$5 Billion+ Poured Into Bitcoin ETFs: Is This The Start Of A New Bull Run?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Is This the Start of a New Bull Run?

The cryptocurrency market is buzzing with excitement after a staggering influx of over $5 billion into Bitcoin exchange-traded funds (ETFs) in recent weeks. This massive investment has sparked fervent speculation: could this be the catalyst for a long-awaited Bitcoin bull run? While no one can predict the future with certainty, the sheer volume of investment warrants a closer look at the potential implications.

The ETF Explosion: A Game Changer?

The approval of several Bitcoin ETFs in major markets, including the United States, has dramatically increased accessibility for institutional and retail investors. Previously, direct investment in Bitcoin involved navigating the complexities of cryptocurrency exchanges, a barrier that many investors found daunting. ETFs, however, offer a familiar and regulated investment vehicle, significantly lowering the barrier to entry. This ease of access has undoubtedly fueled the recent surge in investment.

Why the Sudden Rush to Bitcoin ETFs?

Several factors contribute to this unprecedented influx of capital into Bitcoin ETFs:

- Increased Institutional Adoption: Large financial institutions are increasingly recognizing Bitcoin as a legitimate asset class, diversifying their portfolios to include exposure to this burgeoning market.

- Regulatory Clarity: The approval of ETFs signifies a growing acceptance and regulation of Bitcoin by governmental bodies, reducing uncertainty and attracting more conservative investors.

- Inflation Hedge: With persistent inflation in many economies, investors are seeking alternative assets to protect their purchasing power. Bitcoin, with its limited supply, is increasingly viewed as a potential hedge against inflation.

- Technological Advancements: The ongoing development of the Bitcoin network, including the Lightning Network for faster and cheaper transactions, enhances its functionality and appeal.

Signs of a Bull Run? A Cautious Optimism.

While the massive investment in Bitcoin ETFs is undeniably bullish, declaring a full-blown bull run might be premature. Several factors could temper the exuberance:

- Macroeconomic Uncertainty: Global economic conditions remain volatile, potentially impacting investor sentiment and overall market performance. Geopolitical events and interest rate hikes by central banks could still influence Bitcoin's price.

- Regulatory Headwinds: While regulatory clarity has increased, the regulatory landscape for cryptocurrencies remains dynamic. Future changes could impact the market.

- Market Volatility: Bitcoin is inherently volatile. Sharp price swings are to be expected, and any bull run is likely to experience periods of correction.

What to Watch For:

To gauge the potential for a sustained bull run, keep an eye on:

- Continued ETF Inflows: Sustained investment into Bitcoin ETFs will be a key indicator of long-term market confidence.

- Bitcoin Network Activity: Increased on-chain activity, such as transaction volume and network hash rate, points to growing adoption and use.

- Institutional Investor Sentiment: The ongoing commitment of institutional investors to Bitcoin will play a crucial role in shaping the market's trajectory.

Conclusion:

The $5 billion+ poured into Bitcoin ETFs represents a significant milestone for the cryptocurrency market. While it's too early to definitively declare a new bull run, the surge in investment points towards growing acceptance and institutional adoption of Bitcoin. However, investors should remain cautious, mindful of the inherent volatility of the market and the broader macroeconomic landscape. Further monitoring of key indicators will be vital in determining the longevity and strength of this positive trend. Stay informed, conduct your own research, and invest responsibly.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Is This The Start Of A New Bull Run?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nhl Referee Rooneys Recovery Playoff Hopes Following High Stick Injury

May 21, 2025

Nhl Referee Rooneys Recovery Playoff Hopes Following High Stick Injury

May 21, 2025 -

Assassins Creed Valhalla Ubisoft Addresses The Lack Of Animal Killing

May 21, 2025

Assassins Creed Valhalla Ubisoft Addresses The Lack Of Animal Killing

May 21, 2025 -

Jon Jones Ufc Kept Aspinalls Injury A Secret From Fight Fans

May 21, 2025

Jon Jones Ufc Kept Aspinalls Injury A Secret From Fight Fans

May 21, 2025 -

Oklahoma City Thunders Upset Win Over Denver A Playoff Masterclass

May 21, 2025

Oklahoma City Thunders Upset Win Over Denver A Playoff Masterclass

May 21, 2025 -

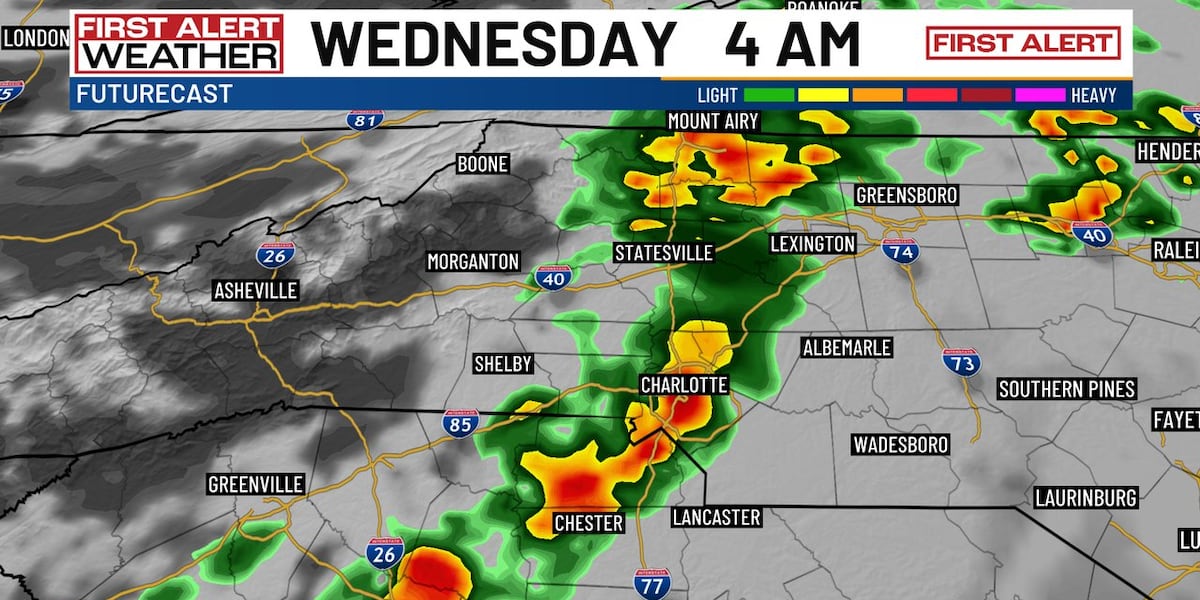

Charlotte Area Braces For Overnight Storms Plunging Temperatures To Follow

May 21, 2025

Charlotte Area Braces For Overnight Storms Plunging Temperatures To Follow

May 21, 2025