$5 Billion+ Poured Into Bitcoin ETFs: What Does This Mean For Bitcoin's Future?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: What Does This Mean for Bitcoin's Future?

Record inflows into Bitcoin exchange-traded funds (ETFs) signal a significant shift in institutional investor confidence and potentially foreshadow a bullish future for the cryptocurrency. Over $5 billion has flooded into Bitcoin ETFs in recent months, a monumental figure that has sent ripples through the financial world. But what does this massive investment truly mean for Bitcoin's trajectory? Let's delve into the implications.

The Institutional Embrace of Bitcoin ETFs

The surge in investment isn't just a fleeting trend. It represents a growing acceptance of Bitcoin as a legitimate asset class among institutional investors. Previously hesitant due to regulatory uncertainty and volatility concerns, large financial players are increasingly viewing Bitcoin ETFs as a relatively safe and regulated way to gain exposure to the cryptocurrency market. This shift is driven by several factors:

- Increased Regulatory Clarity: The approval of several Bitcoin ETFs in key markets, such as the United States, has significantly reduced regulatory hurdles and instilled greater confidence. This clarity is a game-changer for institutional investors who prioritize regulatory compliance.

- Diversification Strategies: Many institutional investors see Bitcoin as a valuable addition to their portfolios, offering diversification benefits beyond traditional asset classes. Its low correlation with stocks and bonds makes it an attractive hedge against market downturns.

- Growing Institutional Demand: The demand for Bitcoin-related investment products is escalating, fueled by the growing belief in Bitcoin's long-term potential as a store of value and a potential medium of exchange.

What This Means for Bitcoin's Price:

The massive influx of capital into Bitcoin ETFs has demonstrably impacted Bitcoin's price. While correlation doesn't equal causation, the timing of the price increases alongside ETF inflows is hard to ignore. This significant investment could lead to:

- Increased Price Volatility (Short-Term): While generally bullish, large inflows can cause short-term price fluctuations as investors buy and sell. This volatility is a characteristic of the cryptocurrency market and should be expected.

- Sustained Price Appreciation (Long-Term): The consistent and substantial investment into Bitcoin ETFs points towards a potential long-term price appreciation. As more institutional money flows in, the demand for Bitcoin is likely to increase, driving up its value.

- Increased Market Liquidity: The availability of Bitcoin ETFs increases market liquidity, making it easier for investors to buy and sell Bitcoin with relative ease. This improved liquidity further contributes to price stability in the long run.

Challenges and Considerations:

Despite the positive outlook, several challenges remain:

- Regulatory Uncertainty (Ongoing): While progress has been made, regulatory landscapes for cryptocurrencies remain dynamic. Changes in regulations could impact Bitcoin's price and the attractiveness of ETFs.

- Market Manipulation: The cryptocurrency market is not immune to manipulation. While ETFs offer a degree of protection, the possibility of manipulation remains a concern.

- Environmental Concerns: The energy consumption associated with Bitcoin mining remains a significant environmental concern that could impact investor sentiment in the long term. [Link to article on Bitcoin mining and energy consumption]

Conclusion:

The over $5 billion poured into Bitcoin ETFs marks a pivotal moment for the cryptocurrency. It showcases a growing institutional acceptance of Bitcoin as a legitimate asset class and suggests a positive outlook for its future price. While challenges remain, the trend toward institutional adoption, increased regulatory clarity, and enhanced market liquidity points towards a potentially bullish future for Bitcoin. However, it’s crucial to remember that investing in cryptocurrencies carries inherent risks, and investors should proceed with caution and conduct thorough research before making any investment decisions. Staying informed about market trends and regulatory developments is essential for navigating this exciting yet volatile landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: What Does This Mean For Bitcoin's Future?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Luis Perezs Week 8 Gamble A Defining Moment In Ufl

May 21, 2025

Luis Perezs Week 8 Gamble A Defining Moment In Ufl

May 21, 2025 -

2025 Pga Championship Schefflers Commanding Final Round

May 21, 2025

2025 Pga Championship Schefflers Commanding Final Round

May 21, 2025 -

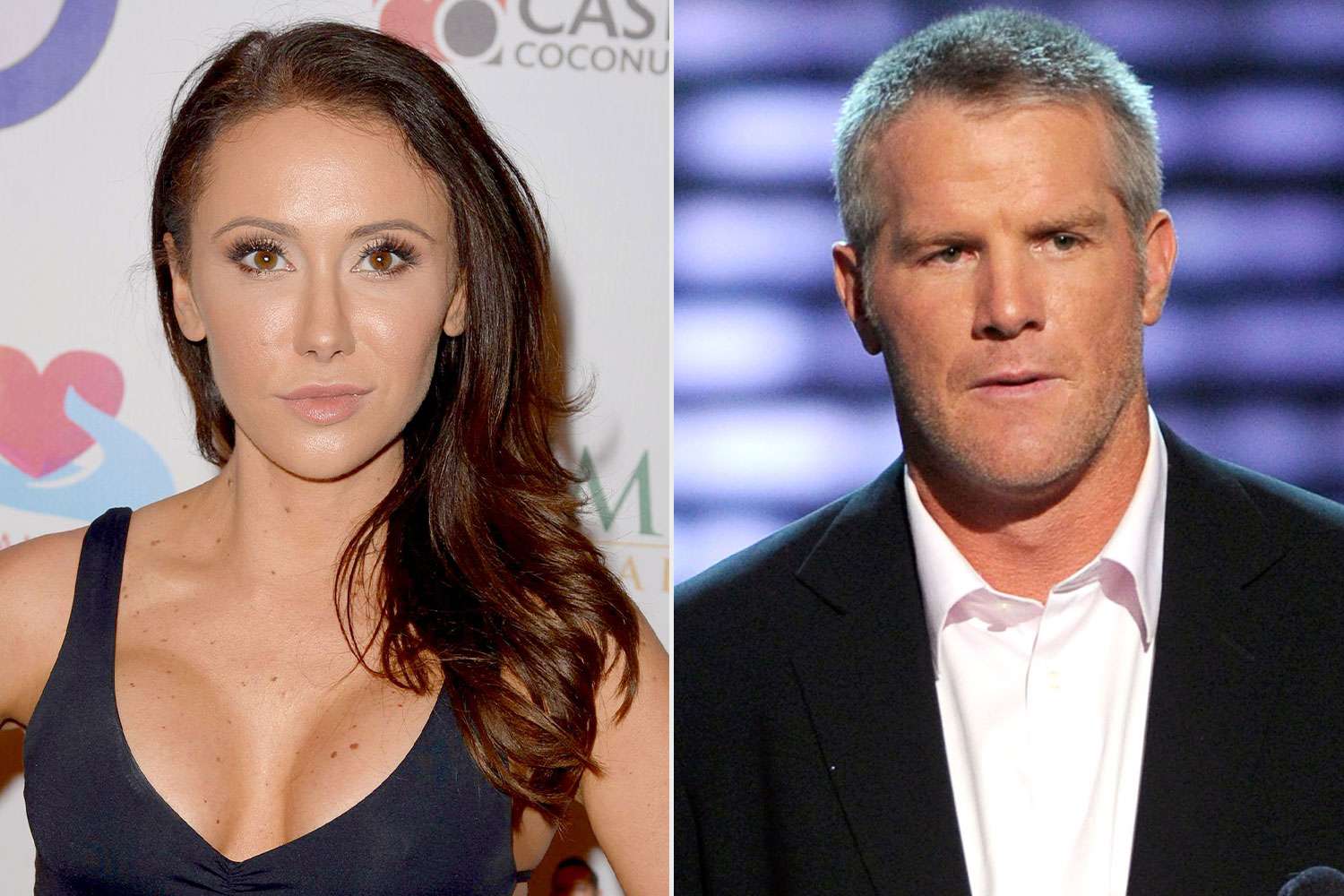

Years Later Jenn Sterger Shares The Impact Of The Brett Favre Sexting Controversy

May 21, 2025

Years Later Jenn Sterger Shares The Impact Of The Brett Favre Sexting Controversy

May 21, 2025 -

160 Japanese Companies Vie For Higher Value Through Nature Conservation A 13 Industry Guideline

May 21, 2025

160 Japanese Companies Vie For Higher Value Through Nature Conservation A 13 Industry Guideline

May 21, 2025 -

Aspinall Injury Jon Jones Accuses Ufc Of Keeping Information From Fans

May 21, 2025

Aspinall Injury Jon Jones Accuses Ufc Of Keeping Information From Fans

May 21, 2025