Adobe Stock Price Prediction: Analyst Insights After Earnings Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Adobe Stock Price Prediction: Analyst Insights After Earnings Report

Adobe (ADBE) recently released its earnings report, sending ripples through the tech sector and leaving investors wondering: what's next for the creative software giant's stock price? The report revealed strong performance in key areas, but also highlighted challenges facing the company in the current economic climate. This article dives into the post-earnings analysis from leading analysts and offers insights into potential future stock price predictions for ADBE.

Strong Q[Quarter Number] Results, But Cautious Outlook:

Adobe's Q[Quarter Number] earnings report showcased robust growth in [mention specific areas of growth, e.g., Creative Cloud subscriptions, Document Cloud revenue]. The company exceeded expectations in [mention specific metrics, e.g., earnings per share, revenue growth], fueling initial optimism among investors. However, the company's guidance for the next quarter was more conservative, reflecting concerns about macroeconomic headwinds like inflation and potential slowdowns in advertising spending. This cautious outlook tempered the initial enthusiasm, leading to a mixed reaction in the market.

Analyst Reactions and Price Targets:

Following the earnings announcement, several prominent analysts adjusted their price targets for Adobe stock.

-

[Analyst Name 1] at [Investment Bank 1]: Maintained a [Buy/Hold/Sell] rating with a price target of $[Price Target]. Their rationale emphasized [mention key arguments supporting their prediction, e.g., long-term growth potential in the creative software market, strength of Creative Cloud subscriptions]. They believe the current dip presents a buying opportunity for long-term investors. You can read their full report [link to report if available].

-

[Analyst Name 2] at [Investment Bank 2]: Revised their price target from $[Previous Price Target] to $[New Price Target], maintaining a [Buy/Hold/Sell] rating. They cited [mention key arguments, e.g., concerns about slowing demand in certain market segments, potential impact of increased competition] as factors influencing their revised prediction. Find their analysis here: [link to report if available].

-

[Analyst Name 3] at [Investment Bank 3]: [Summarize their reaction and price target, including reasoning]. [Link to report if available].

Factors Influencing Future Price Predictions:

Several key factors will likely influence Adobe's stock price in the coming months:

-

Macroeconomic Conditions: Global economic uncertainty remains a significant headwind. Any improvement or worsening of the macroeconomic environment will directly impact Adobe's growth prospects and investor sentiment.

-

Competition: The creative software market is competitive. Adobe faces pressure from both established players and emerging competitors offering alternative solutions.

-

Innovation and New Product Launches: Adobe's ability to continue innovating and launching new products and services will be crucial for sustaining its growth trajectory. Successful new product introductions can significantly boost investor confidence.

-

Subscription Growth: The continued growth of Adobe's Creative Cloud and Document Cloud subscriptions will be a key driver of future revenue and profitability.

Conclusion: A Cautiously Optimistic Outlook?

While the post-earnings reaction was mixed, the overall sentiment towards Adobe remains cautiously optimistic. Many analysts believe that Adobe's strong fundamentals and dominant market position should allow it to weather the current economic headwinds. However, investors should be prepared for potential volatility in the short term, given the uncertainties surrounding the global economy. The long-term outlook for Adobe remains positive, particularly for those with a long-term investment horizon. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Keywords: Adobe, ADBE, Stock Price Prediction, Earnings Report, Analyst Insights, Stock Market, Investment, Tech Stock, Creative Cloud, Document Cloud, Macroeconomic Conditions, Competition, Price Target.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Adobe Stock Price Prediction: Analyst Insights After Earnings Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

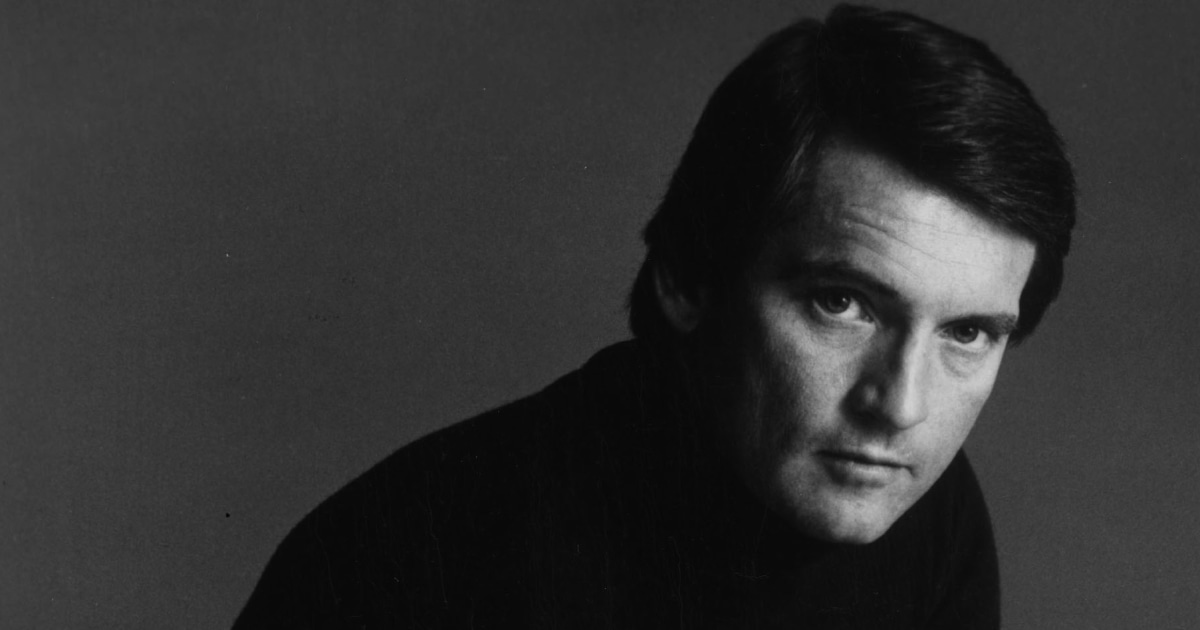

Chris Robinson 86 General Hospital Stars Death Confirmed

Jun 13, 2025

Chris Robinson 86 General Hospital Stars Death Confirmed

Jun 13, 2025 -

Adobe Stock And Ai Examining The Impact On Stock Photography Nasdaq Adbe

Jun 13, 2025

Adobe Stock And Ai Examining The Impact On Stock Photography Nasdaq Adbe

Jun 13, 2025 -

Update Jaylen Browns Knee Surgery And Impact On Boston Celtics 2024 Season

Jun 13, 2025

Update Jaylen Browns Knee Surgery And Impact On Boston Celtics 2024 Season

Jun 13, 2025 -

Premier League News Thomas Frank Takes The Reins At Tottenham

Jun 13, 2025

Premier League News Thomas Frank Takes The Reins At Tottenham

Jun 13, 2025 -

Soap Opera World Mourns Loss Of Beloved Actor At 86

Jun 13, 2025

Soap Opera World Mourns Loss Of Beloved Actor At 86

Jun 13, 2025