AI Semiconductor Showdown: CRDO Stock Vs. AVGO Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AI Semiconductor Showdown: CRDO Stock vs. AVGO Stock – Which Chip Giant Reigns Supreme?

The artificial intelligence (AI) revolution is reshaping the tech landscape, fueling a fierce competition in the semiconductor industry. Two prominent players, Coherent (CRDO) and Broadcom (AVGO), are vying for dominance in this rapidly expanding market. But which stock offers investors the better bet in this AI semiconductor showdown? Let's delve into a detailed comparison.

Understanding the Contenders:

Both CRDO and AVGO are significant players in the semiconductor space, albeit with different focuses. This difference is crucial when evaluating their potential in the booming AI market.

-

Broadcom (AVGO): A diversified semiconductor giant, Broadcom offers a wide array of chips and networking solutions. Their strength lies in their established infrastructure and broad market reach. While not solely focused on AI, AVGO's components are critical for data centers powering AI applications. Think high-speed networking and connectivity solutions – essential for the seamless functioning of AI systems. Their strong presence in the cloud computing sector positions them well for AI growth.

-

Coherent (CRDO): Coherent specializes in laser and photonic technologies. While seemingly less directly involved in AI compared to Broadcom, CRDO's technology is vital for advanced manufacturing processes crucial for producing the sophisticated chips driving AI. Their lasers are essential for lithography, a critical step in creating the intricate circuits within AI chips. This makes them an indirect but significant player in the AI semiconductor race.

The AI Impact:

The demand for high-performance computing power to fuel AI applications is driving unprecedented growth in the semiconductor market. This demand translates into increased sales for companies like AVGO and CRDO, albeit in different ways.

-

AVGO's AI Advantage: Broadcom benefits directly from the increased demand for data center infrastructure. Their networking chips, along with their other semiconductor solutions, are integral to the functioning of large-scale AI systems. This direct involvement makes their growth trajectory closely tied to the AI boom.

-

CRDO's Indirect but Crucial Role: Coherent's technology underpins the production of the very chips powering AI. As AI chip manufacturing becomes more complex and sophisticated, the demand for their advanced laser technology is expected to rise. This indirect exposure to the AI market offers significant long-term growth potential.

Stock Performance and Investment Considerations:

Analyzing the stock performance of CRDO and AVGO reveals distinct patterns:

-

AVGO Stock: Generally demonstrates strong and consistent growth, reflecting its established position and diverse product portfolio. However, its valuation might be higher due to its already established market dominance.

-

CRDO Stock: Might present higher risk but also potentially higher reward. Its growth is heavily dependent on the continued expansion of the semiconductor manufacturing sector, specifically in the AI chip segment.

Which Stock to Choose?

The choice between CRDO and AVGO depends heavily on your risk tolerance and investment horizon.

-

Lower Risk, Steady Growth: AVGO offers a more stable, less volatile investment option due to its diversified business and established market position.

-

Higher Risk, Higher Potential Reward: CRDO presents a higher-risk, higher-reward scenario. Its success is closely tied to the future of advanced semiconductor manufacturing and AI chip development.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should always conduct your own thorough research before making any investment decisions.

Further Research:

For deeper insights, consider exploring:

This AI semiconductor showdown is far from over. Both CRDO and AVGO are poised for significant growth in the coming years, but understanding their distinct approaches and risk profiles is critical for making informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AI Semiconductor Showdown: CRDO Stock Vs. AVGO Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Knicks Game 3 Upset 20 Point Deficit Overcome Against Pacers

May 28, 2025

Knicks Game 3 Upset 20 Point Deficit Overcome Against Pacers

May 28, 2025 -

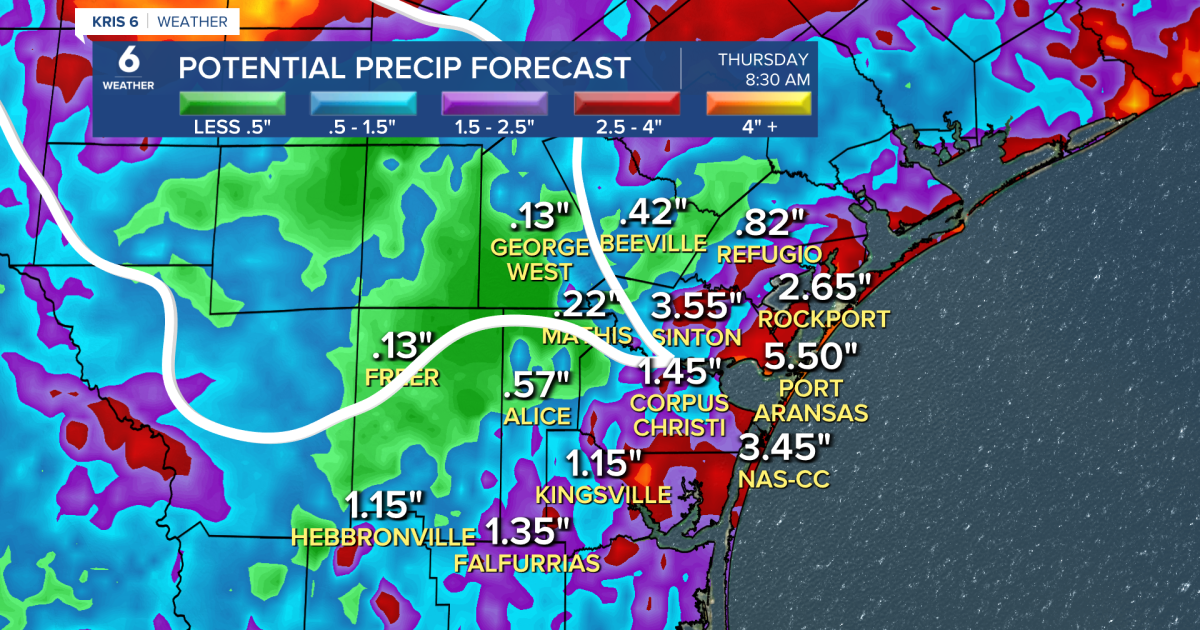

Expect Heavy Rain Series Of Weather Disturbances And Abundant Gulf Moisture

May 28, 2025

Expect Heavy Rain Series Of Weather Disturbances And Abundant Gulf Moisture

May 28, 2025 -

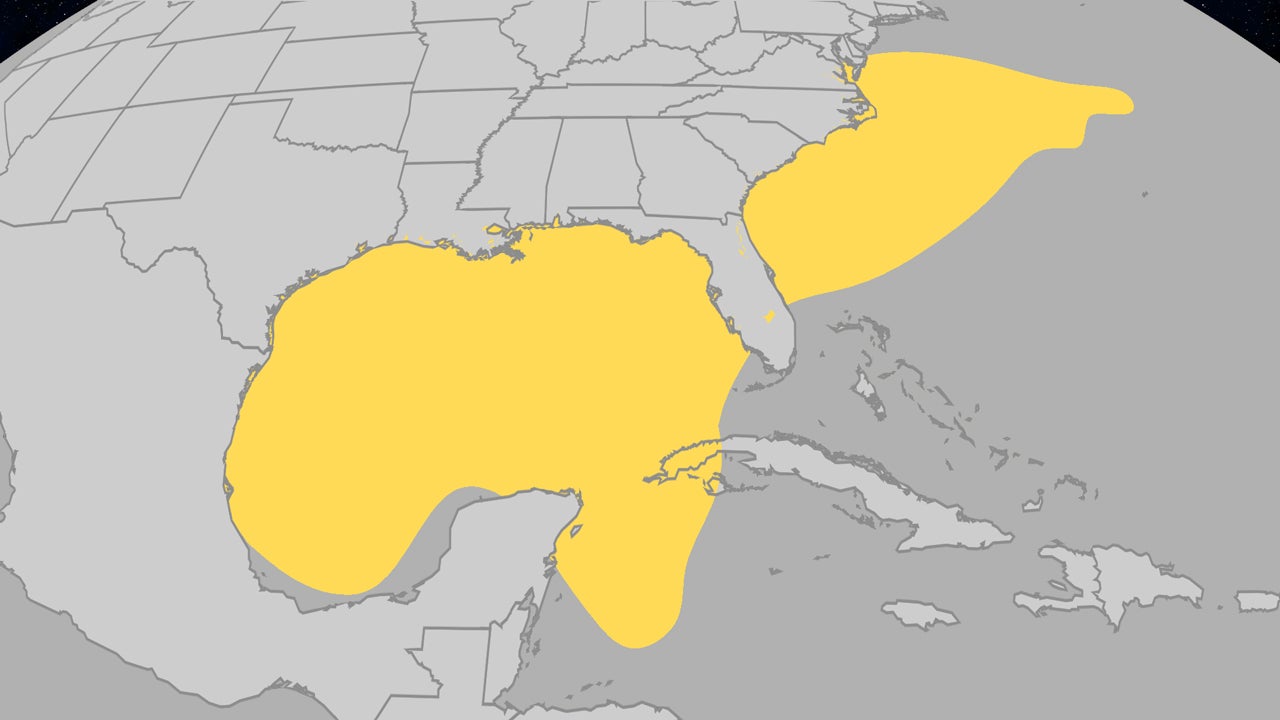

Atlantic Storm Formation A Look At Junes Hurricane Season And Recent Uptick

May 28, 2025

Atlantic Storm Formation A Look At Junes Hurricane Season And Recent Uptick

May 28, 2025 -

Consecutive Leadoff Homers Shohei Ohtani Makes History Again

May 28, 2025

Consecutive Leadoff Homers Shohei Ohtani Makes History Again

May 28, 2025 -

French Open Update Paolini Triumphs Over Yuan Secures Seventh Win

May 28, 2025

French Open Update Paolini Triumphs Over Yuan Secures Seventh Win

May 28, 2025