$5B+ Pours Into Bitcoin ETFs: Directional Bets And Market Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Floods into Bitcoin ETFs: A Bullish Signal or Temporary Surge?

The cryptocurrency market is buzzing after a massive influx of capital into Bitcoin exchange-traded funds (ETFs). Over $5 billion has poured into these investment vehicles in recent weeks, sparking debate about the future direction of Bitcoin and the broader crypto market. This unprecedented level of institutional investment signifies a major shift in sentiment, but is it a sustainable trend or a temporary blip? Let's delve into the details and explore the market outlook.

The Surge in Bitcoin ETF Investments:

The recent surge in Bitcoin ETF investment is undeniably significant. Several factors contribute to this phenomenon:

-

Regulatory Approvals: The SEC's recent approval of several spot Bitcoin ETFs has opened the floodgates for institutional investors who were previously hesitant due to regulatory uncertainty. This legitimizes Bitcoin as an asset class and reduces perceived risk. The availability of regulated investment vehicles makes Bitcoin more accessible to a broader range of investors, including pension funds and other large institutions.

-

Increased Institutional Adoption: We're witnessing a growing trend of institutional investors, including BlackRock, Fidelity, and Invesco, embracing Bitcoin as part of their diversified portfolios. This signifies a growing acceptance of Bitcoin's potential as a store of value and a hedge against inflation.

-

Market Sentiment: Positive market sentiment plays a crucial role. After a period of relative market stagnation, this significant investment signals a renewed belief in Bitcoin's long-term prospects. This positive sentiment can create a self-fulfilling prophecy, drawing even more investors into the market.

Directional Bets and Market Outlook:

The massive inflow into Bitcoin ETFs indicates a predominantly bullish outlook. Many investors view Bitcoin as a potentially lucrative long-term investment, believing its price will continue to appreciate. However, it's crucial to acknowledge the inherent volatility of the cryptocurrency market. While the current trend is positive, several factors could influence future price movements:

-

Macroeconomic Conditions: Global economic conditions, including inflation rates and interest rate hikes, can significantly impact the price of Bitcoin. A volatile macroeconomic environment might lead to increased price fluctuations.

-

Regulatory Developments: Further regulatory clarity or changes in regulatory landscape, both in the US and globally, could affect investor confidence and market dynamics. Any unexpected regulatory actions could cause market volatility.

-

Technological Advancements: Advancements in Bitcoin's underlying technology, such as the Lightning Network, could enhance its scalability and usability, potentially boosting its adoption rate and price.

What This Means for Investors:

While the current influx of funds into Bitcoin ETFs is encouraging, investors should proceed with caution. The cryptocurrency market remains highly volatile, and significant price swings are to be expected. It's crucial to conduct thorough research and only invest what you can afford to lose. Diversification is also key to mitigating risk.

The Bottom Line:

The $5 billion+ investment in Bitcoin ETFs represents a significant milestone for the cryptocurrency market. This massive influx of capital signifies increased institutional adoption and confidence in Bitcoin's long-term potential. However, the market remains volatile, and investors should carefully consider the risks involved before making any investment decisions. The future price trajectory will depend on a variety of factors, including macroeconomic conditions, regulatory developments, and technological advancements. Staying informed about market trends and developments is crucial for navigating this dynamic landscape. Consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Pours Into Bitcoin ETFs: Directional Bets And Market Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

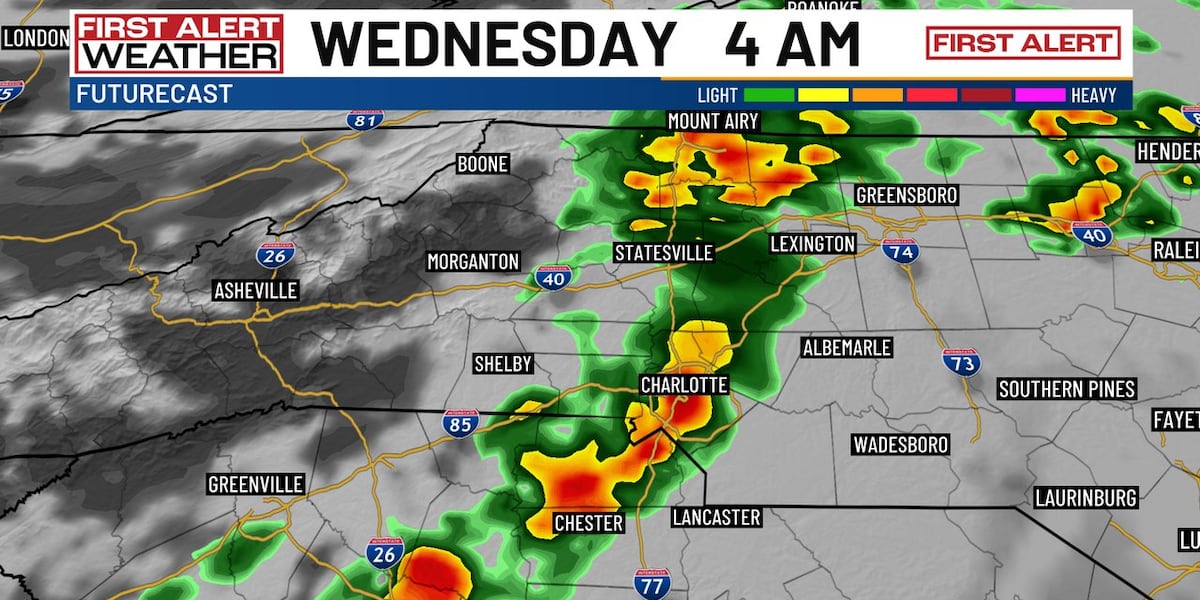

Charlotte Facing Overnight Storms Before Significant Temperature Drop

May 21, 2025

Charlotte Facing Overnight Storms Before Significant Temperature Drop

May 21, 2025 -

Nfl Green Bay Packers Submit Revised Tush Push Rule Proposal

May 21, 2025

Nfl Green Bay Packers Submit Revised Tush Push Rule Proposal

May 21, 2025 -

Indy 500 Pole Rookie Shwartzmans Unexpected Victory

May 21, 2025

Indy 500 Pole Rookie Shwartzmans Unexpected Victory

May 21, 2025 -

Game 7 Blowout How The Oklahoma City Thunder Conquered The Nuggets

May 21, 2025

Game 7 Blowout How The Oklahoma City Thunder Conquered The Nuggets

May 21, 2025 -

Espns Look Inside The First 30 Days Of An Nfl Rookies Career

May 21, 2025

Espns Look Inside The First 30 Days Of An Nfl Rookies Career

May 21, 2025