$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Bold Investment Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Understanding the Bold Investment Strategies

The cryptocurrency market is buzzing. Over $5 billion has flowed into Bitcoin exchange-traded funds (ETFs) in recent months, signaling a significant shift in institutional and retail investor sentiment. This massive influx of capital represents a bold bet on Bitcoin's future, but what's driving this investment surge, and what does it mean for the future of Bitcoin and the broader crypto market?

This article delves into the factors fueling this unprecedented investment in Bitcoin ETFs, explores the diverse investment strategies at play, and assesses the potential implications for the future.

The Rise of Bitcoin ETFs: A Gateway to Crypto Investment

Bitcoin ETFs offer a relatively accessible and regulated entry point into the volatile world of Bitcoin. Unlike directly purchasing Bitcoin, which involves navigating the complexities of cryptocurrency exchanges and wallets, ETFs provide a familiar and regulated investment vehicle, similar to traditional stock market investments. This accessibility is a key driver behind their recent popularity. Investors can now easily buy and sell Bitcoin through their brokerage accounts, mitigating some of the risks and complexities associated with direct cryptocurrency ownership.

Why the $5 Billion+ Influx? A Multifaceted Analysis

Several interconnected factors contribute to this massive investment in Bitcoin ETFs:

-

Increased Institutional Adoption: Large institutional investors, including hedge funds and asset management firms, are increasingly allocating capital to Bitcoin, viewing it as a potential hedge against inflation and a diversification tool within their portfolios. The availability of ETFs lowers the barrier to entry for these institutions.

-

Regulatory Clarity (in select markets): The approval of Bitcoin ETFs in key markets, such as the United States, has significantly boosted investor confidence. Regulatory clarity reduces uncertainty and encourages wider participation. This is particularly crucial for institutional investors who require a certain level of regulatory oversight.

-

Growing Mainstream Acceptance: Bitcoin's increasing mainstream acceptance, fueled by positive media coverage and integration into mainstream financial services, contributes to a growing sense of legitimacy. This increased acceptance drives demand for accessible investment vehicles like ETFs.

-

Inflationary Pressures: Persistent inflation in many economies has led investors to seek alternative assets that can potentially preserve their purchasing power. Bitcoin, often perceived as a "digital gold," is viewed by some as a hedge against inflation.

Investment Strategies Behind the Bitcoin ETF Boom

The investment strategies employed by those pouring billions into Bitcoin ETFs are diverse:

-

Long-Term Hodling: Many investors view Bitcoin as a long-term store of value, adopting a "buy and hold" strategy. ETFs provide a convenient mechanism for implementing this strategy.

-

Short-Term Trading: Others are engaging in short-term trading, attempting to capitalize on price fluctuations. The ease of trading Bitcoin ETFs facilitates this approach.

-

Diversification: Many investors use Bitcoin ETFs as a component of a diversified portfolio, aiming to reduce overall portfolio risk.

-

Inflation Hedging: Some investors see Bitcoin as a hedge against inflation and include it in their portfolios as a protective asset.

What Does the Future Hold?

The massive investment in Bitcoin ETFs represents a significant milestone in the maturation of the cryptocurrency market. However, it's crucial to acknowledge the inherent volatility of Bitcoin. While the long-term potential is significant for some, short-term price fluctuations remain a considerable risk.

This surge in ETF investments signifies a growing belief in Bitcoin’s long-term prospects, but careful due diligence and risk assessment are paramount for all investors. This ongoing evolution of the crypto market presents both significant opportunities and considerable challenges. Staying informed about market trends and regulatory developments is crucial for navigating this dynamic landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in Bitcoin ETFs involves significant risk, and you should consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Bold Investment Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hateful Fan Comments Target Wnba Player League Launches Formal Investigation

May 21, 2025

Hateful Fan Comments Target Wnba Player League Launches Formal Investigation

May 21, 2025 -

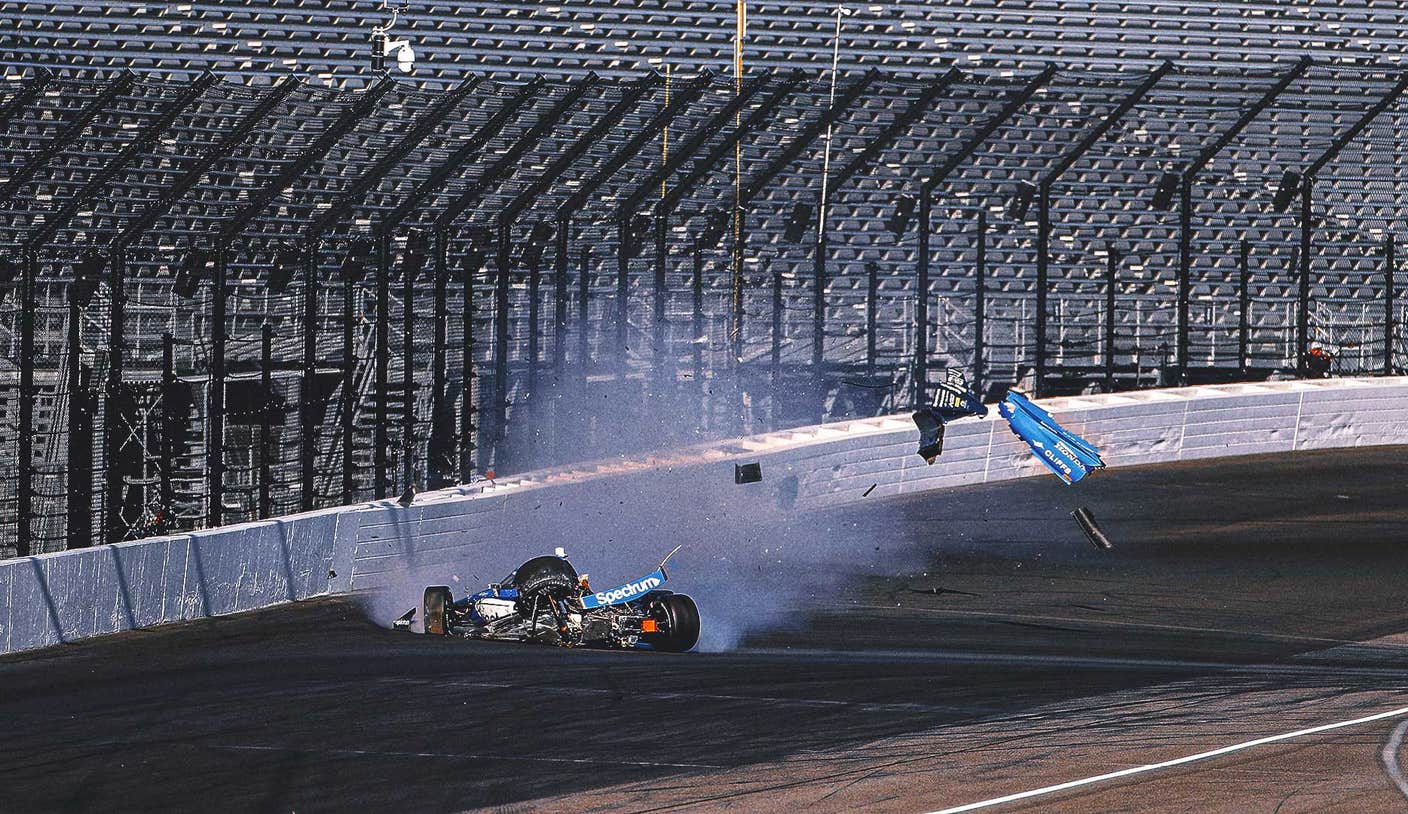

A String Of Accidents Examining The Indy 500 Practice Wrecks

May 21, 2025

A String Of Accidents Examining The Indy 500 Practice Wrecks

May 21, 2025 -

Scottie Scheffler Faces Pga Driver Rules Issue Ahead Of Tournament

May 21, 2025

Scottie Scheffler Faces Pga Driver Rules Issue Ahead Of Tournament

May 21, 2025 -

High Stick Injury Sidelines Referee Rooney Will He Make The Playoffs

May 21, 2025

High Stick Injury Sidelines Referee Rooney Will He Make The Playoffs

May 21, 2025 -

Ufl Week 8 Highlights Renegades Wr Tyler Vaughns Incredible One Handed Td Grab

May 21, 2025

Ufl Week 8 Highlights Renegades Wr Tyler Vaughns Incredible One Handed Td Grab

May 21, 2025