$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Market's Directional Shift

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Understanding the Market's Directional Shift

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) in recent months, signaling a potentially significant shift in investor sentiment and a growing acceptance of Bitcoin as a mainstream asset. This massive influx of capital raises crucial questions about the future of Bitcoin and the broader cryptocurrency landscape. Is this a temporary surge, or are we witnessing the beginning of a sustained bull market? Let's delve into the details.

The Surge in Bitcoin ETF Investments: A Closer Look

The recent surge in Bitcoin ETF investments isn't just a random fluctuation. Several factors contribute to this monumental shift:

- Regulatory Approvals: The approval of Bitcoin ETFs by major regulatory bodies, such as the SEC in the US, has played a pivotal role. This legitimizes Bitcoin in the eyes of institutional investors, who previously hesitated due to regulatory uncertainty. This regulatory clarity is a game-changer.

- Institutional Adoption: Major financial institutions are increasingly embracing Bitcoin, seeing it as a viable asset class for diversification and portfolio growth. This institutional adoption brings significant capital and credibility to the market.

- Inflation Hedge: With persistent inflation concerns globally, investors are seeking alternative assets to hedge against inflation. Bitcoin, with its limited supply, is viewed by many as a potential safe haven.

- Increased Accessibility: Bitcoin ETFs offer investors a simpler and more regulated way to gain exposure to Bitcoin compared to directly purchasing and managing the cryptocurrency. This accessibility is driving greater participation.

What Does This Mean for the Future of Bitcoin?

The massive investment in Bitcoin ETFs suggests a strong bullish sentiment. However, it's crucial to approach this with a balanced perspective. While the inflow of capital is significant, it's not a guarantee of continued upward momentum. Market volatility remains a key factor.

Potential Challenges and Risks:

- Regulatory Uncertainty: While recent approvals are positive, regulatory landscapes can change rapidly. Future regulations could impact the growth of Bitcoin ETFs.

- Market Volatility: Bitcoin's price is notoriously volatile. Sudden price drops are possible, even with significant ETF investments.

- Competition: The emergence of new cryptocurrencies and alternative investment options could impact Bitcoin's dominance.

Navigating the Market: A Cautious Approach

While the recent surge in Bitcoin ETF investments is promising, investors should exercise caution. It's vital to conduct thorough research and understand the risks associated with cryptocurrency investments before committing capital. Diversification remains a cornerstone of a sound investment strategy.

Where to Learn More:

For more in-depth information on Bitcoin ETFs and cryptocurrency investment strategies, you can explore resources like and .

Conclusion: A Turning Point?

The influx of over $5 billion into Bitcoin ETFs marks a potentially significant turning point for the cryptocurrency market. Increased regulatory clarity, institutional adoption, and the perception of Bitcoin as an inflation hedge are contributing factors. However, investors should remain aware of the inherent risks and volatility associated with cryptocurrency investments. This substantial capital inflow signals a growing confidence in Bitcoin's future, but sustained growth will depend on navigating the challenges ahead. The market's directional shift is undeniable, but its ultimate trajectory remains to be seen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Market's Directional Shift. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

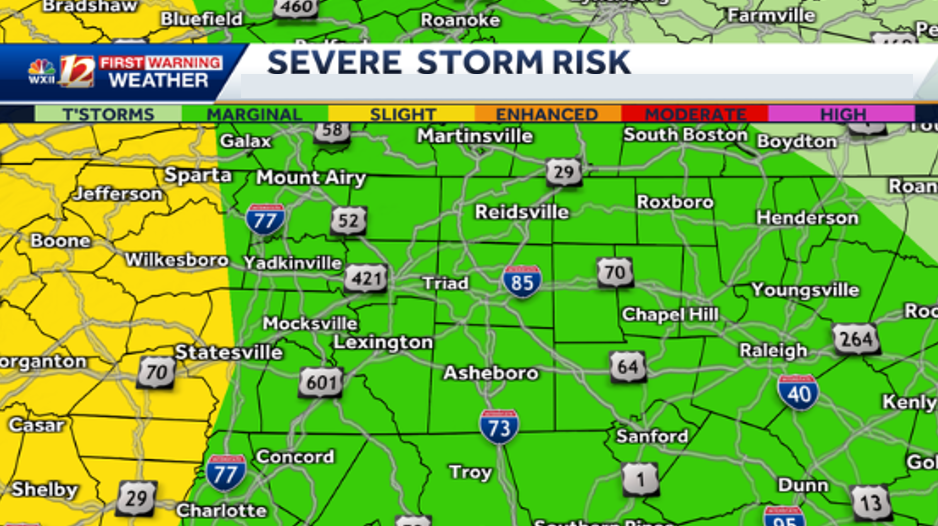

Overnight Rain And Storms High Risk Of Severe Weather In North Carolina

May 21, 2025

Overnight Rain And Storms High Risk Of Severe Weather In North Carolina

May 21, 2025 -

Nhl Referee Rooney Targets Playoff Return Following Ban

May 21, 2025

Nhl Referee Rooney Targets Playoff Return Following Ban

May 21, 2025 -

Wyndham Clark Apologizes For Driver Incident At Pga Championship

May 21, 2025

Wyndham Clark Apologizes For Driver Incident At Pga Championship

May 21, 2025 -

Esports Star Uzi Gifted Electric G Wagon By Mercedes Benz

May 21, 2025

Esports Star Uzi Gifted Electric G Wagon By Mercedes Benz

May 21, 2025 -

Celtics Championship Hopes Can They Stay Contenders This Offseason

May 21, 2025

Celtics Championship Hopes Can They Stay Contenders This Offseason

May 21, 2025