90% Down: Analyzing Snap Stock's Potential For Recovery

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

90% Down: Analyzing Snap Stock's Potential for Recovery

Snap Inc. (SNAP), the parent company of the popular social media app Snapchat, has experienced a dramatic downturn, with its stock price plummeting by approximately 90% from its all-time high. This significant drop has left investors wondering: can Snap stock recover? This in-depth analysis explores the factors contributing to the decline and examines the potential for a resurgence.

The Fall from Grace: Understanding Snap's Stock Decline

Several key factors have contributed to Snap's steep decline. Firstly, the challenging macroeconomic environment has significantly impacted advertising revenue, a primary source of income for the company. Increased inflation and recessionary fears have led to reduced advertising spending across the board, hitting Snap particularly hard due to its reliance on this sector.

Secondly, increased competition from established tech giants like Meta (Facebook and Instagram) and TikTok presents a formidable hurdle. These platforms offer similar features and reach a broader audience, making it increasingly difficult for Snap to maintain its market share and attract new users. The relentless evolution of social media trends further complicates Snap's position, requiring constant innovation to stay relevant.

Thirdly, concerns over user growth have also played a role. While Snapchat boasts a significant user base, particularly amongst younger demographics, the rate of user growth has slowed considerably, raising doubts about the platform's long-term viability. This slower growth translates to less potential for future revenue generation.

Signs of Potential Recovery: A Glimmer of Hope?

Despite the gloomy outlook, several factors suggest that Snap might have the potential for a recovery:

- Strong Brand Recognition: Snapchat remains a highly recognizable and popular platform, especially among younger demographics. This established brand recognition provides a solid foundation for future growth.

- Innovation and New Features: Snap continues to invest in research and development, introducing new features and functionalities to enhance user engagement and attract new users. This commitment to innovation is crucial for staying competitive in the ever-evolving social media landscape.

- Strategic Partnerships: Collaborations and strategic partnerships could open new revenue streams and expand Snap's reach to new markets. These collaborations could potentially mitigate the company's reliance on advertising revenue alone.

- Cost-Cutting Measures: Implementing effective cost-cutting measures can improve profitability and enhance investor confidence. A leaner and more efficient operation can contribute significantly to a turnaround.

- Improving Economic Conditions: A potential easing of macroeconomic headwinds and a recovery in advertising spending could provide a much-needed boost to Snap's financial performance.

Analyzing the Risks: Navigating the Challenges

While the potential for recovery exists, investors must acknowledge significant risks:

- Continued Competition: The intense competition from established players remains a significant threat. Snap needs to continuously innovate and differentiate itself to remain competitive.

- Economic Uncertainty: The global economic outlook remains uncertain, and any further deterioration could negatively impact advertising revenue and user spending.

- Regulatory Scrutiny: Increasing regulatory scrutiny of social media companies poses a potential risk, requiring Snap to adapt to evolving regulations and guidelines.

Conclusion: A Long Road to Recovery

Snap's 90% stock decline represents a significant challenge, but it's not necessarily a death sentence. The path to recovery will be long and arduous, requiring a combination of strategic innovation, effective cost management, and a more favorable macroeconomic environment. While the risks are undeniable, the company's strong brand recognition and commitment to innovation offer a glimmer of hope. Investors should carefully weigh the risks and rewards before making any investment decisions, considering the volatility and uncertainties inherent in the social media landscape. Further research and monitoring of Snap's performance are crucial for informed decision-making. Stay tuned for further updates on Snap's progress and future outlook.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 90% Down: Analyzing Snap Stock's Potential For Recovery. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

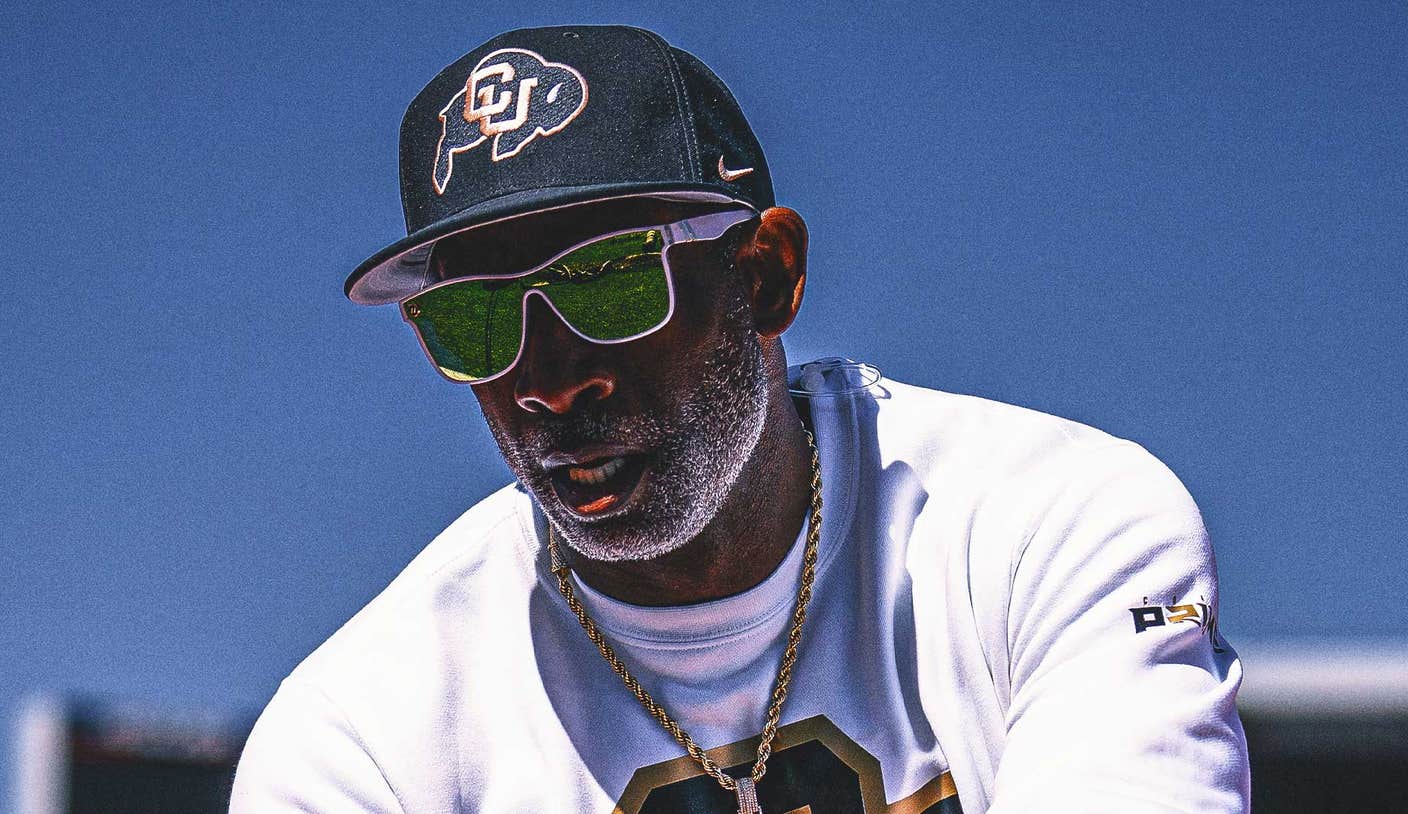

Illness Forces Colorado Football Coach Deion Sanders To Step Away

Jun 11, 2025

Illness Forces Colorado Football Coach Deion Sanders To Step Away

Jun 11, 2025 -

College Game Days Ohio State Visit Lee Corsos Farewell Before Texas Showdown

Jun 11, 2025

College Game Days Ohio State Visit Lee Corsos Farewell Before Texas Showdown

Jun 11, 2025 -

Cavs Guard Darius Garland Out 4 5 Months Following Toe Procedure

Jun 11, 2025

Cavs Guard Darius Garland Out 4 5 Months Following Toe Procedure

Jun 11, 2025 -

Wilderness Select Two Players In Inaugural Nahl Futures Draft

Jun 11, 2025

Wilderness Select Two Players In Inaugural Nahl Futures Draft

Jun 11, 2025 -

2025 College Game Day Ohio State Welcomes Lee Corso For His Final Broadcast

Jun 11, 2025

2025 College Game Day Ohio State Welcomes Lee Corso For His Final Broadcast

Jun 11, 2025