$500 Million Investment: Air Canada's Share Buyback And Its Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$500 Million Investment: Air Canada's Share Buyback and its Impact on Investors and the Future of Air Travel

Air Canada, Canada's flag carrier, recently announced a significant $500 million investment in a share buyback program. This substantial commitment signals confidence in the airline's future performance and offers intriguing implications for investors and the broader aviation industry. But what does this mean for passengers and the future of air travel in Canada? Let's delve into the details.

Understanding Air Canada's Share Buyback

A share buyback, also known as a stock repurchase, is when a company buys back its own shares from the open market. This reduces the number of outstanding shares, theoretically increasing the value of the remaining shares held by existing investors. Air Canada's decision to allocate $500 million to this program reflects a positive outlook on its financial health and profitability. This is a significant move, particularly given the challenges the airline industry faced during the COVID-19 pandemic.

Why is Air Canada Buying Back Shares?

Several factors likely contributed to Air Canada's decision:

- Strong Financial Position: The airline has likely recovered significantly from the pandemic's impact, boasting a robust financial position that allows for such a large investment. This suggests strong passenger demand and efficient cost management.

- Undervalued Shares: Air Canada's management may believe its shares are currently undervalued in the market, presenting a strategic opportunity to purchase them at a discounted price.

- Return to Shareholders: The buyback program represents a direct return of capital to shareholders, boosting investor confidence and potentially driving up the share price.

- Strategic Growth: While not explicitly stated, the buyback could also free up capital for future investments in fleet upgrades, technological advancements, or expansion into new markets.

Impact on Investors and the Stock Price

The announcement of the share buyback program has generally been met with positive sentiment by investors. Analysts expect the move to increase earnings per share (EPS), making Air Canada stock more attractive to potential buyers. However, it's important to note that the actual impact on the share price will depend on various market factors and overall investor sentiment.

Impact on Air Travelers:

While the share buyback directly impacts investors, its indirect effects could influence air travelers. A financially stronger Air Canada could lead to:

- Improved Services: Increased profitability might allow for investments in better in-flight services, improved customer service, and potentially more competitive pricing.

- Expanded Routes: The freed-up capital could fund expansion into new destinations, offering passengers more travel options.

- Fleet Modernization: Investments in newer, more fuel-efficient aircraft could benefit passengers through improved comfort and potentially lower fares.

Long-Term Outlook:

Air Canada's $500 million share buyback signals a strong belief in its future prospects. The success of this strategy will depend on various factors, including maintaining strong passenger demand, managing operational costs effectively, and navigating potential economic headwinds. However, the move signifies a positive step towards ensuring the long-term stability and growth of the airline.

Call to Action: Stay informed about Air Canada's performance and the impact of this share buyback by following industry news and financial reports. Consider consulting with a financial advisor before making any investment decisions.

Keywords: Air Canada, share buyback, stock repurchase, airline industry, investment, stock price, EPS, financial performance, aviation, travel, Canada, investor confidence, economic recovery.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $500 Million Investment: Air Canada's Share Buyback And Its Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jj Watts Family Grows Second Baby Arrives

Jun 26, 2025

Jj Watts Family Grows Second Baby Arrives

Jun 26, 2025 -

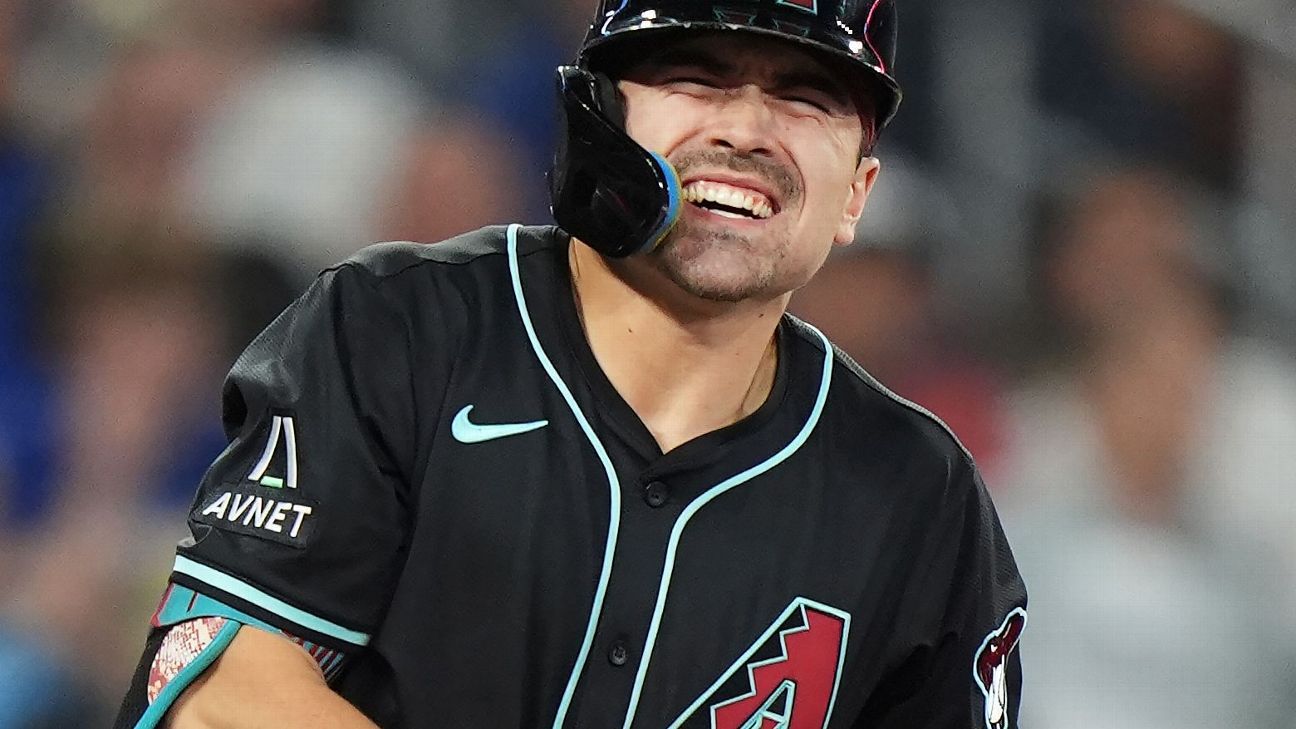

Diamondbacks Carroll Out Indefinitely After Left Wrist Fracture Diagnosis

Jun 26, 2025

Diamondbacks Carroll Out Indefinitely After Left Wrist Fracture Diagnosis

Jun 26, 2025 -

Lafc Breaks Scoring Drought In Club World Cup Despite Early Exit

Jun 26, 2025

Lafc Breaks Scoring Drought In Club World Cup Despite Early Exit

Jun 26, 2025 -

Analysis Louis Vuittons Spring 2026 Menswear Show

Jun 26, 2025

Analysis Louis Vuittons Spring 2026 Menswear Show

Jun 26, 2025 -

Guaranteed Nfl Contracts Arbiters Recommendation To Limit Deals Amidst Collusion Inquiry

Jun 26, 2025

Guaranteed Nfl Contracts Arbiters Recommendation To Limit Deals Amidst Collusion Inquiry

Jun 26, 2025