6.46% Surge For Robinhood (HOOD) On June 3: What Investors Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

6.46% Surge for Robinhood (HOOD) on June 3rd: What Investors Need to Know

Robinhood Markets, Inc. (HOOD) experienced a significant jump on June 3rd, closing with a remarkable 6.46% surge. This unexpected boost sent ripples through the market, leaving many investors wondering about the underlying causes and future implications. While pinpointing a single definitive factor is difficult, several contributing elements likely played a role in this impressive rally. Understanding these factors is crucial for investors navigating the complexities of the financial markets and assessing the potential trajectory of HOOD stock.

What Fueled Robinhood's Impressive Jump?

Several intertwined factors likely contributed to Robinhood's significant price increase on June 3rd:

-

Positive Sentiment Shift: The overall market sentiment seemed to improve slightly on that day, potentially leading to investors taking a more optimistic view on growth stocks like Robinhood. This broader market optimism often provides a tailwind for companies with higher risk profiles.

-

Speculation and Short Covering: A portion of the increase may be attributed to short covering. When investors bet against a stock (short selling), a significant price increase forces them to buy back shares to limit their losses, further driving the price up. Robinhood has historically been a target for short sellers, making this a plausible contributing factor.

-

No Major News Catalyst: Notably, there wasn't a single major news announcement or earnings report directly linked to the price surge. This suggests that the movement might be more influenced by market sentiment and technical trading activity rather than fundamental company news. The absence of a clear catalyst adds to the volatility and makes predicting future movements more challenging.

-

Technical Analysis: Chart patterns and technical indicators often influence short-term trading decisions. Traders may have identified specific technical signals that triggered buying activity, contributing to the price increase. This highlights the importance of technical analysis alongside fundamental analysis for informed investment strategies.

Analyzing Robinhood's Long-Term Prospects:

While the June 3rd surge offers a temporary boost, investors need to look beyond short-term fluctuations and assess Robinhood's long-term potential. The company continues to navigate a challenging landscape, including:

-

Intense Competition: The brokerage industry is fiercely competitive, with established players and new entrants vying for market share. Robinhood needs to consistently innovate and offer compelling features to maintain its competitive edge.

-

Regulatory Scrutiny: The financial industry faces ongoing regulatory scrutiny, which can impact operational costs and business strategies. Robinhood, like other brokerages, needs to adapt to evolving regulatory requirements.

-

User Growth and Retention: Sustained user growth and retention are crucial for Robinhood's long-term success. Attracting and retaining a loyal user base is critical for revenue generation and profitability.

What Should Investors Do?

The 6.46% surge in HOOD stock on June 3rd shouldn't be taken as a standalone indicator of future performance. Investors should conduct thorough due diligence before making any investment decisions. Consider diversifying your portfolio, understanding your risk tolerance, and consulting with a financial advisor before investing in any stock, including Robinhood. Focusing on the company's long-term fundamentals and overall market conditions is crucial for making informed choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 6.46% Surge For Robinhood (HOOD) On June 3: What Investors Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hear The Unheard Grace Potter Opens Her Musical Archives

Jun 05, 2025

Hear The Unheard Grace Potter Opens Her Musical Archives

Jun 05, 2025 -

Portlands Energy Sector Crisis Another Company At Risk

Jun 05, 2025

Portlands Energy Sector Crisis Another Company At Risk

Jun 05, 2025 -

Three Hits One Homer Trout Fuels Angels Win Extends Impressive Run

Jun 05, 2025

Three Hits One Homer Trout Fuels Angels Win Extends Impressive Run

Jun 05, 2025 -

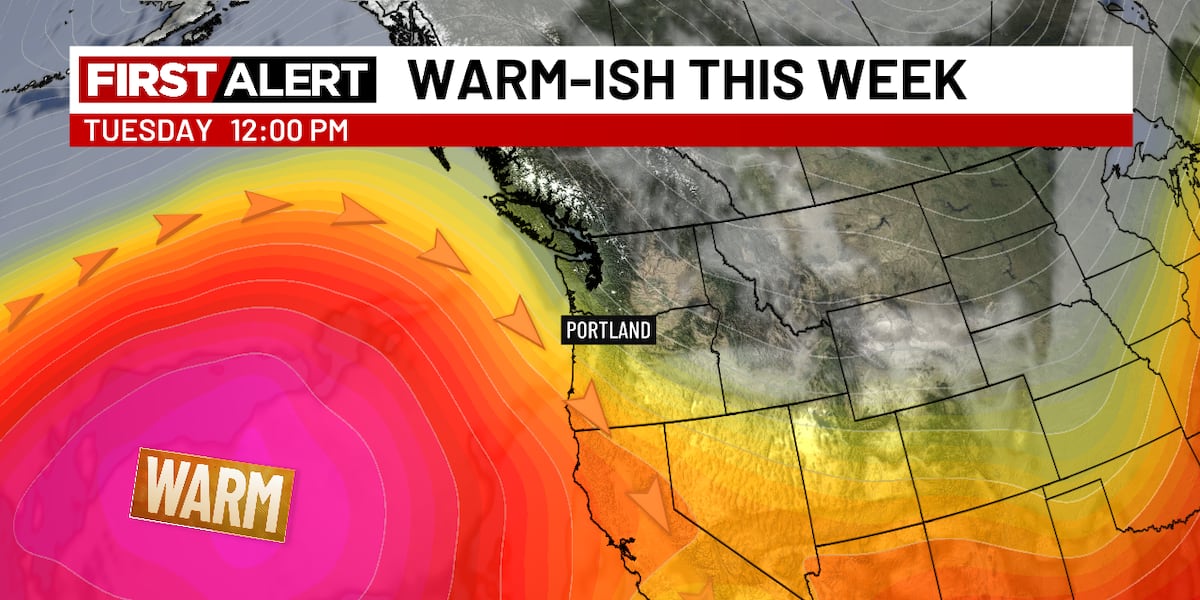

Early June Weather Warm Sunny And Dry Conditions Predicted

Jun 05, 2025

Early June Weather Warm Sunny And Dry Conditions Predicted

Jun 05, 2025 -

Energy Crisis Looms Key Big Battery Supplier In Australia On Brink Of Failure

Jun 05, 2025

Energy Crisis Looms Key Big Battery Supplier In Australia On Brink Of Failure

Jun 05, 2025