$5 Billion+ Poured Into Bitcoin ETFs: Implications For The Crypto Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: A Bullish Signal for the Crypto Market?

The cryptocurrency market is buzzing with excitement following a massive influx of investment into Bitcoin exchange-traded funds (ETFs). Over $5 billion has poured into these funds in recent weeks, marking a significant milestone and sparking debate about the future trajectory of Bitcoin and the broader crypto landscape. This unprecedented level of institutional investment signifies a growing acceptance of Bitcoin as a legitimate asset class, but what are the implications for the market?

The Rise of Bitcoin ETFs and Institutional Adoption

The approval of Bitcoin ETFs in various jurisdictions, including the United States, has opened the floodgates for institutional investors. These funds provide a regulated and accessible way for large financial players to gain exposure to Bitcoin without the complexities and risks associated with directly holding the cryptocurrency. This accessibility has been a key driver behind the recent surge in investment. The ease of trading through established brokerage accounts significantly lowers the barrier to entry for institutional players accustomed to traditional financial instruments.

What's Driving the Investment Boom?

Several factors contribute to this significant investment influx:

- Regulatory Clarity: The increasing regulatory clarity surrounding Bitcoin, particularly in the US with the approval of the first spot Bitcoin ETF, has boosted investor confidence. This reduces uncertainty and makes Bitcoin a more attractive investment for risk-averse institutions.

- Inflation Hedge: Bitcoin, with its limited supply of 21 million coins, continues to be seen as a potential hedge against inflation. In times of economic uncertainty, investors often seek alternative assets, and Bitcoin's decentralized nature makes it an attractive option.

- Growing Institutional Interest: Major financial institutions are increasingly recognizing Bitcoin's potential and actively seeking ways to incorporate it into their portfolios. This institutional adoption legitimizes Bitcoin and fosters a sense of stability within the market.

- Technological Advancements: The ongoing development of the Bitcoin network, including improvements in scalability and transaction speed, enhances its long-term viability and appeal to investors.

Implications for the Crypto Market

The massive investment in Bitcoin ETFs has several significant implications for the broader cryptocurrency market:

- Price Volatility: While the influx of capital is generally bullish, it's important to remember that Bitcoin's price remains volatile. Significant price swings are still possible, influenced by factors such as macroeconomic conditions and regulatory changes.

- Increased Liquidity: The increased trading volume associated with ETFs improves market liquidity, making it easier for investors to buy and sell Bitcoin without significantly impacting the price.

- Mainstream Adoption: The success of Bitcoin ETFs contributes to the mainstream adoption of cryptocurrencies. This increased visibility and accessibility could lead to further growth and innovation in the sector.

- Competition and Innovation: The success of Bitcoin ETFs may incentivize the development of ETFs for other cryptocurrencies, potentially leading to a more diversified and competitive crypto market.

Looking Ahead: Cautious Optimism

While the $5 billion+ poured into Bitcoin ETFs is undoubtedly a positive sign for the crypto market, it's crucial to maintain a balanced perspective. The market remains susceptible to various factors, including regulatory changes and macroeconomic conditions. However, this significant institutional investment signals a growing belief in Bitcoin's long-term potential, suggesting a bullish outlook for the future, albeit one that needs careful monitoring. Further regulatory clarity and technological advancements will be key drivers in shaping the future of Bitcoin and the broader cryptocurrency landscape.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you should conduct thorough research and consider your own risk tolerance before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Implications For The Crypto Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Always Kept It Real Jamie Lee Curtis On Her Friendship With Lindsay Lohan

May 20, 2025

Always Kept It Real Jamie Lee Curtis On Her Friendship With Lindsay Lohan

May 20, 2025 -

Russia Ukraine Conflict Trump Intervenes Peace Talks Imminent

May 20, 2025

Russia Ukraine Conflict Trump Intervenes Peace Talks Imminent

May 20, 2025 -

Adelman Earns Player Backing Amidst Rising Praise For Nuggets Coaching

May 20, 2025

Adelman Earns Player Backing Amidst Rising Praise For Nuggets Coaching

May 20, 2025 -

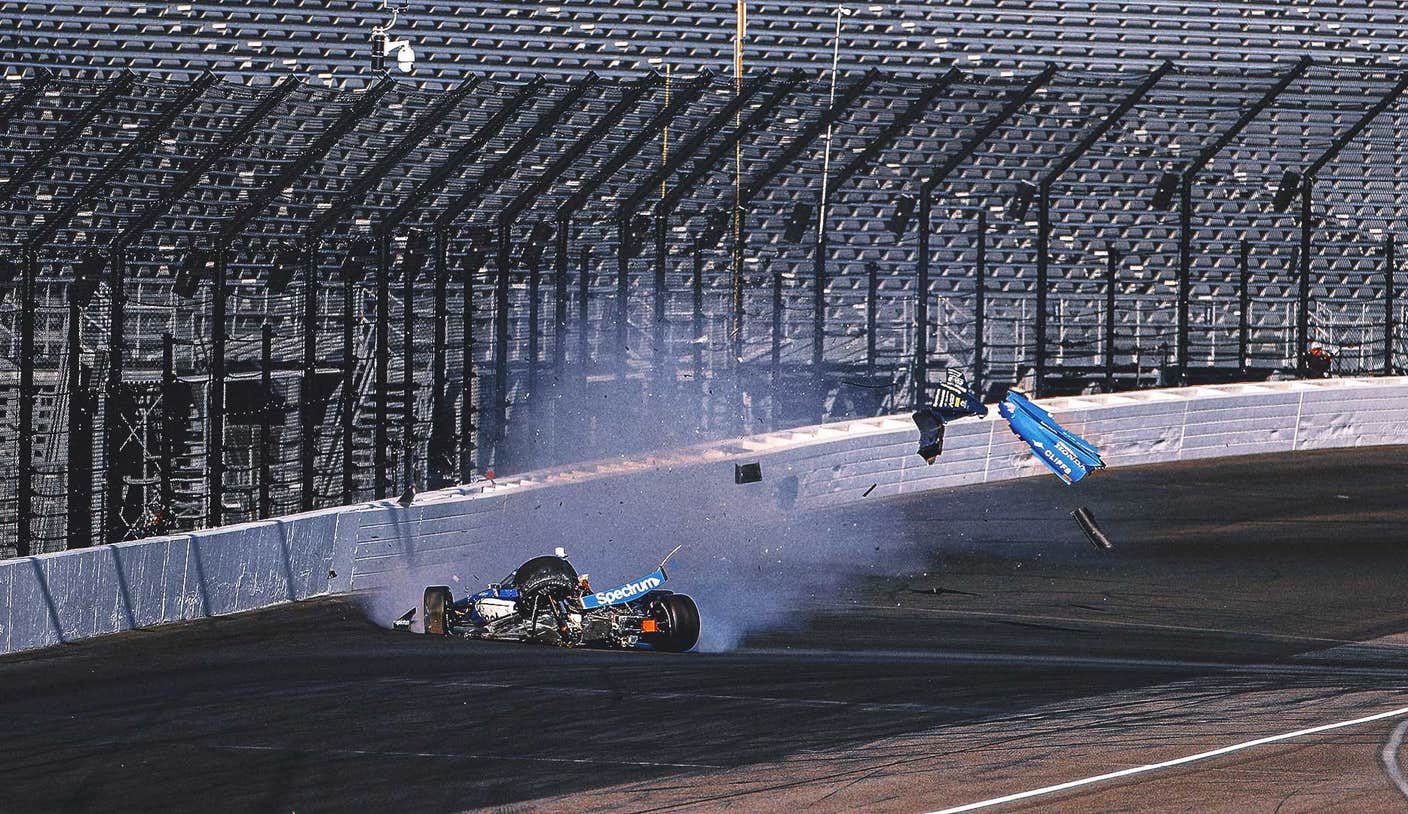

Indy Car Practice A Series Of High Speed Incidents

May 20, 2025

Indy Car Practice A Series Of High Speed Incidents

May 20, 2025 -

College Football 2023 Unveiling The Most Unexpected Regular Season Statistics

May 20, 2025

College Football 2023 Unveiling The Most Unexpected Regular Season Statistics

May 20, 2025