately reflect the company's intrinsic value.

- Improved Financial Health: The ability to successfully execute such a large-scale repurchase program demonstrates Air Canada's strong financial health and liquidity position. It allows them to strategically manage their capital and allocate resources effectively.

Looking Ahead: Navigating Industry Challenges

While the preliminary results and successful share repurchase program are positive indicators, Air Canada, like other airlines, still faces challenges. These include fluctuating fuel prices, potential economic downturns, and ongoing workforce shortages. However, the airline's robust performance in Q3 and its proactive approach to shareholder value creation suggest a resilient and well-positioned company prepared to navigate these difficulties.

What to Expect Next

Investors and analysts will eagerly await the official release of Air Canada's complete Q3 2023 financial report for a detailed breakdown of the performance. This report will provide further insights into the factors contributing to the successful share repurchase program and offer a clearer picture of the airline's future outlook. The release is expected to offer granular data on passenger numbers, load factors, and yield, giving a comprehensive view of Air Canada's operational performance.

Key Takeaways:

- Air Canada successfully completed its $500 million share repurchase program.

- Preliminary Q3 results indicate strong financial performance.

- The program boosts shareholder value and signals confidence in the company's future.

- Air Canada remains aware of industry challenges but appears well-positioned for continued success.

Stay tuned for the full Q3 report and further analysis. We'll be providing updates as soon as the official information is released. (This is a placeholder - replace with actual link if available)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Air Canada Preliminary Results: Success Of $500 Million Share Repurchase Program. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Meet The New Islanders Love Island Usa Season 7 Casa Amor

Jun 26, 2025

Meet The New Islanders Love Island Usa Season 7 Casa Amor

Jun 26, 2025 -

Historic Deal Elite Training George Kittles Journey Continues

Jun 26, 2025

Historic Deal Elite Training George Kittles Journey Continues

Jun 26, 2025 -

Ohtanis Impact How The Blue Jays Giants Cubs And Angels Will Shape Their Rosters

Jun 26, 2025

Ohtanis Impact How The Blue Jays Giants Cubs And Angels Will Shape Their Rosters

Jun 26, 2025 -

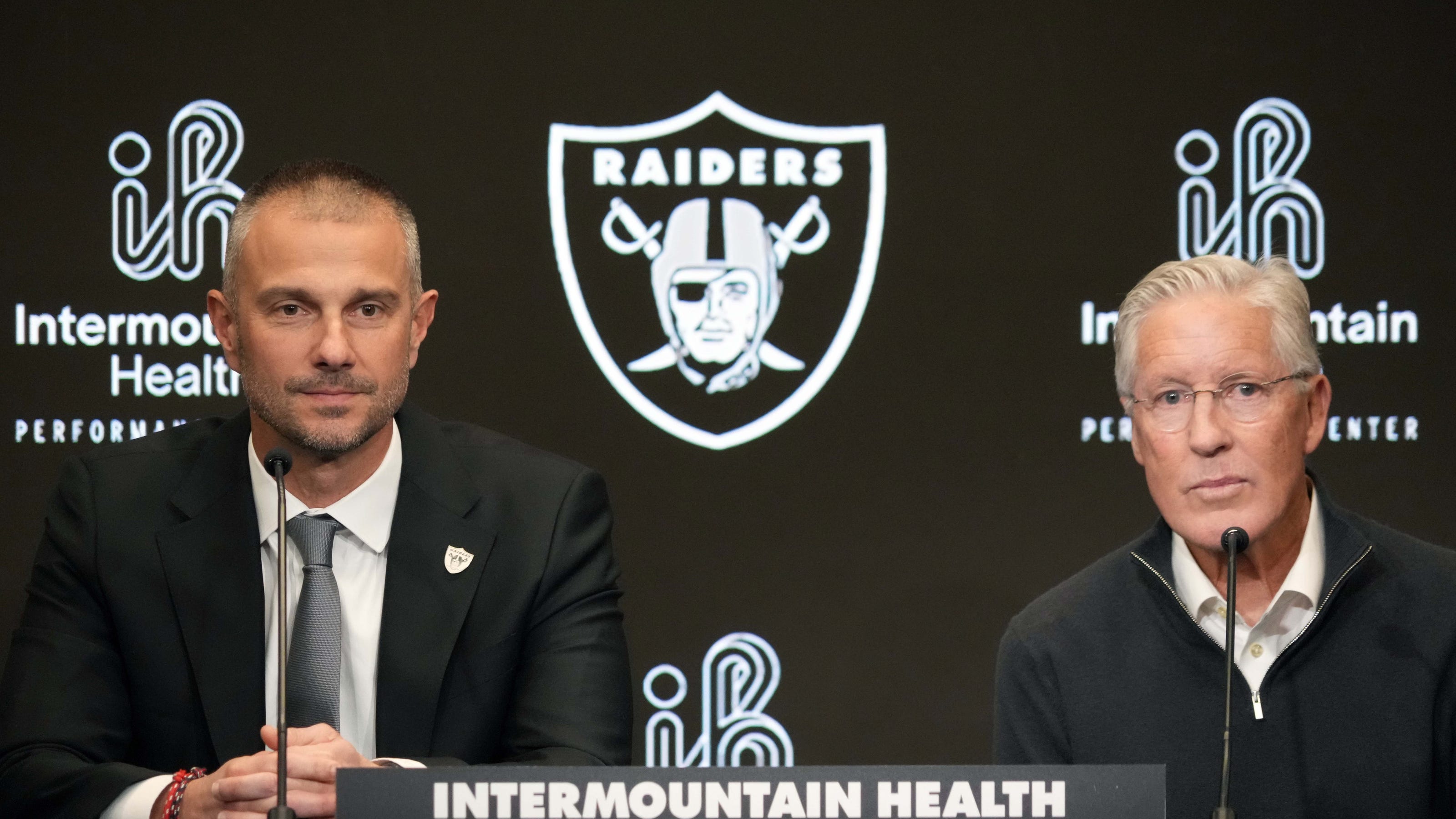

2025 Nfl Offseason Raiders Among The Athletics Top Winners

Jun 26, 2025

2025 Nfl Offseason Raiders Among The Athletics Top Winners

Jun 26, 2025 -

New Love Island Usa Islander From Portland Casa Amor Brings The Drama

Jun 26, 2025

New Love Island Usa Islander From Portland Casa Amor Brings The Drama

Jun 26, 2025