$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Bold Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: A Bold Strategy Explained

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) since the SEC's approval of the first spot Bitcoin ETF, sparking intense debate and speculation about the future of digital assets. This massive influx of capital represents a significant shift in the institutional acceptance of Bitcoin and highlights a bold strategy with potentially far-reaching consequences. But what's driving this investment frenzy, and what does it mean for the future of Bitcoin and the broader financial landscape?

The SEC Approval: A Game Changer

The approval of the first spot Bitcoin ETF by the Securities and Exchange Commission (SEC) was a watershed moment. For years, the SEC had resisted approving such ETFs, citing concerns about market manipulation and investor protection. This decision signaled a significant change in regulatory sentiment, opening the floodgates for institutional investment in a previously inaccessible asset class. This approval removed a major hurdle for institutional investors who were previously hesitant due to the regulatory uncertainty surrounding Bitcoin.

Why the Rush to Bitcoin ETFs?

Several factors contribute to the massive investment in Bitcoin ETFs:

- Accessibility and Regulation: ETFs offer a regulated and easily accessible way for investors to gain exposure to Bitcoin without the complexities and risks associated with directly holding the cryptocurrency. This is particularly attractive to institutional investors who are subject to stricter regulatory requirements.

- Diversification: Bitcoin ETFs provide a way to diversify investment portfolios, offering exposure to a potentially high-growth asset class that is largely uncorrelated with traditional markets. This diversification can help reduce overall portfolio risk.

- Institutional Adoption: The growing acceptance of Bitcoin by institutional investors, including pension funds and hedge funds, is a major driver of ETF investment. These large investors are seeking new avenues for growth and diversification, and Bitcoin ETFs provide a convenient and regulated entry point.

- Inflation Hedge: Many investors see Bitcoin as a potential hedge against inflation. Its limited supply and decentralized nature make it an attractive alternative to traditional assets during times of economic uncertainty.

The Risks Remain

While the surge in investment is impressive, it's crucial to acknowledge the inherent risks associated with Bitcoin and Bitcoin ETFs:

- Volatility: Bitcoin's price is notoriously volatile, and investors should be prepared for significant price swings.

- Regulatory Uncertainty: While the SEC has approved some ETFs, the regulatory landscape remains fluid, and future changes could impact the value of Bitcoin ETFs.

- Security Risks: Although ETFs mitigate some risks associated with holding Bitcoin directly, security breaches and hacks are still possibilities.

What Does the Future Hold?

The $5 billion+ poured into Bitcoin ETFs is a significant development, suggesting increased mainstream acceptance of Bitcoin as a legitimate asset class. This trend is likely to continue, although the pace of growth may fluctuate depending on market conditions and regulatory developments. The long-term success of Bitcoin and Bitcoin ETFs will depend on several factors, including wider adoption, technological advancements, and continued regulatory clarity.

Looking Ahead: The success of these ETFs will be closely watched by investors and regulators alike, shaping the future of both Bitcoin and the broader cryptocurrency market. The influx of capital signifies a major shift, potentially paving the way for further institutional adoption and integration into the mainstream financial system. However, it's crucial for investors to understand the risks involved before investing in this volatile asset class. Conduct thorough research and seek professional financial advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Bold Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Curbing Misbehavior Bali Introduces Stricter Rules For Tourists

May 21, 2025

Curbing Misbehavior Bali Introduces Stricter Rules For Tourists

May 21, 2025 -

Jamie Lee Curtiss Honest Take On Lindsay Lohans Life And Career

May 21, 2025

Jamie Lee Curtiss Honest Take On Lindsay Lohans Life And Career

May 21, 2025 -

Okc Thunder Favored For 2025 Nba Title Knicks A Strong Second

May 21, 2025

Okc Thunder Favored For 2025 Nba Title Knicks A Strong Second

May 21, 2025 -

Jon Jones And Tom Aspinall Analyzing The Fallout From Jones Latest Remarks

May 21, 2025

Jon Jones And Tom Aspinall Analyzing The Fallout From Jones Latest Remarks

May 21, 2025 -

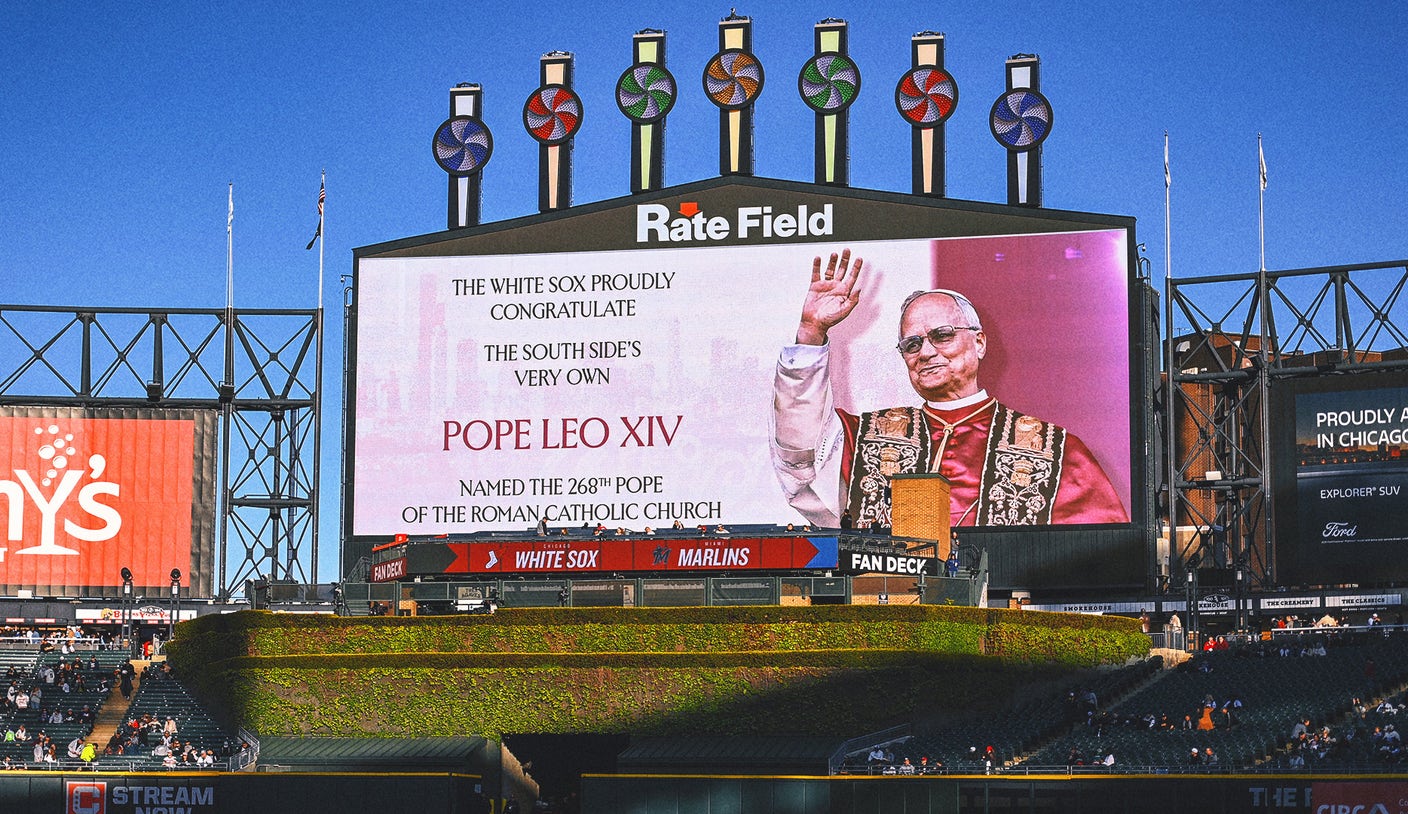

White Sox Pay Homage To Pope Leo Xiii With Impressive New Art Display

May 21, 2025

White Sox Pay Homage To Pope Leo Xiii With Impressive New Art Display

May 21, 2025