$5 Billion+ Poured Into Bitcoin ETFs: What This Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: What This Means for Investors

The cryptocurrency market is buzzing! Over $5 billion has flowed into Bitcoin exchange-traded funds (ETFs) since the first spot Bitcoin ETF was approved by the SEC. This monumental influx of capital signifies a major shift in the landscape of Bitcoin investment, opening doors for both seasoned crypto traders and newcomers alike. But what does this actually mean for investors? Let's dive into the implications of this significant investment surge.

The SEC Approval: A Game Changer

The approval of the first spot Bitcoin ETF by the Securities and Exchange Commission (SEC) marked a watershed moment. For years, the crypto industry had lobbied for regulated access to Bitcoin, arguing that ETFs offer a safer and more accessible entry point for mainstream investors compared to directly purchasing Bitcoin through exchanges. This approval shattered previous barriers to entry, legitimizing Bitcoin investment in the eyes of many institutional and retail investors.

Why the Massive Influx?

Several factors contribute to the billions pouring into Bitcoin ETFs:

- Increased Institutional Adoption: The approval signaled a green light for institutional investors – hedge funds, pension funds, and other large financial entities – to allocate funds to Bitcoin through a familiar and regulated vehicle. This is a significant step towards Bitcoin's mainstream acceptance.

- Reduced Regulatory Uncertainty: ETFs operate within a well-defined regulatory framework, reducing the uncertainty and risk associated with direct Bitcoin ownership. This appeals to risk-averse investors seeking a more secure investment option.

- Ease of Access and Trading: Investing in Bitcoin ETFs is far simpler than navigating the complexities of cryptocurrency exchanges. This accessibility attracts a broader range of investors, including those unfamiliar with digital asset trading.

- Diversification Opportunities: Bitcoin ETFs allow investors to easily diversify their portfolios, adding exposure to a potentially high-growth asset class without needing to manage the intricacies of private key security.

What This Means for You: Opportunities and Considerations

The influx of capital into Bitcoin ETFs presents both opportunities and challenges for investors:

Opportunities:

- Increased Liquidity: The high volume of trading in Bitcoin ETFs leads to increased liquidity, making it easier to buy and sell shares without significantly impacting the price.

- Lower Fees (Potentially): While fees vary between ETFs, they generally offer a lower cost of entry compared to some cryptocurrency exchanges.

- Accessibility: The simplified investment process lowers the barrier to entry for many investors.

Considerations:

- Market Volatility: Bitcoin remains a volatile asset. While ETFs offer a regulated approach, they are still subject to the price swings inherent in the cryptocurrency market.

- Expense Ratios: Remember to factor in the expense ratios charged by the ETF provider.

- Regulatory Changes: The regulatory landscape for cryptocurrencies is constantly evolving. Stay informed about any potential changes that could impact your investments.

Looking Ahead: The Future of Bitcoin ETFs

The success of the initial Bitcoin ETFs is likely to pave the way for more innovation in the space. We can anticipate the launch of new ETFs, potentially tracking other cryptocurrencies or offering different investment strategies. This increased competition should benefit investors through improved products and potentially lower fees.

Conclusion:

The $5 billion+ investment surge into Bitcoin ETFs is a significant development, signaling growing institutional and retail interest in Bitcoin. This shift toward regulated investment vehicles offers numerous advantages but also necessitates careful consideration of the inherent market risks. Thorough research and a well-defined investment strategy are crucial for navigating this exciting but volatile landscape. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: What This Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Okc Thunder Return To Western Conference Finals Dominant Victory Over Nuggets

May 20, 2025

Okc Thunder Return To Western Conference Finals Dominant Victory Over Nuggets

May 20, 2025 -

Mlb Twins Shutout Brewers Again 13 Game Win Streak Intact

May 20, 2025

Mlb Twins Shutout Brewers Again 13 Game Win Streak Intact

May 20, 2025 -

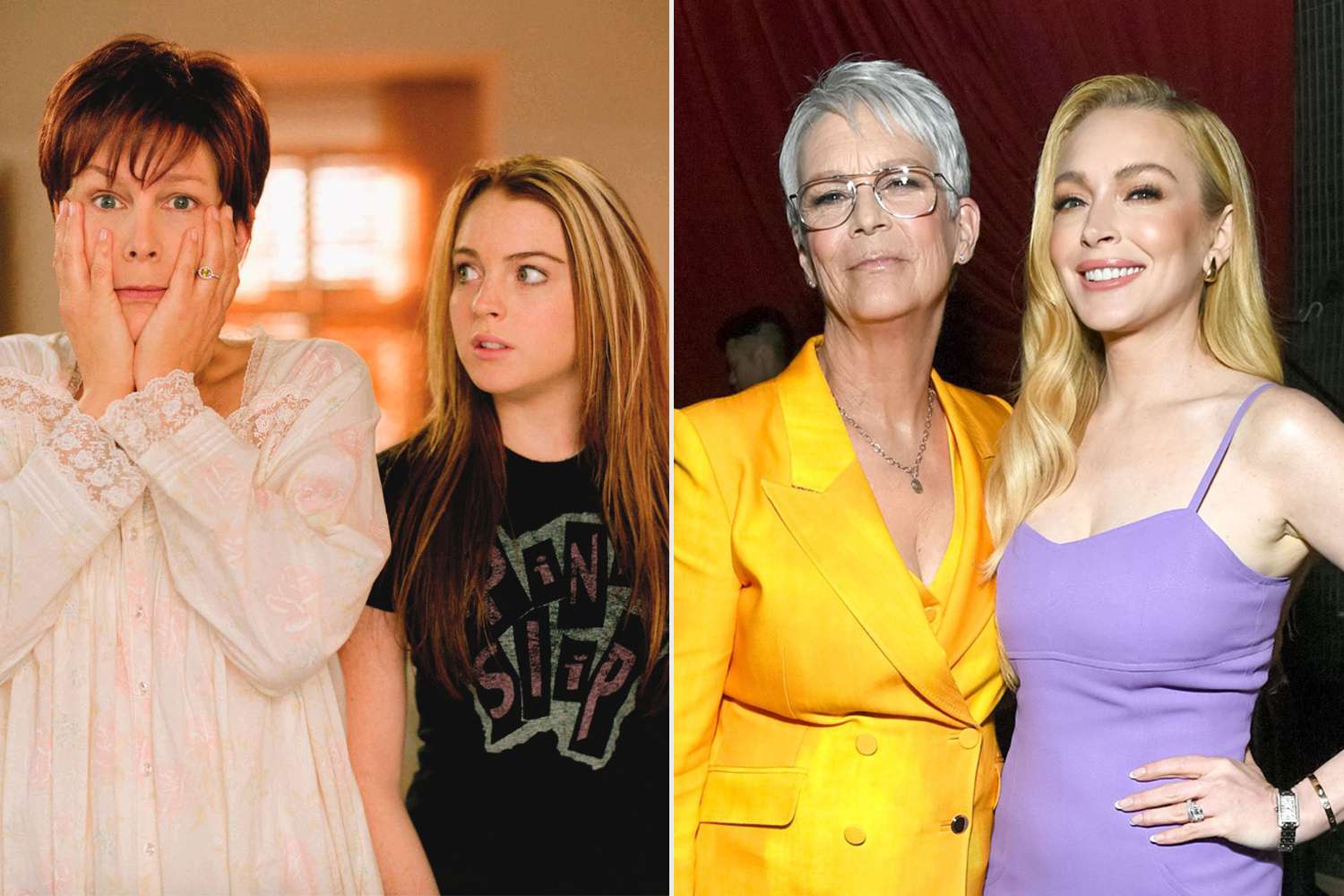

Freaky Friday Reunion Jamie Lee Curtis Reveals Update On Lindsay Lohan Friendship

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Reveals Update On Lindsay Lohan Friendship

May 20, 2025 -

Okc Thunder Clinch Western Conference Finals Berth Dominant Victory Over Nuggets

May 20, 2025

Okc Thunder Clinch Western Conference Finals Berth Dominant Victory Over Nuggets

May 20, 2025 -

Congressional Action On Pet Cremation Addressing Recent Scandal

May 20, 2025

Congressional Action On Pet Cremation Addressing Recent Scandal

May 20, 2025