6.46% Jump For Robinhood (HOOD) On June 3rd: Investors React

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Soars 6.46% on June 3rd: Investor Reactions and Market Analysis

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, closing the day with a remarkable 6.46% jump. This unexpected boost sent ripples through the financial markets, prompting investors and analysts to dissect the reasons behind this sudden rally and its implications for the future of the popular trading app. While no single event definitively triggered the increase, a confluence of factors likely contributed to this positive market sentiment.

What Fueled the Rally? Unpacking the HOOD Surge

Several contributing factors could explain HOOD's impressive performance on June 3rd:

-

Improved Market Sentiment: The broader market showed signs of recovery on June 3rd, creating a generally positive atmosphere that benefited many tech stocks, including HOOD. Positive economic data releases or easing concerns about inflation could have played a part in this overall market upturn.

-

Increased Trading Activity: While official trading volume data needs to be confirmed, anecdotal evidence suggests a potential increase in trading activity on the Robinhood platform. This could be attributed to several factors, including renewed interest from retail investors or a response to specific market events. Increased trading activity directly translates to higher revenue for Robinhood.

-

Speculation and Short Covering: It's important to consider the role of speculation and short covering. If a significant number of investors were shorting HOOD, anticipating further decline, a sudden positive shift could trigger a wave of short covering, artificially inflating the price.

-

Strategic Moves (Unannounced): While not publicly confirmed, Robinhood may have undertaken behind-the-scenes strategic moves that positively impacted investor confidence. This could include new partnerships, improved financial projections, or other internal developments that haven't been released to the public yet.

Analyst Opinions and Future Outlook for HOOD

The sudden jump in HOOD's stock price has prompted diverse reactions from analysts. While some remain cautious, citing ongoing challenges for the company, others see potential for continued growth, particularly if Robinhood can successfully navigate the competitive landscape and regain investor trust. Many analysts are awaiting the company's next earnings report for more concrete insights.

Several key areas will determine HOOD's future trajectory:

-

Competition: Robinhood faces stiff competition from established players like Fidelity and Charles Schwab, as well as newer entrants in the fintech space. Maintaining a competitive edge requires continuous innovation and improvements to its platform.

-

Regulatory Scrutiny: The financial technology sector is subject to intense regulatory scrutiny. Any significant regulatory changes could impact Robinhood's operations and profitability.

-

User Growth and Engagement: Sustained user growth and high levels of engagement are crucial for Robinhood's long-term success. The company needs to attract and retain users by offering compelling features and a positive user experience.

Call to Action: Stay Informed and Monitor Market Trends

The 6.46% jump in HOOD's stock price on June 3rd serves as a reminder of the volatility inherent in the stock market. Staying informed about market trends, analyzing company performance, and conducting thorough due diligence before making any investment decisions is crucial for every investor. Remember to consult with a financial advisor before making any investment choices. Further updates on Robinhood's performance will be reported as they become available. Stay tuned for more in-depth analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 6.46% Jump For Robinhood (HOOD) On June 3rd: Investors React. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Baltimore Ravens Lock Up Rashod Bateman With 36 75 Million Deal

Jun 06, 2025

Baltimore Ravens Lock Up Rashod Bateman With 36 75 Million Deal

Jun 06, 2025 -

Where To Watch The France Vs Spain Nations League Semifinal Match Your Guide

Jun 06, 2025

Where To Watch The France Vs Spain Nations League Semifinal Match Your Guide

Jun 06, 2025 -

Ravens Secure Batemans Future Three Year Contract Extension Announced

Jun 06, 2025

Ravens Secure Batemans Future Three Year Contract Extension Announced

Jun 06, 2025 -

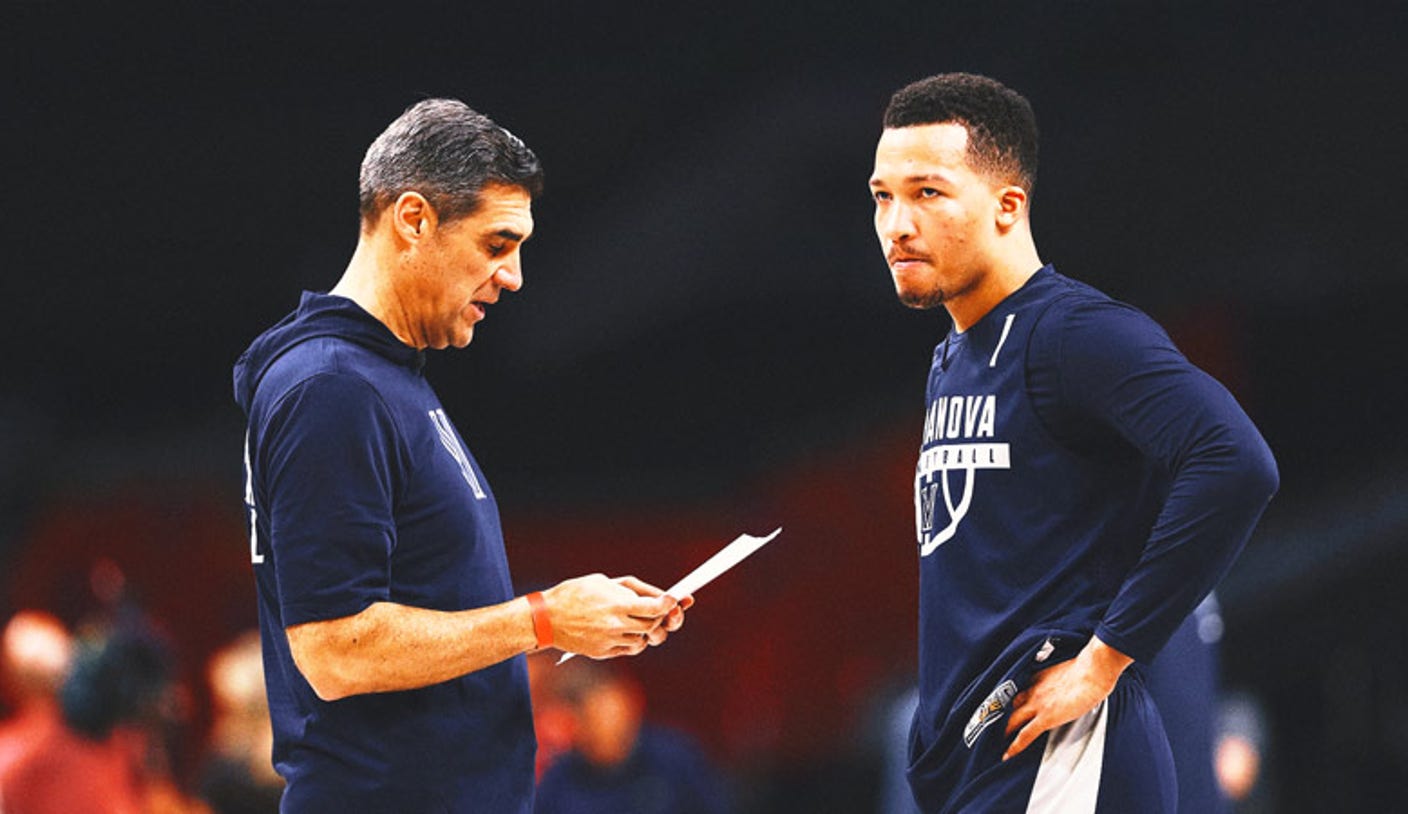

Could Dan Hurley Or Jay Wright Coach The New York Knicks

Jun 06, 2025

Could Dan Hurley Or Jay Wright Coach The New York Knicks

Jun 06, 2025 -

Actor Walton Goggins Tearfully Explains Instagram Decision Regarding Aimee Lou Wood

Jun 06, 2025

Actor Walton Goggins Tearfully Explains Instagram Decision Regarding Aimee Lou Wood

Jun 06, 2025