6.46% Uptick For Robinhood (HOOD): Understanding The June 3rd Market Movement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

6.46% Uptick for Robinhood (HOOD): Understanding the June 3rd Market Movement

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, closing with a remarkable 6.46% increase. This unexpected jump sparked considerable interest among investors and analysts, prompting questions about the underlying factors driving this positive market movement. Understanding the reasons behind this upswing requires examining several contributing elements, from broader market trends to specific company developments.

Dissecting the June 3rd Rally:

Several factors likely contributed to Robinhood's impressive performance on June 3rd. While pinpointing a single cause is difficult, a combination of influences likely fueled the stock's rise.

1. Positive Market Sentiment: The overall market displayed a generally positive trend on June 3rd. Broader indices like the S&P 500 and Nasdaq showed gains, creating a favorable environment for growth stocks like Robinhood. This positive market sentiment often lifts the boats of all stocks, regardless of individual company-specific news.

2. Speculation and Short Covering: Robinhood has historically been a volatile stock, attracting a significant number of both bullish and bearish investors. Some analysts suggest that short covering – investors buying shares to close out their short positions – may have played a role in the price increase. When short sellers anticipate a price rise, they often buy back shares to limit potential losses, thereby driving the price even higher.

3. Potential for Future Growth: Despite facing challenges in recent years, Robinhood continues to invest in its platform, expanding its offerings and targeting new customer demographics. Investors may be anticipating future growth fueled by these ongoing efforts. Their expansion into new financial products and services could be viewed as a catalyst for future gains.

4. Absence of Negative News: The absence of any significant negative news or announcements concerning Robinhood also contributed to the positive market reaction. In the volatile world of finance, the lack of negative press can often be perceived as positive news in itself.

Analyzing the Long-Term Outlook for HOOD:

While the June 3rd surge is encouraging, investors need to consider the long-term prospects of Robinhood. The company faces ongoing competition in the brokerage space, along with regulatory hurdles and challenges related to customer acquisition and retention.

Challenges Remain for Robinhood:

- Increased Competition: The online brokerage industry is intensely competitive, with established players and new entrants vying for market share. Robinhood must continuously innovate and improve its platform to stay ahead of the curve.

- Regulatory Scrutiny: The financial industry is subject to rigorous regulation, and Robinhood has faced scrutiny in the past. Navigating this regulatory landscape effectively is crucial for the company's long-term success.

- Customer Acquisition & Retention: Attracting and retaining customers in a crowded marketplace requires a compelling value proposition and a seamless user experience. Robinhood's ability to achieve this will be key to its future growth.

Conclusion:

The 6.46% uptick in Robinhood's stock price on June 3rd was likely a result of a combination of factors, including broader market sentiment, speculation, short covering, and the absence of negative news. However, investors should carefully consider the long-term challenges facing the company before making any investment decisions. Further analysis and a thorough understanding of Robinhood's financial performance and strategic direction are crucial for informed investment strategies. It's important to consult with a financial advisor before making any significant investment decisions. Stay informed about market trends and company developments for a comprehensive understanding of HOOD's future trajectory.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 6.46% Uptick For Robinhood (HOOD): Understanding The June 3rd Market Movement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Teyana Taylor Unveils Details On Upcoming Album Escape Room And Film Straw

Jun 06, 2025

Teyana Taylor Unveils Details On Upcoming Album Escape Room And Film Straw

Jun 06, 2025 -

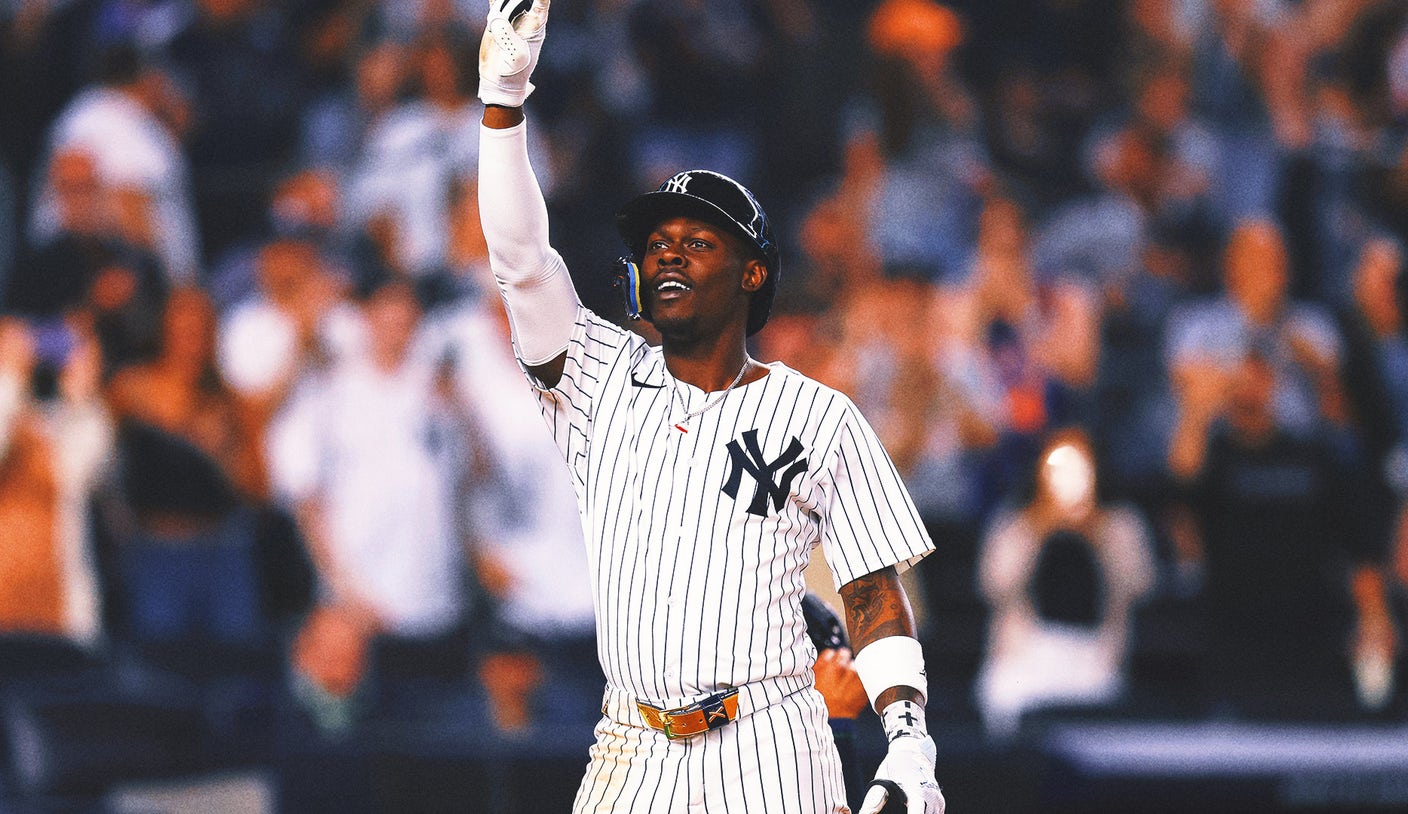

Injury Return Game Winning Home Run Chisholm Jr Leads Yankees

Jun 06, 2025

Injury Return Game Winning Home Run Chisholm Jr Leads Yankees

Jun 06, 2025 -

Ravens Bateman Gets Three Year Contract Extension Impact On The Offense

Jun 06, 2025

Ravens Bateman Gets Three Year Contract Extension Impact On The Offense

Jun 06, 2025 -

Thibodeaus Knicks Tenure Ends Searching For A New Head Coach

Jun 06, 2025

Thibodeaus Knicks Tenure Ends Searching For A New Head Coach

Jun 06, 2025 -

Sources Confirm Karl Anthony Towns Undergoing Treatment For Knee Finger Injuries Espn

Jun 06, 2025

Sources Confirm Karl Anthony Towns Undergoing Treatment For Knee Finger Injuries Espn

Jun 06, 2025