90% Down: Analyzing Snap Stock's Potential For A 2025 Rebound

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

90% Down: Analyzing Snap Stock's Potential for a 2025 Rebound

Snap Inc. (SNAP), the parent company of the popular social media app Snapchat, has experienced a dramatic downturn, losing approximately 90% of its value since its peak. This staggering decline has left many investors wondering: is there a potential for a rebound in 2025? While predicting the future of the stock market is inherently risky, a thorough analysis of Snap's current position, challenges, and potential growth avenues can shed light on this possibility.

The Fall from Grace: Understanding Snap's Decline

Snap's precipitous fall can be attributed to several interconnected factors. The initial hype surrounding its IPO, followed by aggressive growth projections, led to an inflated valuation. The subsequent failure to consistently meet these expectations, coupled with increased competition from established players like Meta (Facebook) and TikTok, significantly impacted investor confidence. Furthermore, macroeconomic headwinds, including inflation and a challenging advertising market, further exacerbated the situation. The company also faced criticism regarding its user engagement metrics and monetization strategies.

Challenges Facing Snap in the Short Term

Several obstacles remain for Snap in the near future. The intensely competitive social media landscape continues to pose a significant challenge. Maintaining user engagement against giants like TikTok, with its viral video format, requires constant innovation and substantial investment. Furthermore, the ongoing economic uncertainty impacts advertising revenue, a crucial component of Snap's revenue stream. Addressing these challenges effectively will be critical to any potential rebound.

Potential Catalysts for a 2025 Rebound

Despite the challenges, several factors could contribute to a potential Snap stock rebound by 2025:

- Innovation and New Features: Snap's continued investment in augmented reality (AR) technology and new features could attract and retain users, boosting engagement and potentially attracting new advertisers. The success of initiatives in this area will be key.

- Improved Monetization Strategies: Refining its advertising platform and exploring new monetization avenues beyond advertising, such as subscriptions or in-app purchases, could significantly improve profitability.

- Macroeconomic Recovery: A stabilization or improvement in the global economy could lead to increased advertising spending, benefiting Snap and other companies reliant on advertising revenue.

- Strategic Partnerships: Collaborations with other tech companies or brands could expand Snap's reach and open new revenue streams.

Analyzing the Investment Risk

It's crucial to acknowledge the inherent risks associated with investing in Snap stock. The company's performance remains heavily reliant on the volatile advertising market and its ability to maintain user engagement in a fiercely competitive landscape. Investors should carefully assess their risk tolerance and diversification strategy before considering any investment.

Conclusion: A Gamble with Potential Rewards?

Predicting a definite rebound for Snap stock by 2025 is impossible. However, the potential for a turnaround exists, contingent upon the company's ability to overcome its current challenges and capitalize on emerging opportunities. The factors outlined above, particularly innovation, improved monetization, and macroeconomic recovery, will play a pivotal role in determining Snap's future trajectory. Investors should closely monitor the company's performance, strategic initiatives, and the broader economic climate before making any investment decisions. This requires a comprehensive understanding of the financial markets and a careful assessment of personal risk tolerance. Consider consulting with a financial advisor before making any significant investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 90% Down: Analyzing Snap Stock's Potential For A 2025 Rebound. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

World Cup Qualifier Predictions Tuesdays Match Analysis And Card Betting Tips

Jun 11, 2025

World Cup Qualifier Predictions Tuesdays Match Analysis And Card Betting Tips

Jun 11, 2025 -

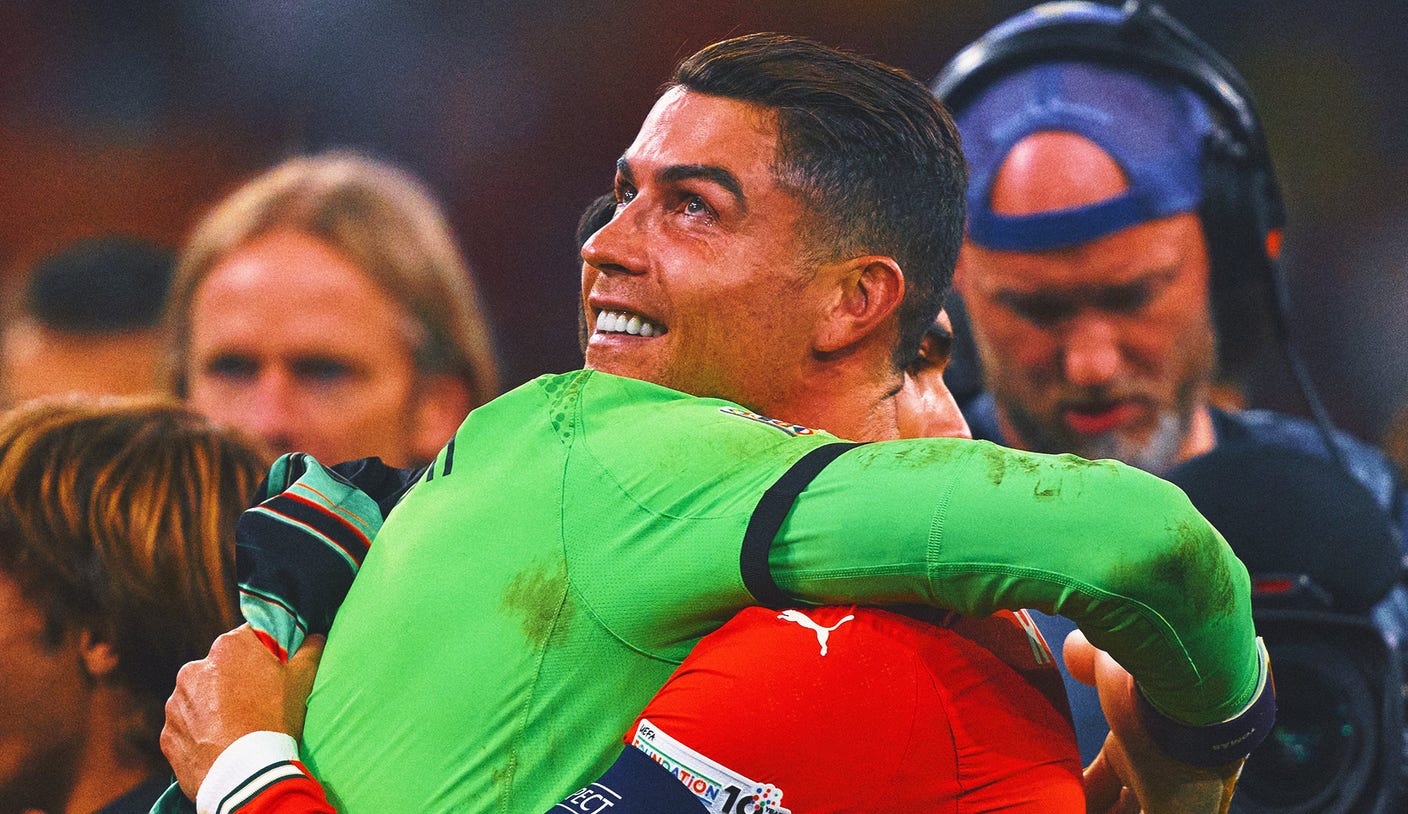

Ronaldos Club Future Uncertain Despite Portugals Win Statement Analyzed

Jun 11, 2025

Ronaldos Club Future Uncertain Despite Portugals Win Statement Analyzed

Jun 11, 2025 -

2025 Gold Cup Viewing Guide Dates Channels And Live Streams

Jun 11, 2025

2025 Gold Cup Viewing Guide Dates Channels And Live Streams

Jun 11, 2025 -

Rami Hamadis Performance Key To Palestines World Cup Bid

Jun 11, 2025

Rami Hamadis Performance Key To Palestines World Cup Bid

Jun 11, 2025 -

Serbia Vs Andorra In Depth Preview Predicted Starting Lineups And Analysis

Jun 11, 2025

Serbia Vs Andorra In Depth Preview Predicted Starting Lineups And Analysis

Jun 11, 2025