£950 Compensation Cap For Mis-sold Car Finance: What It Means For Victims

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

£950 Compensation Cap for Mis-sold Car Finance: What it Means for Victims

Are you one of the thousands affected by mis-sold car finance? A recent ruling has capped compensation payouts at just £950, leaving many feeling cheated and frustrated. This article breaks down the implications of this controversial cap and explores what options remain for those who feel they haven't received fair compensation.

The Financial Conduct Authority (FCA) recently announced a compensation cap of £950 for victims of mis-sold car finance agreements. This affects consumers who were sold add-on insurance products, such as Guaranteed Asset Protection (GAP) insurance or payment protection insurance (PPI), alongside their car finance agreements. Many believe these add-ons were often mis-sold, with consumers not fully understanding the terms and conditions, or the products' lack of value.

What constitutes mis-sold car finance?

Mis-sold car finance typically involves situations where:

- High-pressure sales tactics: Dealers used aggressive or misleading sales techniques to persuade customers to purchase unnecessary add-on products.

- Lack of transparency: Consumers weren't provided with clear and concise information about the products, their costs, and their benefits.

- Unfair terms and conditions: The terms and conditions of the add-on products were complex, unclear, or unfairly biased towards the lender.

- Misrepresentation of product benefits: The benefits of the add-on products were exaggerated or misrepresented to encourage purchases.

The Impact of the £950 Cap

The £950 cap has sparked outrage among consumer rights groups and affected individuals. Many argue that this figure is far too low to adequately compensate those who suffered financial losses due to mis-selling. The actual losses can be far greater, particularly if the consumer was persuaded into taking out expensive and unnecessary insurance policies.

What are my options if I feel undercompensated?

While the £950 cap is in place, it's crucial to understand your options:

- Seek independent legal advice: A solicitor specializing in consumer rights and mis-selling claims can assess your case and advise on potential avenues for further action. They may be able to challenge the cap on your behalf.

- Formal complaint: You can lodge a formal complaint with the Financial Ombudsman Service (FOS). The FOS can investigate complaints against financial institutions and may be able to overturn the £950 cap in certain circumstances.

- Join a collective action: Consider joining a collective action lawsuit against the financial institutions involved. This can provide a more powerful platform to challenge the cap and seek fairer compensation. This option requires finding a law firm experienced in collective actions.

- Review your contract carefully: Understanding the exact terms of your agreement is crucial to building a strong case.

The Future of Mis-sold Car Finance Compensation

The £950 compensation cap is a controversial development, highlighting the ongoing struggle for consumers to receive fair treatment when dealing with financial institutions. The fight for better consumer protection and more equitable compensation remains a significant challenge. Staying informed about updates from the FCA and consumer rights groups is vital for anyone affected by mis-sold car finance.

Call to Action: If you believe you've been a victim of mis-sold car finance, don't hesitate to seek professional advice and explore all available avenues to reclaim your losses. Your rights matter.

Keywords: Mis-sold car finance, compensation cap, £950 compensation, car finance claims, mis-selling, Guaranteed Asset Protection (GAP), payment protection insurance (PPI), Financial Conduct Authority (FCA), Financial Ombudsman Service (FOS), consumer rights, legal advice, collective action, compensation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on £950 Compensation Cap For Mis-sold Car Finance: What It Means For Victims. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

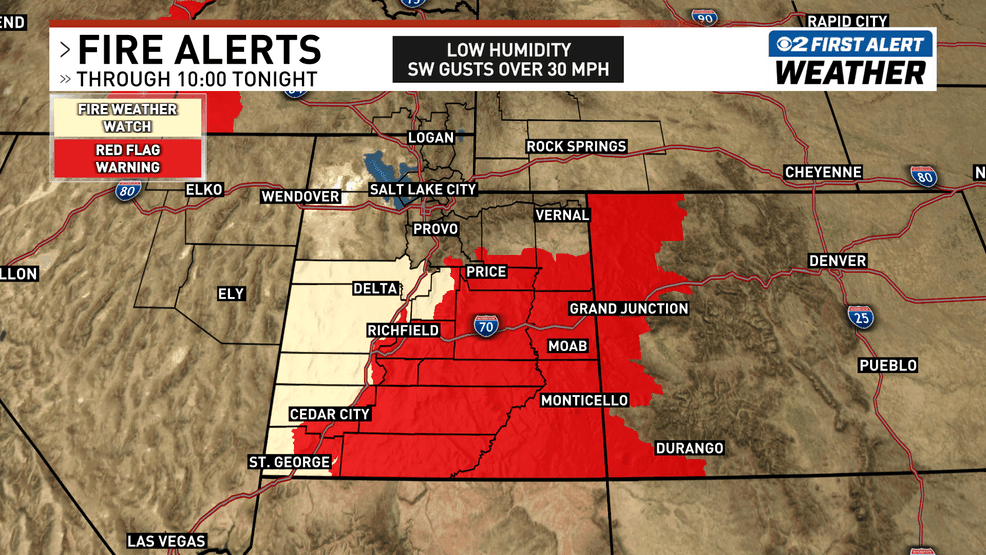

Utah Weather Alert Thunderstorm Potential North High Fire Risk South

Aug 05, 2025

Utah Weather Alert Thunderstorm Potential North High Fire Risk South

Aug 05, 2025 -

A Rod Jeter And Big Papi Weigh In Mlb Trade Deadline Winners And Losers

Aug 05, 2025

A Rod Jeter And Big Papi Weigh In Mlb Trade Deadline Winners And Losers

Aug 05, 2025 -

Chikungunya Virus Surge In China Understanding The 7 000 Case Report

Aug 05, 2025

Chikungunya Virus Surge In China Understanding The 7 000 Case Report

Aug 05, 2025 -

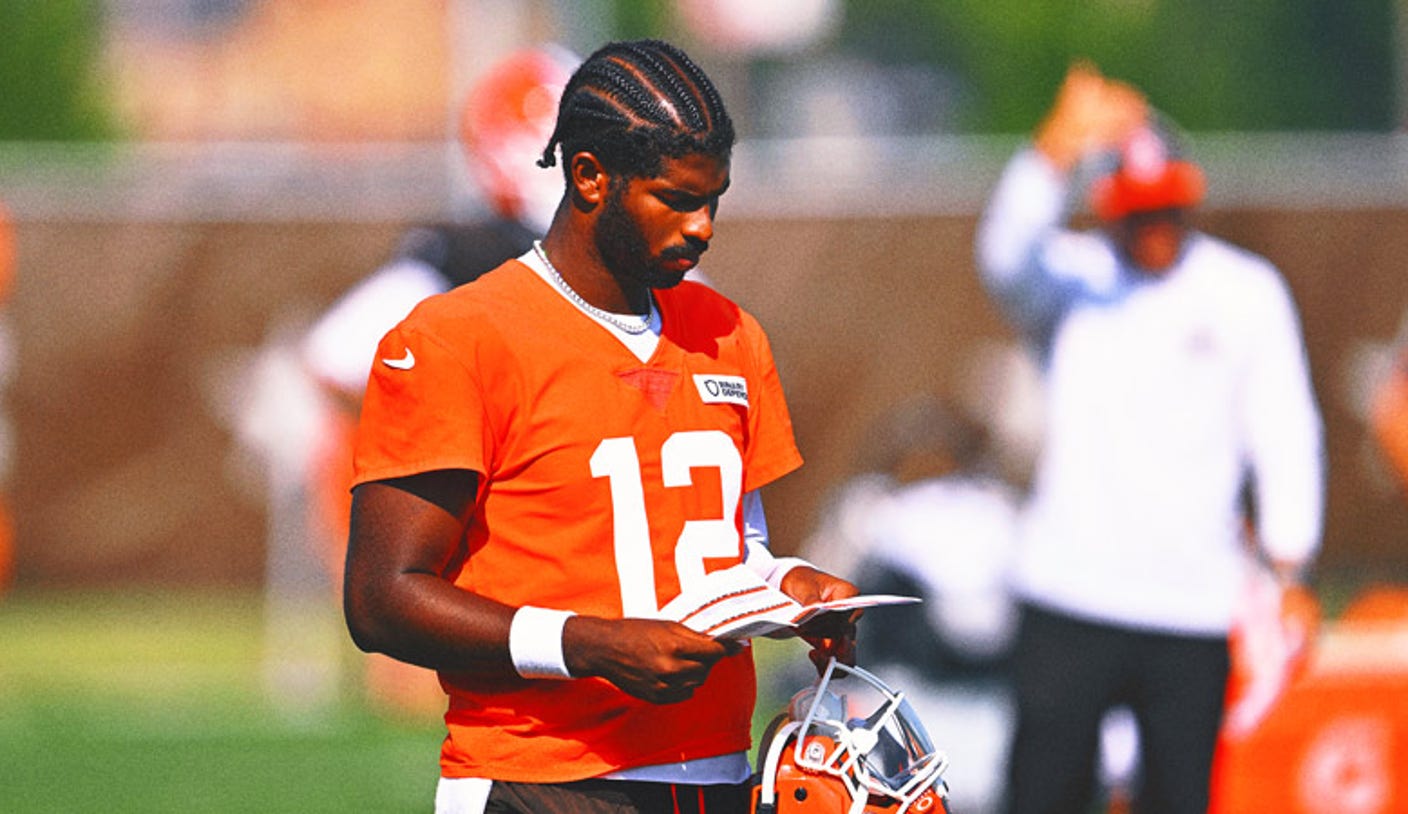

Shedeur Sanders Arm Soreness Cleveland Browns Rookie Misses Practice

Aug 05, 2025

Shedeur Sanders Arm Soreness Cleveland Browns Rookie Misses Practice

Aug 05, 2025 -

Mc Laurin Trade Rumors Heat Up Examining The Commanders Options And Potential Landing Spots

Aug 05, 2025

Mc Laurin Trade Rumors Heat Up Examining The Commanders Options And Potential Landing Spots

Aug 05, 2025

Latest Posts

-

Unprecedented Victory Marlins 7 3 Win Secures First Sweep Against Yankees

Aug 06, 2025

Unprecedented Victory Marlins 7 3 Win Secures First Sweep Against Yankees

Aug 06, 2025 -

Amorim Defends Fernandes Criticism Of Lazy Manchester United Players

Aug 06, 2025

Amorim Defends Fernandes Criticism Of Lazy Manchester United Players

Aug 06, 2025 -

Mlb History Made Julio Rodriguezs Unprecedented Fourth Straight 20 20 Season

Aug 06, 2025

Mlb History Made Julio Rodriguezs Unprecedented Fourth Straight 20 20 Season

Aug 06, 2025 -

Julio Rodriguez Achieves Remarkable 20 20 Milestone For Fourth Straight Year

Aug 06, 2025

Julio Rodriguez Achieves Remarkable 20 20 Milestone For Fourth Straight Year

Aug 06, 2025